The EUR/USD pair increased by approximately 100 points on Wednesday evening. We shall examine the outcomes of the Fed meeting in a moment, but for now, we will remark that such a market reaction was unreasonable and violated all market laws. However, we stated that it would not be possible to make conclusions before the middle of Thursday, when European, Asian, and American traders would not have properly comprehended the meeting's outcomes. We were correct, as the pair fell like a stone the next day. Therefore, I would like to reiterate that nothing occurs in the foreign currency market. Numerous experts quickly commented that the meeting's outcomes could be construed as "dovish," and the 0.75 percent rate increase reportedly underwhelmed the market. The market was also displeased with reports that the Fed would begin to slow the pace of monetary policy tightening. We remind you that the current growth rate in the United States is the highest it has been in forty years. Thus, it makes no difference whether the Fed raises rates by 0.75 percent or 1.00 percent! The market could have anticipated a 0.75 percent rate hike in advance, but this does not invalidate the fact that now there will be adjustments in the American economy and none in the European economy, for example. The difference in monetary strategies can and should affect currency rates. As a result, the European currency was forced to decline.

Let's investigate it with greater gravity. The euro cannot regularly adjust, as 300 points on a trend of one and a half years is little. The Fed continues to hike interest rates, but the ECB has yet to boost rates this month. Not in America but on the European continent, geopolitics remains challenging. Every month, the environment for investing in safe assets improves in the United States. To invest in the American economy, dollars, not euros, are required. Do you require additional justifications for why the euro will continue to fall? It's only that the currency can't decline daily for an entire year and a half!

The Federal Reserve was not startled and did not alter its aggressive monetary policy.

So, the Federal Reserve decided to increase the key rate by 0.75 percentage points to 2.5 percent. From our perspective, this should have been the case, as there was no use in going further and immediately increasing the rate by 1.00 percent. If it had made sense, it would have been easy to raise the rate by 3.5 percent a few months ago, and the aim would have been fulfilled. Why, therefore, all of this tedious progressive tightening? Specifically, the shift to a tighter monetary policy is gradual, so that market participants and the financial system can recover without difficulty.

Moreover, as we can all see, inflation has not yet responded to the Fed's efforts. The consumer price index has already increased by 9.1 percent year-over-year and will not begin to decelerate until the next two months. And that is not the case! Who asserted that inflation would inevitably begin to decline because the rate has been raised to a neutral level?We have stated in previous articles that the Federal Reserve's forecasts rarely come true. If the Federal Reserve considers inflation "temporarily high," it will remain "long-term high." If the Fed feels that a rate between 3.25 and 3.5 percent will be sufficient to return to the target level, it will not be sufficient. If the Fed expects inflation to recover to 2 percent within a year, it will take three years to reach this objective. Therefore, we are adamant that the rate be increased above 3.5 percent. At least 4 percent. In addition, we must wait until inflation falls for at least two consecutive months before concluding that a cycle of declining price growth has begun.

Consequently, the Fed will have to hike rates by 0.75 percentage points at its next meeting in September, as it will not have access to such information. We currently believe that this scenario is the most likely outcome. With only one dollar, it has no choice except to resume its expansion.

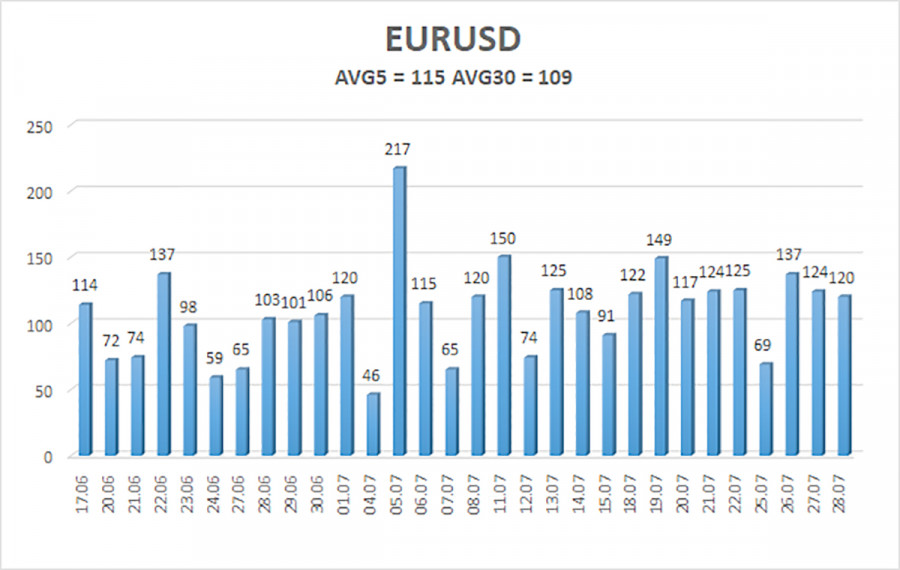

As of July 29, the average volatility of the euro/dollar currency pair for the previous five trading days was 115 points, which is considered "high." Thus, we anticipate the pair will trade between 1.0050 and 1.0280 today. The Heiken Ashi indicator's upward reversal will suggest a new round of upward movement.

Nearest support levels:

S1 – 1.0132

S2 – 1.0010

S3 – 0.9888

Nearest resistance levels:

R1 – 1.0254

R2 – 1.0376

R3 – 1.0498

The EUR/USD pair is attempting to continue its long-term downturn but drifting sideways. Consequently, it is now viable to trade on the reversal of the Heiken Ashi indicator between 1.0132 and 1.0254 until the price exits this channel.

Explanations for the figures:

Channels of linear regression – aid in determining the present trend. If both are moving in the same direction, the trend is now strong.

Moving average line (settings 20.0, smoothed) – determines the current short-term trend and trading direction.

Murray levels serve as movement and correction targets.

Volatility levels (red lines) represent the expected price channel that the pair will trade within over the next trading day, based on the current volatility indicators.

The CCI indicator – its entry into the oversold area (below -250) or the overbought area (above +250) indicates that a trend reversal is imminent.