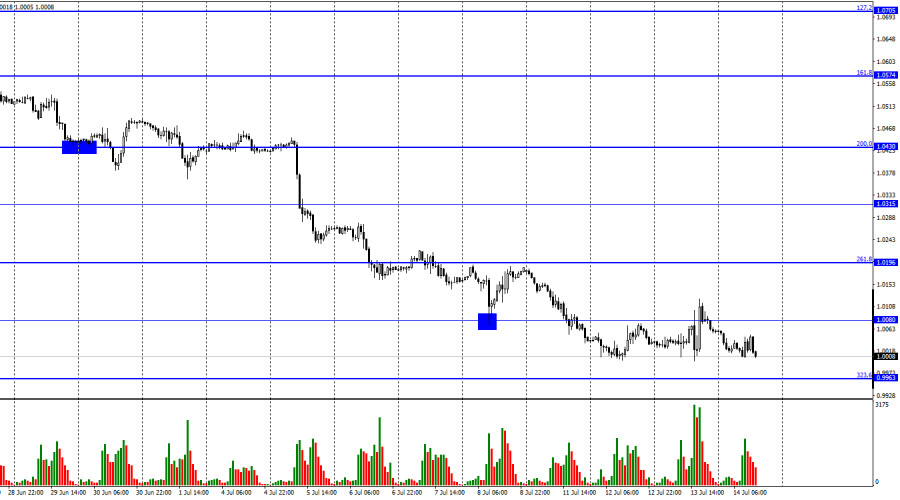

Yesterday, the EUR/USD pair executed a reversal in favor of the European currency and a slight rise with a close above 1.0080. It appears that this is the moment for the euro. An hour after this event, however, a reversal in favor of the US dollar occurred, and by the time this article was written, the European quotes had returned to the lowest levels of the week, month, and past 20 years. Thus, the falling process can continue in the direction of the corrective level of 323.6% (0.9963). One event alone was remembered from yesterday. Even though there were reports from the European Union and the United Kingdom yesterday, they had little impact on the sentiment of traders. However, after the release of the inflation report, such movements began. Inflation in the United States has risen again and now stands at 9.1%. From my perspective, the remaining inflation figures are unimportant, and this is why.

As much as one would like to believe otherwise, the Fed is not more concerned with the underlying inflation rate (excluding food and fuel). According to the most recent report, core inflation can decline when the primary indicator rises. In recent months, the price of oil (gas and gasoline) has broken all previous records, so all goods whose price includes transportation costs become automatically more expensive after hydrocarbons. How can you turn a blind eye to many first-rate necessities for humans? Let me remind you that, first and foremost, the lower class of the population suffers from high inflation, and for them, the rise in food prices is of immense significance. More than half of the US population that does not have an extra $500-$1000 per month to cover rising costs is impacted negatively by high inflation, so it is no surprise that this is already being stated. From my perspective, rising inflation makes it plausible that the Fed will raise rates by 0.75 percentage points in July. Today, some agencies and analysts began discussing an increase of even 1.00 percent.

On the 4-hour chart, the pair has positioned itself below the corrective level of 127.2% (1.0173). Consequently, the price decline can continue in the direction of the subsequent corrective level of 161.8 percent, or 0.9581. The downward trend corridor continues to characterize "bearish" sentiment among traders. Both indicators have formed "bullish" divergences, which have thus far did not affect the sentiment of traders.

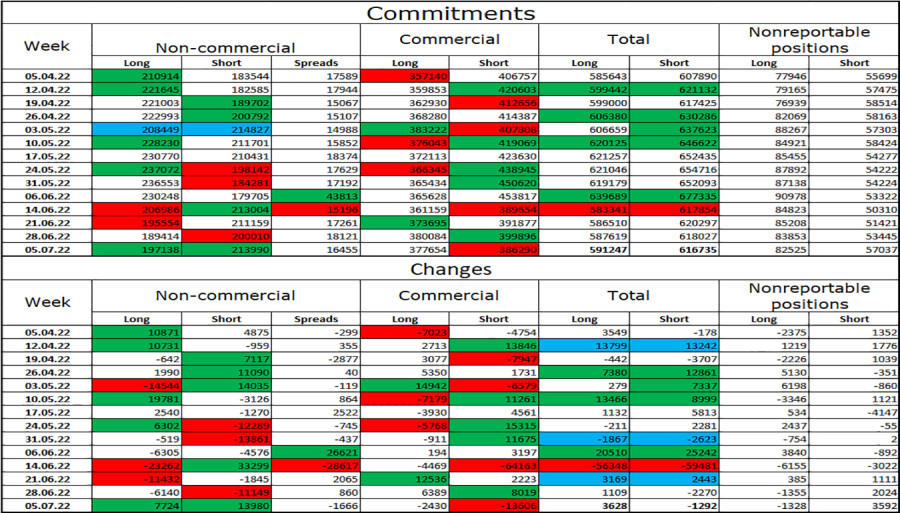

Report on Commitments of Traders (COT):

Last reporting week, 7,724 long contracts and 13,980 short contracts were opened by speculators. This indicates that the "bearish" sentiment of the major players has again intensified and continues to be "bearish." The total number of long contracts held by speculators is now 197 thousand, and the number of short contracts is 214 thousand. The disparity between these numbers is slight, but it does not favor the bulls. Most "Non-commercial" traders have maintained a "bullish" outlook on the euro in recent months, which has not helped the euro currency. Recent COT reports indicate that new sales of the EU currency may follow, as speculators' sentiment has shifted from "bullish" to "bearish" over the past few weeks. This is the exact development of events that we are currently witnessing.

News calendar for the United States and Europe:

The number of initial claims for unemployment benefits in the United States (12:30 UTC).

The economic event calendars of the European Union and the United States contain one entry for two on July 14. The report on applications for unemployment benefits is not likely to elicit a strong reaction. Today, the impact of the information background on the sentiment of traders may be negligible or nonexistent.

EUR/USD forecast and trader recommendations:

I suggested selling the pair when it reached a closing price of 1.0196, with targets of 1.0080 and 0.9963; the first target has been reached, and the second can be reached today. On a 4-hour chart, I advise buying the euro when the price is above the corridor with a target of 1.1041.