The EUR/USD currency pair traded quite calmly on Monday amid the complete absence of macroeconomic and fundamental events. Perhaps the most important event of the day was the results of the first round of presidential elections in France. But we'll talk about this later. In the meantime, it should be noted that the euro/dollar pair failed to start a correction on Monday, failed to gain a foothold above the moving average line, and traders again found no reason to buy the European currency. From our point of view, everything is going according to plan, since at this time there are still very few reasons for the growth of the euro. This, of course, does not mean that the euro will fall constantly and non-stop. There will still be corrections. And it is they who can confuse traders since even just explaining the strengthening of the euro currency in the current circumstances is extremely difficult. However, it should be remembered that macroeconomic, fundamental, and geopolitical factors now unequivocally support the US dollar. And the medium-term downtrend has been going on for 15 months. Separately, I would like to note that during any correction within the framework of this trend, the pair could not update its last local maximum. That is, we are dealing with a classic trend, where each next peak is lower than the previous one.

Although there was no geopolitical news either on Monday or on the weekend, the markets cannot feel calm. Official Kyiv has made several statements in recent days, which indicate that the conflict with Russia can be very long-lasting. For example, Presidential adviser Alexey Arestovich said that over the next 13 years Ukraine will somehow be in a state of military conflict with Russia. During this period, Arestovich predicts at least two new incursions of the Russian Federation into Ukraine. It is difficult to say what these forecasts are based on, but Arestovich has already predicted the future quite accurately several times. Thus, there is indeed a high probability that this whole conflict will escalate into "Donbas 2.0". That is, it will drag on for many years.

What are the positions of Ukraine and Russia before the new stage of negotiations?

Before making our conclusions about the duration of the military conflict, we suggest understanding what positions Kyiv and Moscow occupy at this time. The key position - in relation to Crimea and Donbas - remains unchanged on both sides. Neither Kyiv nor Moscow is going to give up these territories, so this factor alone is enough for the conflict to last until one of the parties is completely defeated. Kyiv receives powerful weapons from the European Union and the United States, large financial and humanitarian aid, and therefore can wage war for a long time. Russia has been drained of blood by sanctions, more than half of its gold and foreign exchange reserves have been frozen, and in the near future, the EU countries may still decide to impose an oil and gas embargo. However, even if all this happens, it does not mean that Russia will immediately withdraw its troops from Ukraine and sign a peace treaty on unfavorable terms for itself. Such a decision simply will not be understood in Russia itself. Why was it necessary to launch a military operation if, as a result, Crimea was lost, and Donbas was again ceded to Ukraine?

Moreover, the Russian army has huge resources. These resources will be enough for years of conducting a military operation, even if all the factories for the production of weapons for lack of imported components stop. Moreover, absolutely all military experts predict that in the coming weeks the active phase of the military operation will be replaced by a passive one. That is, the positions will take up the defense and will not make active attempts to move forward. Ukraine simply has nothing (yet) to go on the offensive with, and it is not entirely profitable for Russia, since it is much more difficult to attack than to defend, and the losses of military equipment and personnel will grow daily. Thus, most likely, it will be exactly like this: the conflict will persist, the European economy will slide into recession, the European Union will face both a food and energy crisis, and only the States will benefit from all this mess in Eastern Europe. Naturally, the euro will continue to fall against this background.

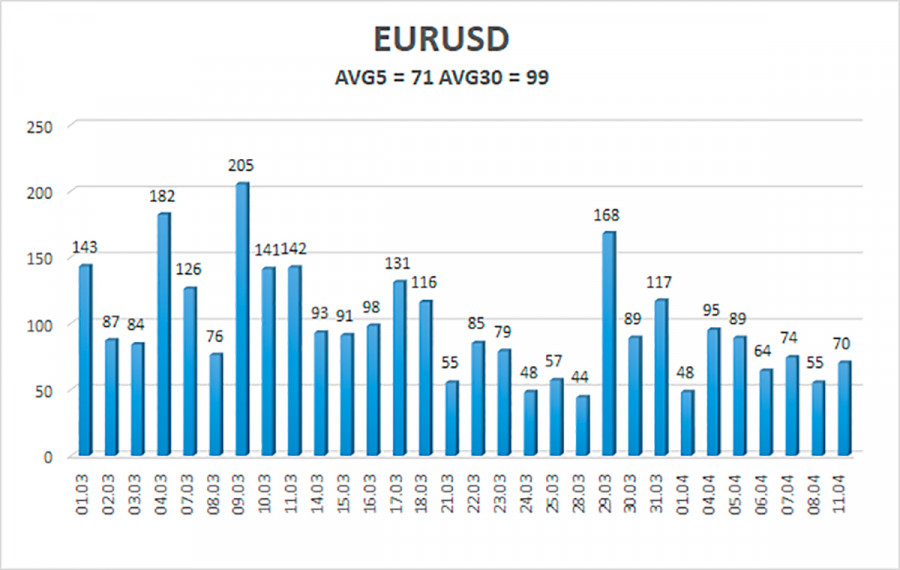

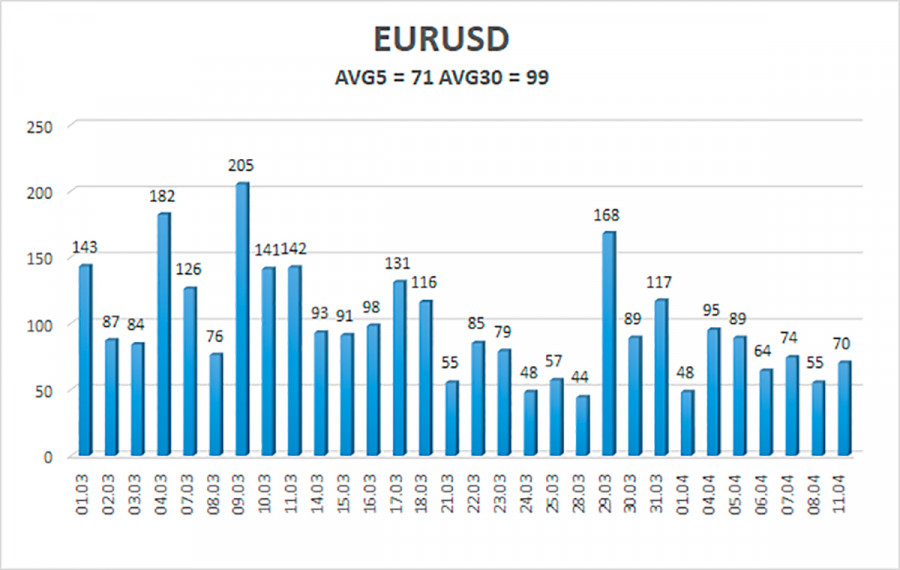

The volatility of the euro/dollar currency pair as of April 12 is 71 points and is characterized as "average". Thus, we expect the pair to move today between the levels of 1.0804 and 1.0947. The reversal of the Heiken Ashi indicator downwards signals the resumption of the downward movement.

Nearest support levels:

S1 – 1.0864

S2 – 1.0742

S3 – 1.0620

Nearest resistance levels:

R1 – 1.0986

R2 – 1.1108

R3 – 1.1230

Trading Recommendations:

The EUR/USD pair continues to be located below the moving average line. Thus, now we should consider new short positions with targets of 1.0804 and 1.0742 after the reversal of the Heiken Ashi indicator down. Long positions should be opened with a target of 1.1108 if the pair is fixed above the moving average.

Explanations of the illustrations:

Linear regression channels - help to determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.