The EUR/USD currency pair changed its direction of movement again on Tuesday and gained a foothold above the moving average. However, who is surprised by another overcoming of the moving average line if the pair continues to be inside the side channel? Recall that the price has been trading between the levels of 1.0132 and 1.0254 for a month, only occasionally trying to leave this range. However, it did not succeed even in those days when "macroeconomics" and "foundation" were strong. Well, on the first two trading days of the current week, few people believed that the euro currency would be able to start forming a new trend, so the news calendar for these days was empty. Of course, we said the pair could leave the side channel any day since this does not require strong statistics or a "foundation." It involves the desire of traders to trade. However, there was no exit from the flat on Monday and Tuesday, so we continued to wait for this moment.

It should be noted that today the chances of the euro exiting the flat are increasing. In the afternoon, July's most important inflation report will be published in the States, which may provoke a strong market reaction. However, this is just one report. How many points can a pair go through after its publication? 100? It may well not be enough to leave the channel. Thus, we believe that today the market will trade quite actively, but it is far from a fact that this will be enough to get quotes out of the limited price range. At the same time, there is no denying the fact that the inflation report may have a long-term impact on the dollar exchange rate. If it turns out that inflation continues to rise, then the US dollar may also start a new growth since the probability of new increases in the Fed's key rate will increase many times. In the opposite case, the US currency may resume falling since a decrease in inflation will mean that now the Fed can relax a little. But in general, we are waiting for the continuation of the long-term downward trend.

The European Union is taking measures in case of a "gas war."

On Tuesday, August 9, a plan to reduce natural gas consumption came into force in the European Union. Recall that this document was developed a month ago to save natural fuel for the winter period and in case the "gas war" with Russia begins. They fear that Moscow may stop exporting gas to Europe, although Brussels is considering introducing a full oil and gas embargo. However, Brussels wants to impose an embargo when its economy and population are ready for it. That is, at a convenient moment for yourself. And the Kremlin, it turns out, should wait for this moment, realizing that the EU will stop buying gas and oil from it anyway.

This topic is extensive, and there are many different opinions about how the situation will develop. There is an opinion that China and India will buy back all the volumes of petroleum products that the EU will refuse. There is an opinion that China and India will supply oil and gas to the European Union in the winter. There is an opinion that the Kremlin will be the first to abandon gas and oil cooperation with Europe, and it is better to strike first than to expect a strike at an inopportune moment. In general, hardly anyone can say what scenario this conflict will take. One thing is for sure – by the beginning of March 2023, the EU countries should reduce gas consumption by 15%. As always, there will likely be an "intermediate" option. Gazprom has already begun to reduce the volume of supplies to some EU countries, which the Kremlin considers as unfriendly as possible. And the European Union has begun to reduce oil and gas purchases, seeking to replace them with hydrocarbons from other countries worldwide. It's hard to say who will benefit from this. Europeans are unlikely to freeze this winter, but many industrial enterprises may begin to reduce their production volumes due to a shortage of "blue fuel." And this may negatively affect the growth rates of the EU economy, which has not yet slipped into recession, but looking at how the British and American economies are sliding into it, there is reason to believe that this "happiness" will not pass by the European economy either.

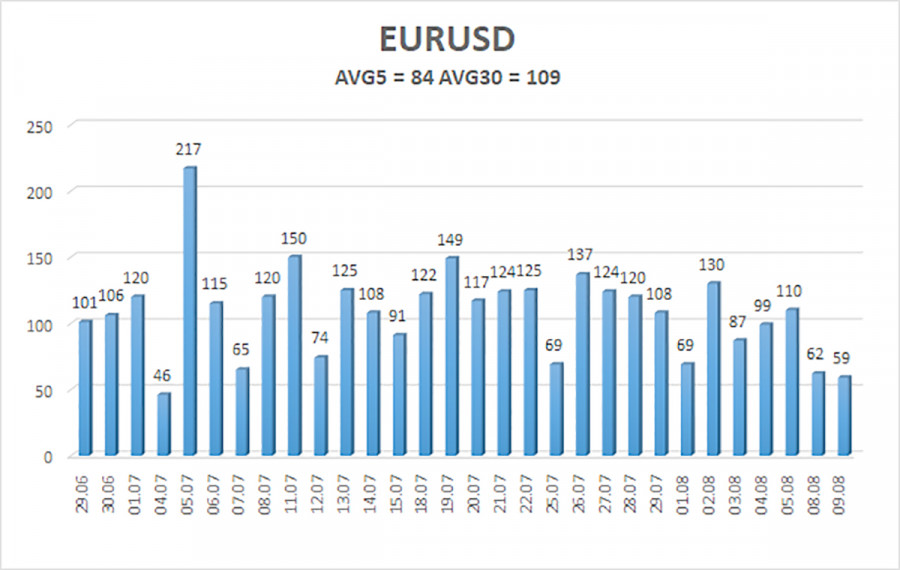

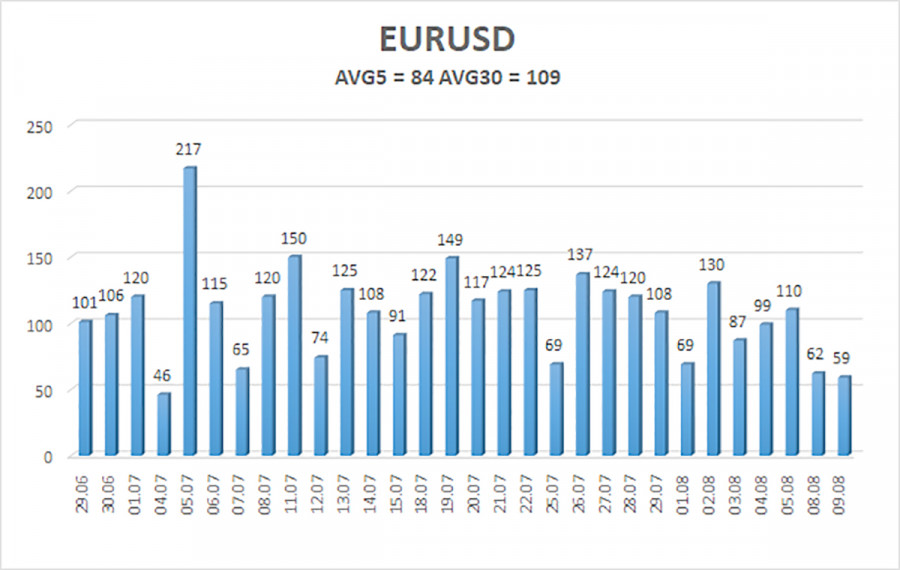

The average volatility of the euro/dollar currency pair over the last 5 trading days as of August 10 is 84 points, which is characterized as "average." Thus, we expect the pair to move today between 1.0140 and 1.0308. The reversal of the Heiken Ashi indicator downwards signals a new round of downward movement within the flat.

Nearest support levels:

S1 – 1.0132

S2 – 1.0010

S3 – 0.9888

Nearest resistance levels:

R1 – 1.0254

R2 – 1.0376

R3 – 1.0498

Trading recommendations:

The EUR/USD pair has been moving in an absolute flat for a month. Thus, it is now possible to trade on the reversals of the Heiken Ashi indicator between the levels of 1.0132 and 1.0254 until the price leaves this channel.

Explanations of the illustrations:

Linear regression channels – help to determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) – determines the short-term trend and the direction in which to trade now.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) are the likely price channel in which the pair will spend the next day, based on current volatility indicators.

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.