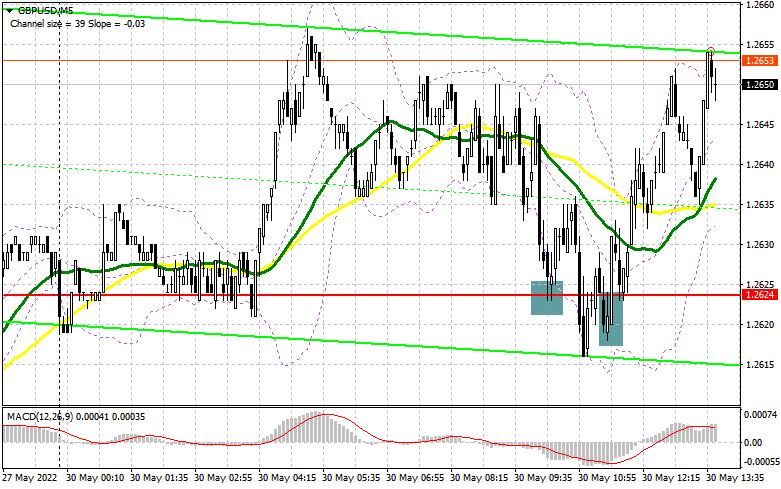

Earlier, I asked you to pay attention to the level of 1.2624 to decide when to enter the market. Let us take a look at the 5-minute chart to clear up the market situation. A decline and a false break of 1.2624 were quite expectable amid the absence of important macroeconomic data. As a result, traders got a perfect buy signal, which allowed the pair to climb by 30 pips. If you missed the first signal, you could have benefited from the second decline and a false break of 1.2624. From the technical point of view, the situation remained the same.

Conditions for opening long positions on GBP/USD:

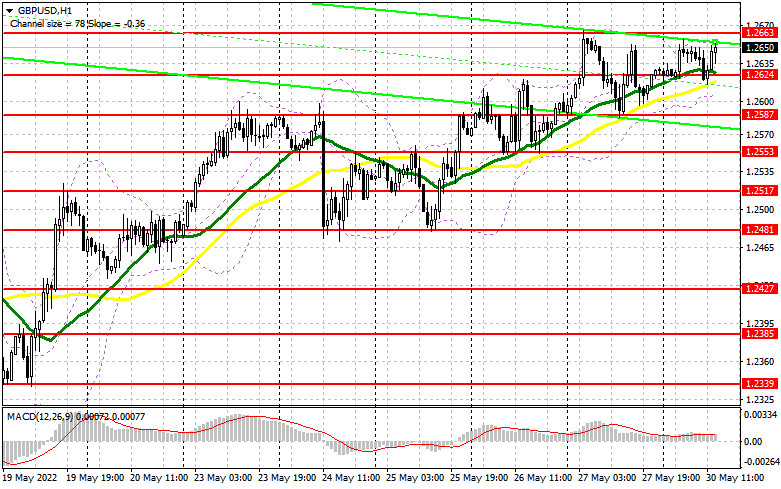

Buyers are pushing the pound sterling to the upper limit of the triangle. The pair's direction depends on the break of this limit. The absence of macroeconomic reports and a federal holiday in the US may seriously affect the market volatility in the second part of the day. That is why I suppose that the British pound will hardly break the upper limit of the triangle and will enter a sideways channel of 1.2587-1.2663. Buyers should primarily protect the level of 1.2624. Only a false break of this level will give a long signal with the target at the weekly high of 1.2663. The pair may show a jump after it consolidates above 1.2663 and downwardly breaks it. In this case, the pound/dollar pair may reach new highs at 1.2709 and 1.2755, where it is recommended to lock in profits. A farther target is located at 1.2798. If the pound sterling declines and buyers fail to protect 1.2624, pressure on the pair will surge. In this case, it will return to 1.2587. Against the backdrop, it is better to be cautious when opening long positions. It will be wise to enter the market after a false break of this level. It is also possible to buy after a rebound from 1.2553 or lower – from 1.2517, expecting a rise of 30-35 pips within the day.

Conditions for opening short positions on GBP/USD:

Bears tried to break 1.2624, but all in vain. Nevertheless, at the end of the month, big players are likely to close their long positions, thus causing a correction. Bears should primarily protect the monthly high of 1.2663 and return to 1.2624. A false break of 1.2663 will create a perfect short signal with the target at 1.2624. A break and an upward test of this level will give an additional sell signal, allowing the pair to return to 1.2587 and then to 1.2553, where it is recommended to lock in profits. A farther target is located at a weekly low of 1.2517. However, even a break of this level will hardly stop the uptrend. It may just cool down buyers a bit. If the pound/dollar pair rises and bears fail to protect 1.2663, the price may surge. In this case, it is better to avoid short orders until the pair hits the next resistance level of 1.2709. There, it is possible to go short, but only after a false break. It is also possible to sell the asset after a bounce off the high of 1.2755 or higher – off 1.2798, expecting a drop of 30-35 pips.

COT report

According to the COT report from May 17, the number of both short and long positions dropped. This means that the market may reach the bottom and that traders are benefiting from attractive prices regardless of the uncertain situation in the UK. The fact is that the UK has faced several serious problems, including surging inflation and a slowdown in economic growth. Although the Bank of England is between two fires, Andrew Bailey emphasizes that the regulator will hardly stop raising the key interest rate in the near future. Meanwhile, the US Fed may change its mind. There are rumors that the US regulator is planning to pause the key interest rate hike as early as September. This will inevitably affect the US dollar. According to the COT report from May 17, the number of long non-commercial positions declined by 2,856 to 26,613, whereas the number of short non-commercial positions slumped by 3,213 to 105,854. As a result, the negative value of non-commercial net position decreased to -79,241 from -79,598. The weekly close price increased to 1.2481 from 1.2313.

Signals of indicators:

Moving Averages

Trading is performed slightly above 30- and 50-day moving averages, thus pointing to buyers' intention to push the pound sterling higher.

Note: The period and prices of moving averages are considered by the author on the one-hour chart that differs from the general definition of the classic daily moving averages on the daily chart.

Bollinger Bands

If the pair grows, the resistance level will be located at the middle limit of the indicator at 1.2660. In case of a decline, the lower limit of the indicator located at 1.2610 will act as support.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing volatility and noise). The period is 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing volatility and noise). The period is 30. It is marked in green on the graph.

- MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages). A fast EMA period is 12. A slow EMA period is 26. The SMA period is 9.

- Bollinger Bands. The period is 20.

- Non-profit speculative traders are individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions is a total number of long positions opened by non-commercial traders.

- Short non-commercial positions is a total number of short positions opened by non-commercial traders.

- The total non-commercial net position is a difference in the number of short and long positions opened by non-commercial traders.