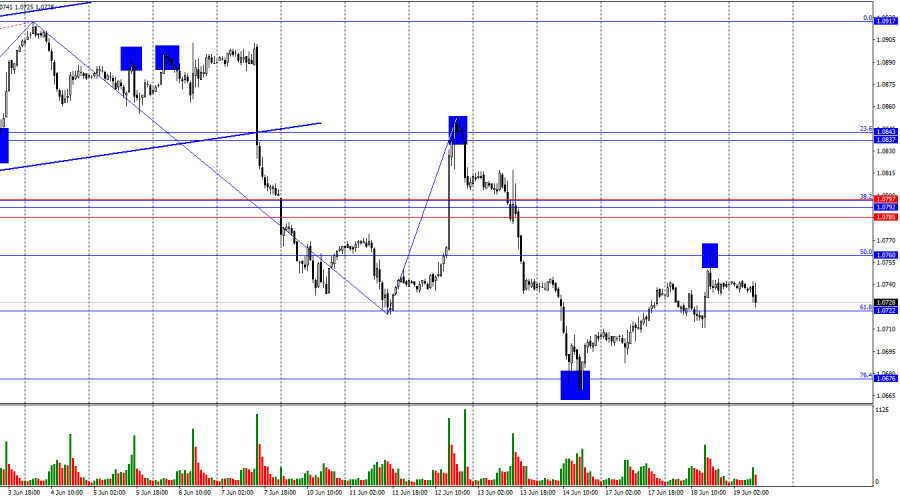

On Tuesday, the EUR/USD pair rose to the corrective level of 50.0%–1.0760, bounced off it, and turned in favor of the US dollar. Thus, the decline began with the first target being the Fibonacci level – 1.0722. A rebound of the pair from this level will favor the euro and a resumption of growth towards 1.0760, while consolidation below it will allow for the resumption of the "bearish" trend towards 1.0676.

The wave situation remains clear. The new downward wave broke the low of the previous wave from June 11, while the last completed upward wave failed to break the peak of the previous wave. Thus, the "bearish" trend continues to form. In the near future, the informational background should allow the bears to continue their attacks. The first sign of the "bearish" trend ending will be the breaking of the peak of the last upward wave from June 12. However, in the coming days, the bulls are unlikely to be able to lift the pair to the level of 1.0850.

The informational background on Tuesday did not have a strong impact on traders. The inflation report went unnoticed, as traders were prepared for a value of 2.6% year-on-year. The US retail sales report was weaker than expected (+0.1% m/m versus +0.2%), which activated the dollar bears during the day. Still, the next US report, released 45 minutes later, slightly cooled their enthusiasm. Industrial production grew by 0.9% in May, although traders expected only a 0.3% increase. Thus, the level of 1.0760 was precisely pierced and rebounded. This graphical signal suggests a potential decline in the euro. This week, several more reports will be released in the US and the EU. Specifically, I advise paying attention to the business activity indices in the manufacturing and services sectors on Friday.

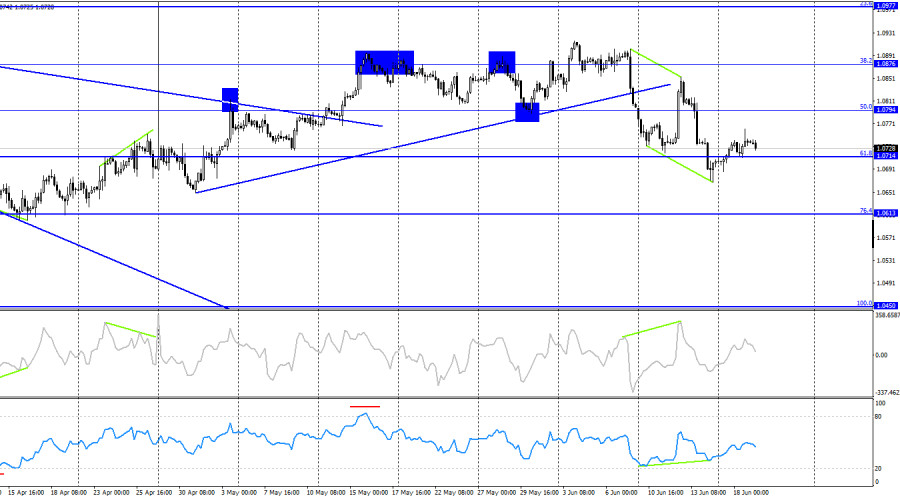

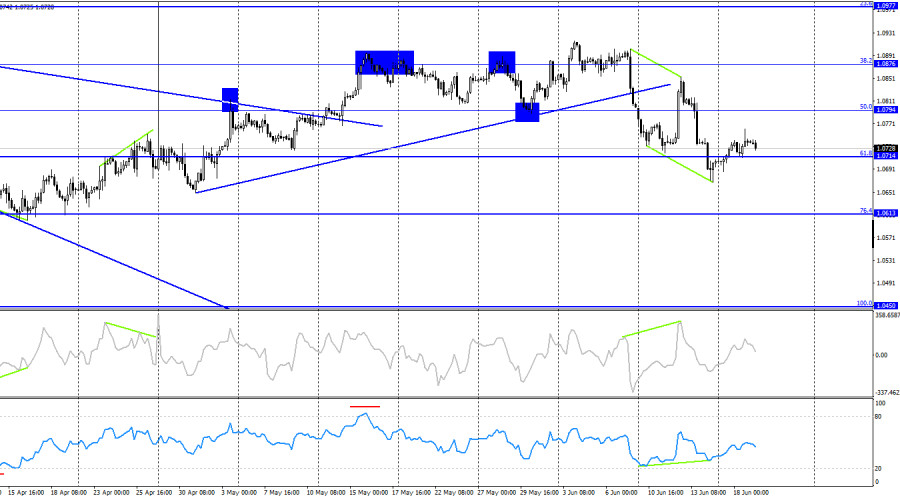

On the 4-hour chart, the pair reversed in favor of the euro after forming a "bullish" divergence on the RSI indicator. The quotes closed above the 61.8% Fibonacci level – 1.0714, but I do not believe in prolonged euro growth. On the 4-hour chart, a week ago, the pair closed below the trendline, changing traders' sentiment to "bearish." Thus, I expect a small correction, followed by a resumption of the decline. Consolidation of the pair's rate below the level of 1.0714 will allow for the resumption of the decline towards the 76.4% Fibonacci level – 1.0613.

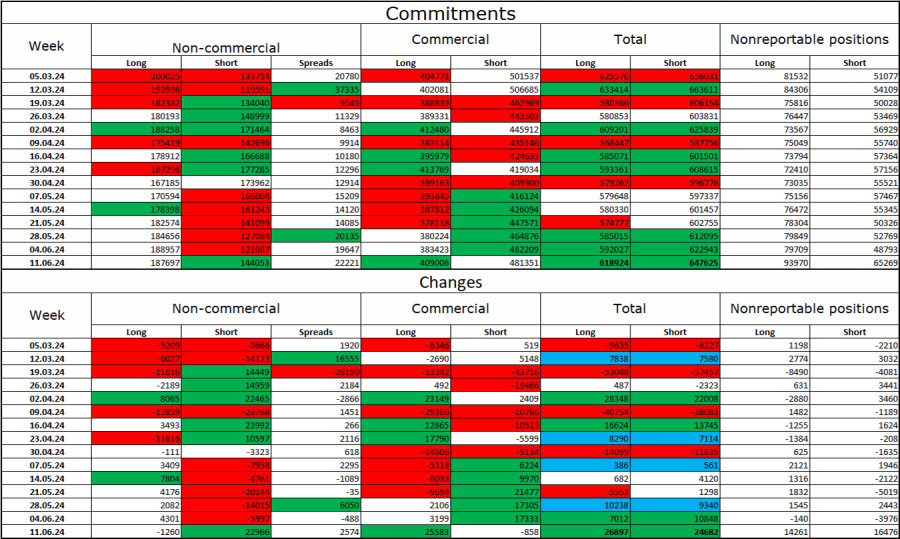

Commitments of Traders (COT) Report:

During the last reporting week, speculators closed 1,260 Long contracts and opened 22,966 Short contracts. The sentiment of the "Non-commercial" group changed to "bearish" a few weeks ago, and sellers are once again increasing their positions. The total number of Long contracts held by speculators is now 187,000, while Short contracts total 144,000. The gap is narrowing.

The situation will continue to shift in favor of the bears. I do not see long-term reasons to buy the euro, as the ECB has begun easing monetary policy, which will reduce the yield on bank deposits and government bonds. In America, they will remain at a high level for at least several more months, making the dollar more attractive to investors. The potential for the euro's decline is substantial, even according to the COT reports. If the sentiment among large players is still "bullish" and the euro is falling, where will the euro be when the sentiment turns "bearish"?

News Calendar for the US and Eurozone:

June 19: The economic events calendar contains a few interesting entries. The informational background will not influence traders' sentiment today.

Forecast for EUR/USD and trading advice:

Selling the pair was possible on the hourly chart upon a rebound from the level of 1.0760 with targets of 1.0676 and 1.0602. These trades can still be held. Buying the euro is possible today on the hourly chart upon a rebound from the level of 1.0722 with targets of 1.0760 and 1.0785 while simultaneously closing sales.

The Fibonacci grid levels are built from 1.0602 to 1.0917 on the hourly chart and from 1.0450 to 1.1139 on the hourly chart.