As technology stocks have slumped over the past week, traders have found a haven in shares of Apple.

The company's securities rallied on Tuesday to close at a record high, even as tech shares and the broader market sold off on concerns over higher interest rates and the Omicron coronavirus variant. The iPhone maker was one of only seven stocks in the S&P 500 to rise against all odds, and it's adding to those gains Wednesday in premarket trading, up 1.6%.

Institutional investors have often prized Apple for its consistent sales growth and hefty cash balance, and the stock now is getting boost from the hype around autonomous vehicles and its planned foray into metaverse-related products.

"Wall Street is viewing it as a safety blanket tech name during this market turbulence," Dan Ives, an analyst at Wedbush who sees the stock gaining another 12% in the next year, said.

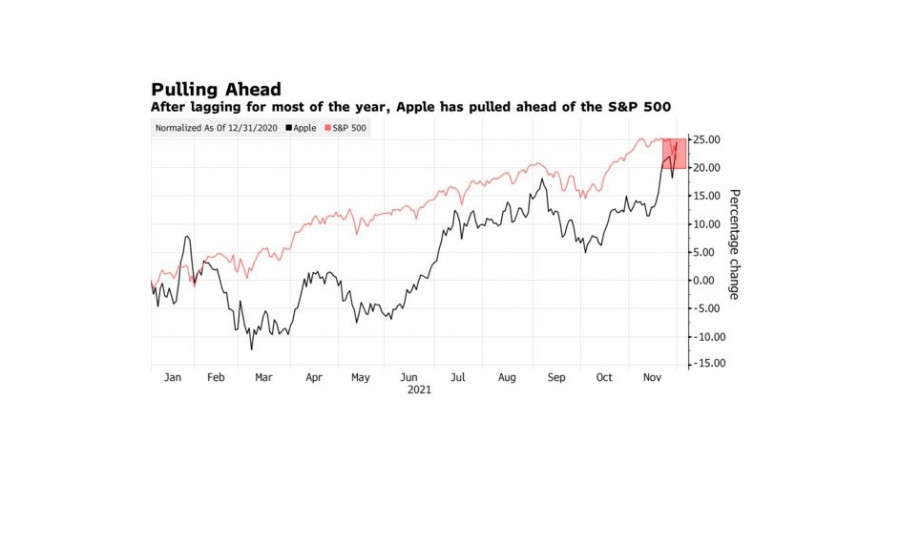

Traders' embrace of Apple has contrasted with the previous month, when the stock was underperforming the S&P 500 and the company warned that a shortage of semiconductors would hamper product sales for the holidays.

Morgan Stanley analysts have been talking up Apple's electric car program after a report this month that the company is accelerating the effort. Even if the firm wins just a 4% share of the global mobility market, its revenue base could double, according to the bank.

Similarly, mass market adoption of either augmented reality or virtual reality - a gateway to the metaverse - will only occur "when Apple enters the race", Morgan Stanley technology analysts Katy Huberty and Erik Woodring wrote in a report.

"It's as safe as it gets in the tech space and yet there's still fantastic opportunities in the coming years," Craig Erlam, senior market analyst at Oanda, said. "So there's every reason for investors to feel safe with a stock like that, even in turbulent times."

Since the report on foray into cars, Apple shares have risen almost 8%, and the stock is now outperforming the S&P 500 for the year.

Early data on sales trends over the Thanksgiving weekend have highlighted weaker-than-expected online spending as more shoppers chose to go out and buy from traditional brick-and-mortar retailers.

According to data from Mastercard SpendingPulse, in-store purchases jumped in the US by 43% on Black Friday, compared with e-commerce growth of 11%. Spending on Cyber Monday shrank this year to $10.7 billion from $10.8 billion in 2020, missing projections, data from Adobe Inc. showed.

In the case of Apple, worries about holiday sales may turn out to have been overdone. "Based on retail checks and supply chain it appears iPhone 13 demand is robust coming out of Black Friday," Ives said.

While Apple has escaped those concerns, e-commerce companies such as Shopify Inc. and eBay Inc. are suffering backlashes. An index of web merchants has fallen 6% since the day before Thanksgiving, twice the decline in the S&P 500 over the same period. Among the biggest decliners are Wayfair Inc. with a 11% drop, eBay at 7,2% and Shopify at 6,6%.

Among e-commerce companies, Amazon.com is best positioned for market share gains this holiday due to its relatively healthy supply chain and buy-now-pay-later option, analysts Justin Post and Michael McGovern wrote in a research note.

Indeed, online mono-brand shops, such as Apple, benefit as they have more accurate stock availability and can guarantee delivery of the products on time.

The same goes for shops that provide payment-by-delivery services. But overall, they will probably still lose out to mono-brands, as consumers are not prepared to risk Christmas shopping even with the option of payment after delivery. Many consumers will decide that, as a last resort, they will have to shop in supermarkets on the eve of the holidays, when the most interesting items are already sold out.

So, if you count on retail or online delivery companies, remember that this factor is particularly important in the pre-holiday period to assess your targets comprehensively. As for safe havens, Apple, which has been able to avoid major scandals or management changes, looks like a good investment.