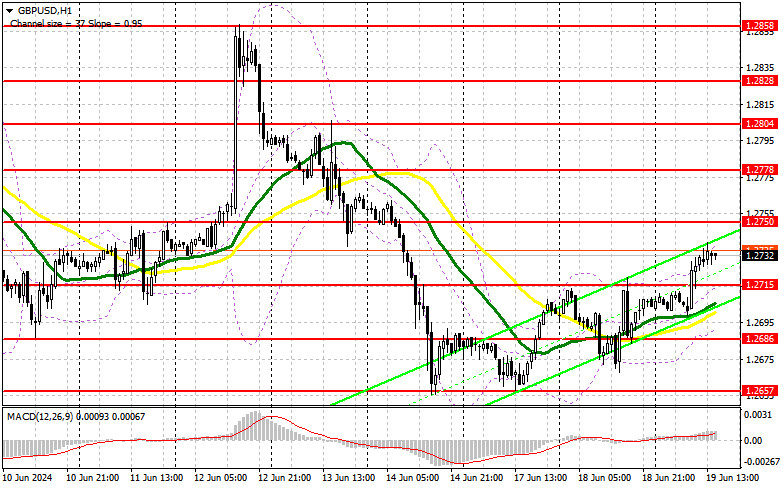

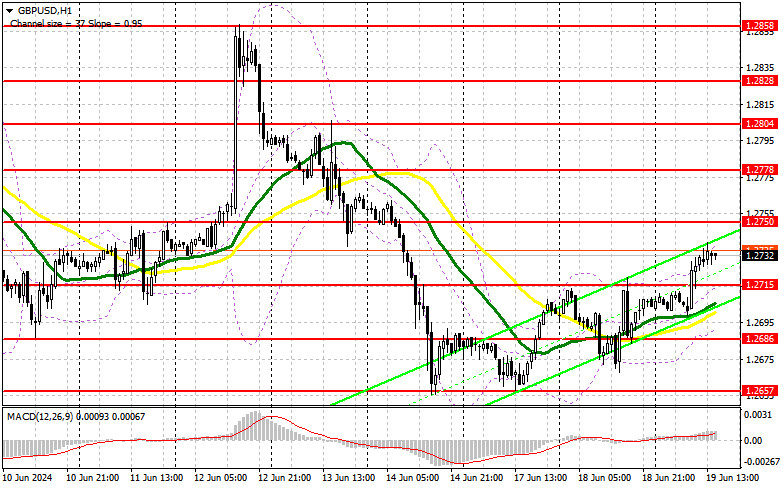

In my morning forecast, I paid attention to the 1.2719 level and planned to make decisions on entering the market from it. Let's look at the 5-minute chart and figure out what happened there. The breakout and the reverse test of this range led to the entry point for the purchase of the pound, which, at the time of writing, increased by 20 points. In the afternoon, the technical picture was slightly revised.

To open long positions on GBP/USD, you need:

The news that inflation in the UK increased by 0.3% compared to last month and slowed to 2.0% per annum, which coincided with economists' forecasts, led to a slight strengthening of the British pound, as the data failed to surprise traders. Obviously, all this will not change the Bank of England's monetary policy plans tomorrow, so we can count on some strengthening of the pound. Given that there are no statistics during the American session, the primary task of buyers will be to protect the nearest resistance of 1.2715, which is the focus. Only the formation of a false breakdown there will give an entry point into long positions with the aim of a new wave of growth to the level of 1.2750 – resistance, where I expect active actions by sellers. A breakout and a reverse test from top to bottom of this range will be a suitable condition for buying, already counting on the 1.2778 update. The farthest target will be the area of 1.2804, where I'm going to take profits. In the scenario of a decline in GBP/USD and a lack of activity on the part of the bulls at 1.2715 in the afternoon, buyers of the pound will lose all initiative, which will only increase pressure on the pair. This will also lead to a decrease and an update of the next support 1.2686, above which the moving averages playing on the buyers' side pass. Only the formation of a false breakout will be a suitable condition for opening long positions. I'm going to buy GBP/USD immediately on a rebound from the minimum of 1.2657 with the aim of correcting 30-35 points within the day.

To open short positions on GBP/USD, you need:

Sellers no longer control the market, and in order not to completely miss it, you need to show yourself already around 1.2750. Only the formation of a false breakdown will be a suitable option for opening short positions in order to reduce the support area of 1.2715, which acts as resistance in the morning. But the return to control of this level, as well as a breakthrough and a reverse bottom-up test – all this will be a big blow for buyers, which will lead to the demolition of stop orders and open the way to 1.2686. The farthest target will be the area of 1.2657, where I will record profits. A test of this level will also indicate the return of the market to sellers' control. With the option of GBP/USD growth and lack of activity at 1.2750 in the afternoon, buyers will strengthen their advantage. In this case, I will postpone sales until a false breakdown at the level of 1.2778. In the absence of a downward movement there, I will sell GBP/USD immediately for a rebound from 1.2804, but only counting on a correction of the pair down by 30-35 points within the day.

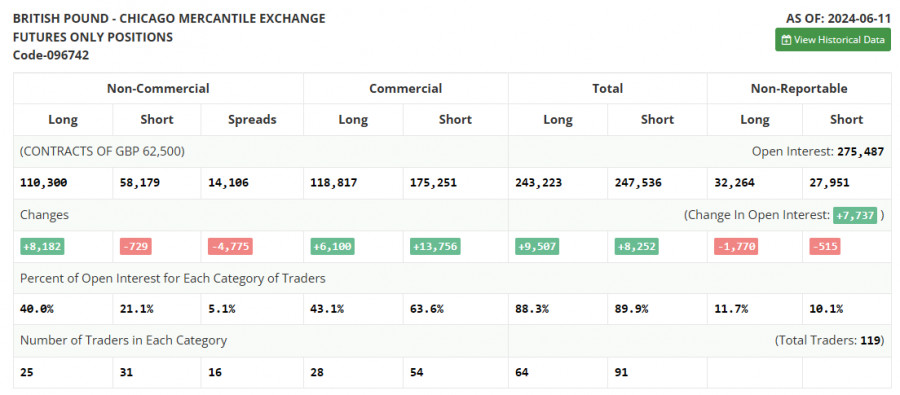

In the COT report (Commitment of Traders) for June 11, there was an increase in long positions and a reduction in short ones. The Bank of England will hold a meeting in the near future, which may continue to prepare the markets for a rate cut in late summer and early autumn this year. This could definitely put pressure on the British pound, as the soft position of the regulator will be quite at odds with the actions of the Federal Reserve System, which left interest rates unchanged last week, signaling only one possible reduction in the cost of borrowing this year. All of this will definitely play on the dollar side. The latest COT report says that long non-profit positions increased by 8,182 to 110,300, while short non-profit positions decreased by 729 to 58,179. As a result, the spread between long and short positions fell by 4,775.

Indicator Signals:

Moving Averages:

Trading is conducted above the 30 and 50-day moving averages, indicating further growth of the pair.

Note: The period and prices of the moving averages are considered by the author on the H1 hourly chart, differing from the general definition of classical daily moving averages on the D1 daily chart.

Bollinger Bands:

In case of a decline, the lower boundary of the indicator, around 1.2715, will act as support.

Indicator Descriptions:

- Moving Average (MA): Determines the current trend by smoothing volatility and noise. Period: 50. Marked in yellow on the chart.

- Moving Average (MA): Determines the current trend by smoothing volatility and noise. Period: 30. Marked in green on the chart.

- MACD (Moving Average Convergence/Divergence): Fast EMA period 12, Slow EMA period 26, SMA period 9.

- Bollinger Bands: Period 20.

- Non-commercial traders: Speculators such as individual traders, hedge funds, and large institutions use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions: The total long open positions of non-commercial traders.

- Short non-commercial positions: The total short open positions of non-commercial traders.

- Total non-commercial net position: The difference between the short and long positions of non-commercial traders.