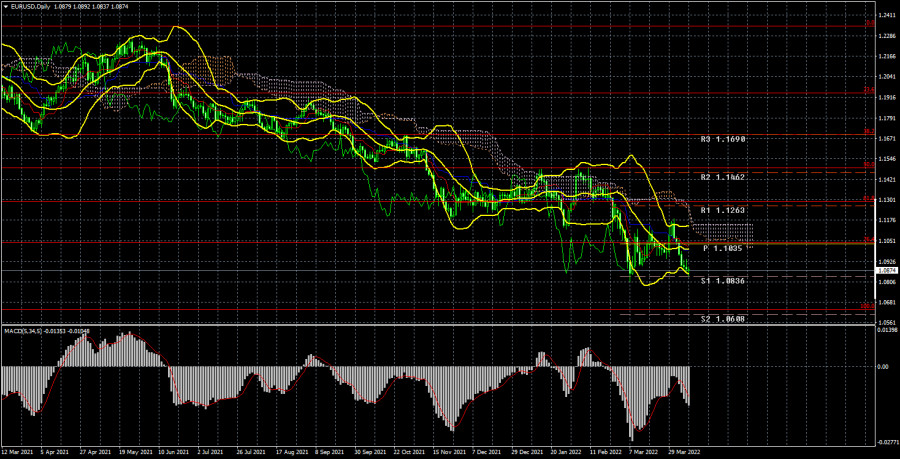

Long-term perspective.

The EUR/USD currency pair resumed falling during the current week after it failed once again to overcome the important line of the Ichimoku indicator. Formally, the price was fixed for two days above this line, but it did not even reach the approach to the next important Senkou Span B line, which once again confirms the weakness of the European currency and the strength of the US dollar. In principle, we have already listed a million times the reasons why the euro is falling and, most likely, will continue to fall against the dollar. This week, the fundamental background has only gotten worse for the euro and better for the dollar. In the middle of the week, several representatives of the Fed's monetary committee made it clear that the regulator's intentions to tighten monetary policy and curb inflation were not just sound. Already in May, the key rate may be raised by 0.5% and the unloading of the Fed's balance sheet, which amounts to almost $ 9 trillion, will begin. What does this mean? Everything is clear with the rate, but the unloading of the Fed's balance sheet is an "anti-QE" program. That is, the reverse program to withdraw excess liquidity from the economy. If earlier the Fed's QE program stimulated the US economy, now there will be a reverse process, which is also, it turns out, a tightening of monetary policy. And since the ECB cannot afford to even raise the rate once, which, we recall, is negative, the gap between the approaches of the Fed and the ECB is only increasing. And, of course, this gap will increase the pressure on the European currency. In addition, the European economy is on the verge of recession and stagflation, which, of course, does not add reasons for optimism to euro buyers and investors. At this time, the pair is already near its 15-month lows and there is no reason to expect that the fall will end there.

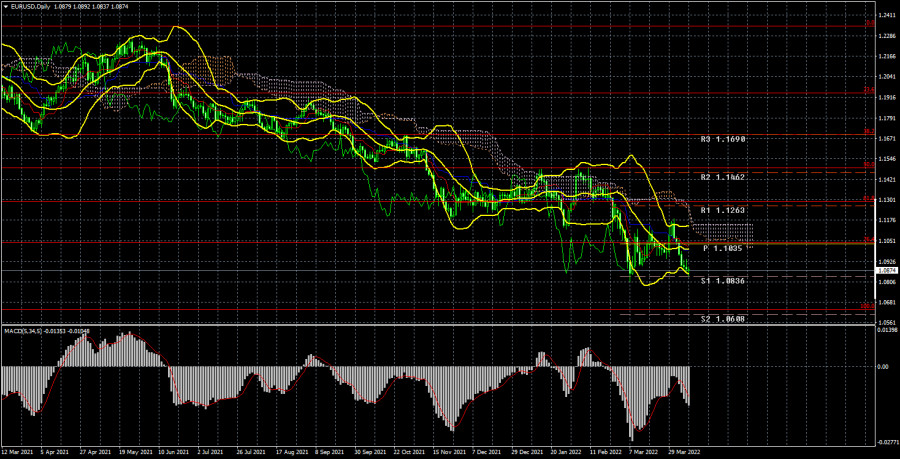

COT analysis.

The latest COT report turned out to be more interesting than the previous ones. Even paradoxical, because the big players were building up long positions. During the reporting week, the number of longs increased by 10.8 thousand, and the number of shorts in the "Non-commercial" group - by 4.8 thousand. Thus, the net position increased by 6 thousand contracts. This means that the bullish mood has intensified. It is "bullish" since the total number of buy contracts now exceeds the total number of sell contracts with non-commercial traders by almost 30 thousand. Accordingly, the paradox lies in the fact that the mood of traders is "bullish", but the euro currency is falling almost non-stop. We have already explained in previous articles that this effect is achieved by even higher demand for the US dollar. It turns out that the demand for the dollar is higher than the demand for the euro, which is why the dollar is growing in pairs with the euro currency. Based on this conclusion, these COT reports on the euro currency now do not make it possible to predict the further movement of the pair. They are, one might say, meaningless. However, if the demand for the euro currency starts to fall among professional players, this may lead to an even greater fall in the euro, since the demand for the dollar is likely to remain high due to geopolitics and macroeconomics.

Analysis of fundamental events.

During the current week, there were practically no important reports and events in the European Union. All the key news related to geopolitics or just politics. So the European Union introduced a new package of sanctions against Russia, which did not contain any bans on energy imports, for which the whole package was immediately criticized even within the EU itself. Even the ban on the import of coal from the Russian Federation will take effect only in August. The question is, what is the point of such sanctions if they begin to take effect when the hostilities themselves may have already stopped? Also yesterday, the head of the European Commission, Ursula von der Leyen, personally visited Kyiv, Bucha, and met with President Zelensky. It is not yet known whether there will be any new decisions regarding Russian aggression in Ukraine, but the delegation of Europeans has already stated that after what they saw, it is necessary to increase sanctions pressure on Russia. Sanctions pressure, from which Europe itself will suffer very much in economic terms. Thus, this news only gives new reasons to assume the fall of the European currency. We are confidently moving towards price parity with the dollar.

Trading plan for the week of April 11-15:

1) On the 24-hour timeframe, the pair briefly exceeded the Kijun-sen line, but after a couple of days, it collapsed again. Almost all factors still speak in favor of the growth of the US dollar, and not vice versa. The price is below the Ichimoku cloud, so there is still little chance of euro growth. Rather, the euro's decline will continue with targets of 1.0636 and 1.0608. So far, sales remain the most relevant.

2) As for purchases of the euro/dollar pair, they are not relevant now. First, there is not a single technical signal or sign that an upward trend may begin. Second, the "foundation" and "macroeconomics" continue to exert strong pressure on the euro. Third, "geopolitics" may continue to put pressure on traders and investors who still believe that in any incomprehensible situation it is necessary to buy the dollar. Only overcoming the Senkou Span B line we would consider a strong basis for a new upward trend.

Explanations of the illustrations:

Price levels of support and resistance (resistance /support), Fibonacci levels - target levels when opening purchases or sales. Take Profit levels can be placed near them.

Ichimoku indicators (standard settings), Bollinger Bands (standard settings), MACD (5, 34, 5).

Indicator 1 on the COT charts - the net position size of each category of traders.

Indicator 2 on the COT charts - the net position size for the "Non-commercial" group.