Details of the economic calendar for August 29

The new trading week usually starts with an empty macroeconomic calendar. Important statistics were not published in Europe and the United States, while the UK observed a holiday.

Investors and traders were able to digest everything said by the head of the Fed last Friday, and a pullback in the US dollar appeared on the market.

Information from the Fed was by no means a catalyst for price surges in the euro and the pound, but it was an integral part of the entire information and news background.

What was the leverage for buying the euro?

Initially, the euro was inspired by the news that gas prices in the EU fell by almost 20% after Germany's statement about full storage facilities.

After that, information began to appear in the media that the ECB could start raising interest rates more sharply.

This news has become a catalyst for the growth of the euro.

Analysis of trading charts from August 29

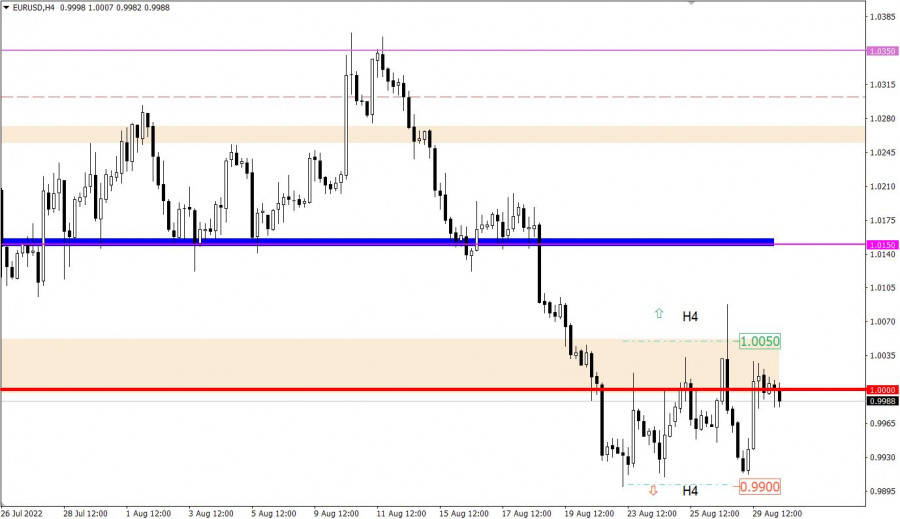

The EURUSD currency pair opened the new trading week with a roll towards the parity level (1.0000). The activity was so strong that there was an inertial move of about 90 points.

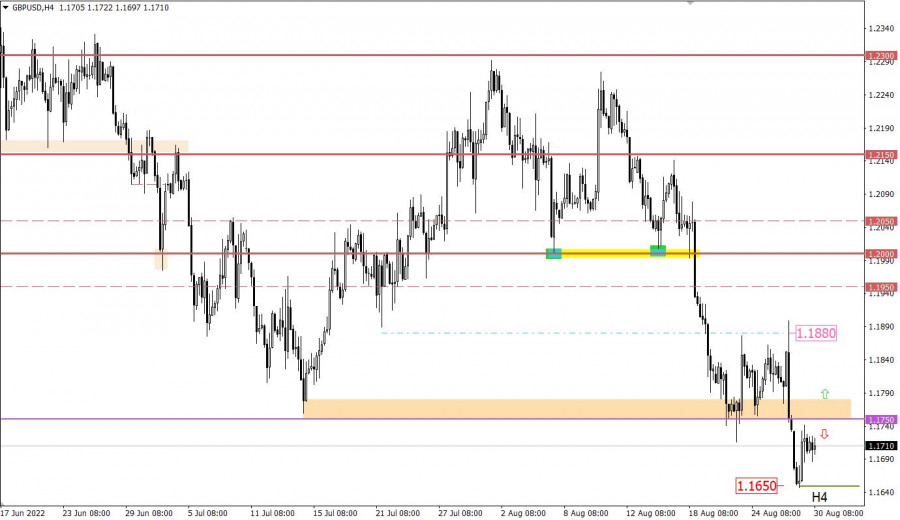

The GBPUSD currency pair reached 1.1650 during an intensive downward movement, against which there was a reduction in the volume of short positions as a result of a technical pullback. In this case, the incentive to buy the pound sterling was the positive correlation with the euro, which has significantly strengthened in value over the past day.

Economic calendar for August 30

Today, data on the UK lending market will be published, which is expected to decline. This is a negative factor for the UK economy, which may lead to the weakening of the pound sterling.

During the American session, data on housing prices in the United States will be published, where a decrease is expected based on the forecast. Data on JOLTS job openings for July is also expected.

Time targeting:

UK lending market – 08:30 UTC

US House Price Index – 08:30 UTC

US JOLTS Job Openings – 14:00 UTC

Trading plan for EUR/USD on August 30

Despite the existing price changes, the quote is still within the weekly amplitude of 0.9900/1.0050. In order for a shift in trading forces to occur, which will lead to a full-fledged move, the quote must be kept outside of a certain control value for at least a four-hour period.

We concretize the above:

The upward move in the currency pair is taken into account after holding the price above the value of 1.0050 in a four-hour period.

The downward trend should be considered after holding the price below 0.9900 in a four-hour period.

Excerpt on indicator analysis

Comprehensive indicator analysis indicates multidirectional interest in the short term due to price stagnation within the parity level. Indicators in the intraday period are focused on the recent upward momentum from the value of 0.9900. In the medium term, the indicators are still focused on the downward trend.

Trading plan for GBP/USD on August 30

In this situation, the pullback returned the quote to the area of the previously passed level 1.1750, where the upward cycle slowed down. In order for a subsequent increase in the volume of long positions, which will lead to a pullback prolongation, the quote needs to stay above 1.1780 for at least a four-hour period.

Otherwise, we are waiting for the completion of the pullback stage, followed by a price rebound from 1.1750. This scenario does not rule out updating the local low of the downward trend.

What is shown in the trading charts?

A candlestick chart view is graphical rectangles of white and black light, with sticks on top and bottom. When analyzing each candle in detail, you will see its characteristics of a relative period: the opening price, closing price, and maximum and minimum prices.

Horizontal levels are price coordinates, relative to which a stop or a price reversal may occur. These levels are called support and resistance in the market.

Circles and rectangles are highlighted examples where the price of the story unfolded. This color selection indicates horizontal lines that may put pressure on the quote in the future.

The up/down arrows are the reference points of the possible price direction in the future.