Balanced data came out on the US labor market on Friday, an impressive growth rate was maintained. As in March, 428,000 new jobs were created in April, which is higher than forecasted 390,000.

Unemployment also remained unchanged from the previous month (3.6%). Overall, current employment is 1.2 million below pre-pandemic peaks and reflects full employment.

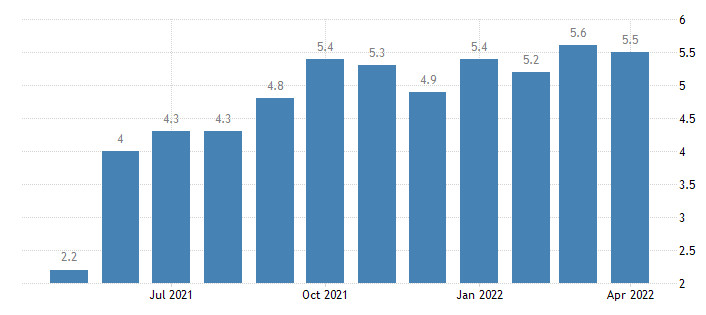

Traders' focus on the report on employment in the non-farm sector is the average wage. This is perhaps the most important economic indicator that has maintained support for Treasury yields and the dollar.

US Average Hourly Wage Y/Y

The average hourly wage rose by 0.3% in April compared to March and by 5.5% in annual terms. Historically, this is a high growth rate, but it is still not able to outpace the 8.5% price increase.

However, wage growth has stabilized and is unlikely to push inflation sharply upwards, as it was before. It is worth noting that the current data does not provide for the need for a more stringent Federal Reserve rate hike. In other words, they are a kind of signal that the Fed will continue to adhere to the current course in monetary policy.

Friday's balance of signals from the labor market should contain fluctuations in the stock and currency markets, but the trends will remain unchanged. The stock market will weaken, albeit at a slower pace, and the dollar will strengthen.

At the end of the working week, the dollar index still conquered the 104.00 high, thus testing new peaks in almost 20 years. It wasn't difficult, as major competitors are losing customer support one by one.

The US dollar now has good chances to settle above 104.00. The last time the index tried to climb higher, the economy and inflation needed to be stimulated. Now everything is quite the opposite - cooling is needed.

Compared to last year, now the attitude towards the greenback has changed a lot, given that in 2021 the dollar was often talked about as losing its status. This sort of thing happens from time to time when things go downhill for a greenback. Now it is back on horseback and can overtake previous achievements.

The rising value of the dollar, along with more attractive US Treasury yields, make it an almost uncompromising choice at the moment.

Experts almost unanimously talk about the strength of the dollar. Economists at HSBC believe it will continue to rise.

"We continue to believe that the US dollar will remain strong. First, the Fed's attitude to the corresponding pace of tightening may change if the situation requires it. Secondly, the 50bp momentum is likely to be maintained over the next few meetings. Third, while dollar bears will say that the Fed's aggressive hike is priced in, the same is true for most Big 10 central banks. And finally, the dollar will remain the most attractive buy in the face of global slowdown risks," strategists comment.

On Friday, the US dollar index is under some selling pressure after reaching 104.00. However, the underlying bullish potential remains in place. A fresh surge above 104.00 should test 105.63 (11 December 2002 high) before targeting the December 2002 peak at 107.31.

Such movements of the US currency will force its key competitors to retreat further. Will European and Japanese officials calmly watch their names fall broadly? Probably not. This will exacerbate the existing economic problems and the situation with inflation.

Japan managed to stop the strongest fall of the yen at the end of April, which stabilized near 130.00 against the dollar. Recently, there has been a wave of intensification from politicians about a possible tightening of rates to match the pace of tightening from the Fed.

So far, these are only verbal interventions, and the greenback looks extremely confident. If next week it manages to settle above 104.00 on the index, then the bulls' appetite will rise significantly. The 107.00 level, the next technical stop may well be the value of 120.00. Here we are talking about the high since the beginning of this century.