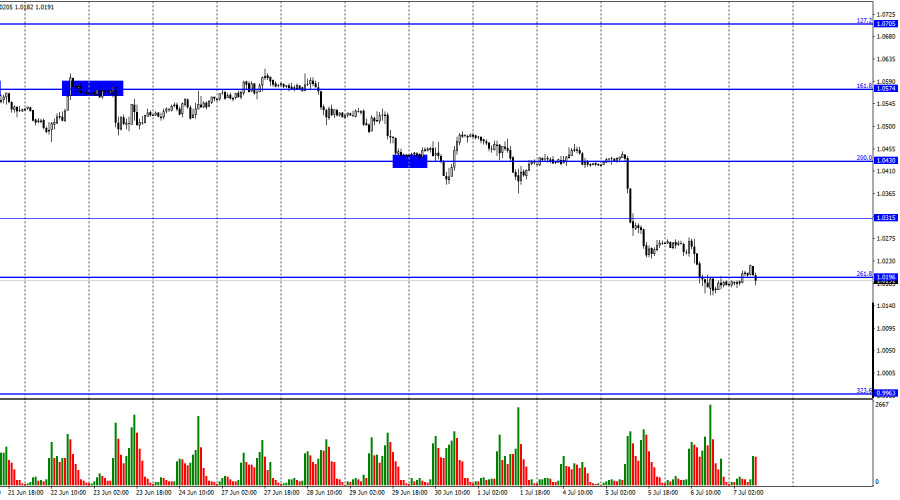

EUR/USD is trading around the 261.8% retracement level of 1.0196 on Thursday. It only made a drop to this level yesterday. As you can see, there will definitely be no reversal in favour of the EU currency and no rally. The bear traders have a strong grip on the market and are probably getting ready for a new sell-off. Therefore, in the coming days the price may continue to fall towards the correction level of 323.6% at 0.9963. It is difficult to even find any growth drivers for the European currency. Tomorrow there will be an important Nonfarm Payrolls report in the USA, which will get a reaction from traders. If the report is strong, the USD is more likely to continue its rally. Last night the Fed published the minutes from its June meeting. These reports are usually of little interest. All relevant information is announced by Jerome Powell immediately after the meeting.

The Fed president makes public appearances quite often. Traders therefore know well what to expect. Thus, I was not looking forward to anything interesting from the minutes. The document stated that price stability remains the Fed's primary concern, with the central bank willing to sacrifice both economic growth and unemployment in order to bring inflation down to normal levels. The Fed clearly shows its willingness to continue to raise interest rates at the appropriate pace in order to reduce inflation. Traders believe that the rate will be raised by 0.75% this month. I would still recommend waiting for the next inflation report which is due out in a week. If it shows an increase in price growth again, the rate will definitely be raised. Of the entire committee, only one member did not support a 0.75% rate hike at the last meeting. If the Fed hikes the rate in July by 0.75%, the dollar will continue its rally.

On the 4-hour chart, the pair performed a drop to the 127.2% retracement level of 1.0173. The pair's rebound from this level will benefit the euro and lead to some growth in the direction of the lower line of the descending corridor, which continues to characterize traders' current "bearish" sentiment. I do not anticipate a rapid increase in the value of the EU's currency until it is fixed above the corridor. A close below 1.0173 would increase the possibility of further declines. There are no emerging divergences in any indicator today.

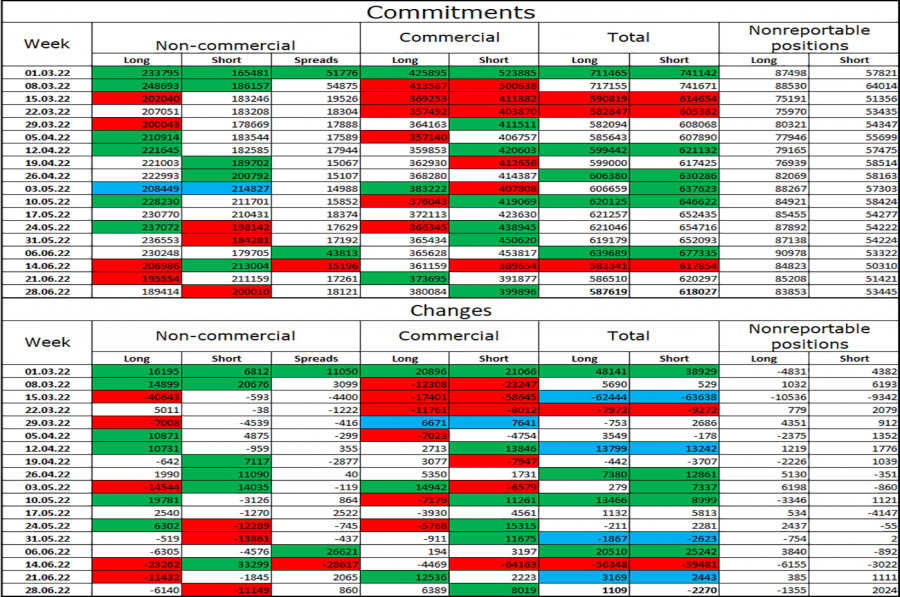

Commitments of Traders (COT) report:

Speculators closed 6,140 long contracts and 11,149 short contracts during the previous reporting week. This indicates that the "bearish" sentiment of the major market participants has weakened slightly but remains "bearish." The total number of long contracts held by speculators is 189,000, and the number of short contracts is 200,000. The disparity between these numbers is negligible, but it does not favor the bulls. Most "Non-commercial" traders have maintained a "bullish" outlook on the euro in recent months, which has not helped the euro currency. Recent COT reports indicate that new sales of the EU currency may follow, as speculators' sentiment has shifted from "bullish" to "bearish" over the past few weeks. The Fed and the ECB have not provided positive updates regarding the euro.

News calendar for the United States and Europe:

EU - ECB monetary policy meeting minutes (11-30 UTC).

US - Non-farm payrolls from ADP (12-15 UTC).

US - Initial jobless claims (12-30 UTC).

On July 7, the EU and US economic calendars contain some interesting notes. I believe that traders may pay attention to the ADP report. The other events they are likely to ignore. The influence of the information background may be weak today.

EUR/USD outlook and tips for traders:

I recommended open short positions when the pair consolidates below 1.0315 on the hourly chart with a target of 1.0196. This level has been adjusted. New sales are suggested at 1.0196 with a target of 1.0080. I recommend opening long positions on the Euro currency when it gets above the corridor on the 4-hour chart with a target of 1.1041.