GBP/USD 5M

The GBP/USD currency pair traded in different directions on Monday. At night, it managed to rise to the critical line and fall by 80 points, during the daytime - an increase of 70 points back to Kijun-sen. As a result, the day ended exactly at this line, which is quite important for the future prospects of the pound. If this line is broken, then the pound may continue its strengthening towards the Senkou Span B, which is the last stronghold to maintain the downward trend. However, it doesn't look like this is the end of the trend yet. Often, a strong trend ends with a sharp departure from the low price. Now, nothing of the kind is observed. The fundamental and macroeconomic backgrounds have not changed recently. Therefore, the factor of the need to correct from time to time still plays in favor of the pound. But if traders do not start short positions and/or buy the pound, then there will be no upward movement. No important statistics published either in the US or in the UK on Monday. The calendar included a speech from Bank of England Governor Andrew Bailey, there was no information about this.

Trading signals on Monday were very bad. By and large, they did not exist at all, since the price at a certain moment reached the extreme level of 1.2259 and began to "dance" around it. In principle, all signals near this level could be safely ignored, since the critical line was located a little higher. But traders probably opened one deal for short positions. It, of course, turned out to be unprofitable, since the price could not go down even 20 points. Stop Loss could not be set to breakeven. The last signal near the critical line should not have been worked out - it was formed too late.

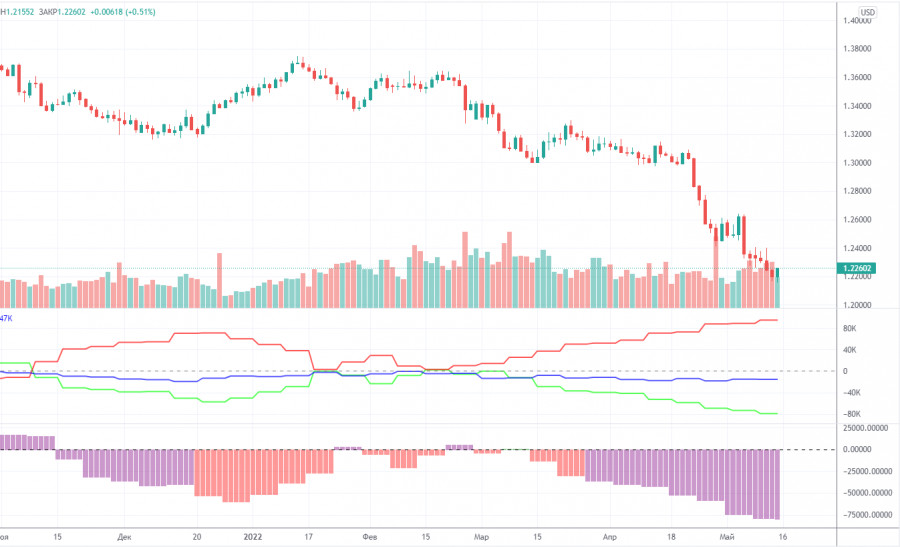

COT report:

The latest Commitment of Traders (COT) report on the British pound has witnessed a new increase in bearish sentiment among professional traders. During the week, the non-commercial group closed 4,000 long positions and opened 1,700 short positions. Thus, the net position of non-commercial traders decreased by another 5,700. The net position has been falling for three months already, which is perfectly visualized by the green line of the first indicator in the illustration above. Or the histogram of the second indicator. The non-commercial group has already opened a total of 109,000 shorts and only 29,000 long s. Thus, the difference between these numbers is already fourfold. This means that the mood among professional traders is now "pronounced bearish" and this is another factor that speaks in favor of the continuation of the fall of the British currency. Note that in the case of the pound, the data from the COT reports very accurately reflects what is happening in the market. Traders are "strongly bearish" and the pound has been falling against the US dollar for a very long time. We do not yet see concrete signals for the end of the downward trend, however, usually a strong divergence of the red and green lines of the first indicator signals the imminent end of the trend and the beginning of another. Therefore, the conclusion is that an upward trend may begin in the near future, but it is dangerous to try to catch its beginning at the lowest point. The pound may well fall another 200-400 points.

We recommend to familiarize yourself with:

Overview of the EUR/USD pair. May 17. The Baltic is a new platform for a possible clash between Russia and NATO.

Overview of the GBP/USD pair. May 17. Great Britain and the European Union are obviously bored: a trade war may begin.

Forecast and trading signals for GBP/USD on May 17. Detailed analysis of the movement of the pair and trading transactions.

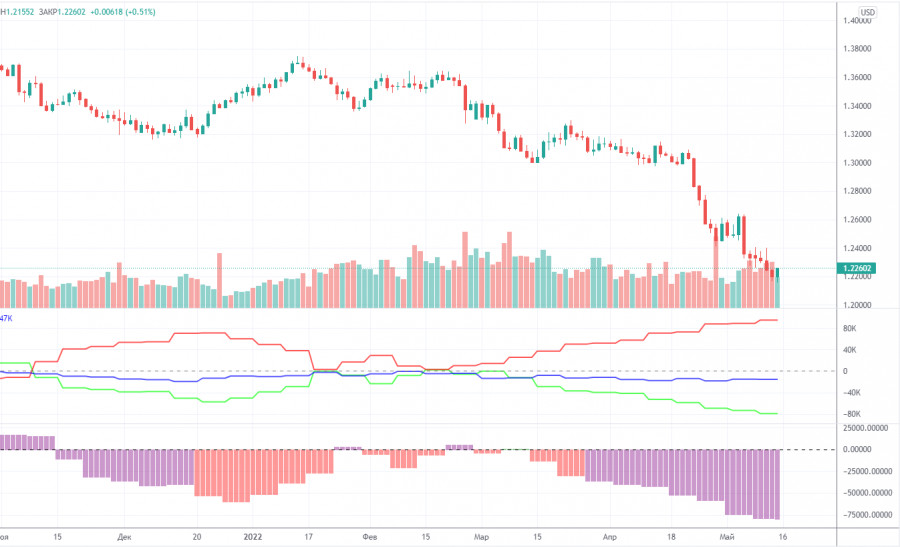

GBP/USD 1H

You can clearly see on the hourly timeframe that the pound has barely recovered to the critical line. Now, if it does overcome it, we can count on growth by another 120 points, to the area of 1.2405-1.2410. Rebound = new fall to 1.2163. The downward trend continues. For May 17, we highlight the following important levels: 1.2073, 1.2163, 1.2259, 1.2405-1.2410. Senkou Span B (1.2447) and Kijun-sen (1.2278) lines can also be sources of signals. Signals can be "rebounds" and "breakthrough" of these levels and lines. The Stop Loss level is recommended to be set to breakeven when the price passes in the right direction by 20 points. Ichimoku indicator lines can move during the day, which should be taken into account when determining trading signals. The chart also contains support and resistance levels that can be used to take profits on trades. Today, the UK is set to publish reports on unemployment, applications for unemployment benefits and wages. This is not the most important data, and now traders generally like to ignore the statistics from Great Britain. About the same reports in terms of importance are US industrial production and retail sales. There is a little more chance of finding a market reaction.

Explanations for the chart:

Support and Resistance Levels are the levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels.

Kijun-sen and Senkou Span B lines are lines of the Ichimoku indicator transferred to the hourly timeframe from the 4-hour one.

Support and resistance areas are areas from which the price has repeatedly rebounded off.

Yellow lines are trend lines, trend channels and any other technical patterns.

Indicator 1 on the COT charts is the size of the net position of each category of traders.

Indicator 2 on the COT charts is the size of the net position for the non-commercial group.