Well, after a heavy hangover among bull investors, it is becoming clear to the world that dovish signals from the US central bank's monetary policy (and the value of the dollar) are not worth it. In response to the measures taken by the central bank, bond yields shot up. What does this mean for the markets?

Are your strategies not working? And they won't. What does the fall of Wall Street tell us?

Traders seem to be beginning to realize that they are in the midst of what may be the biggest attempt to tighten financial conditions in the history of the Federal Reserve. This has the potential to shift global market sentiment. But the realization of this fact also threatens dangerous developments in society and politics, as both producers and households try to adapt to new living conditions.

And yet, after a week of market benchmarks and aggressive central bank intervention, divisions among economists are running wild. And this cannot but be alarming. It would seem that the markets have fully realized that the future is associated with tighter conditions for fighting inflation, and with it an increased risk of recession; but even though these sobering things are now taken for granted, there remain profound differences in the attempts to deal with this fact. Let's see what the numbers tell us.

Bonds, go!

Bonds are the most important indicator for the markets, since they form the value component of stocks. And here we see progress, and even what!

It is now obvious that the downward trend in the yield of 10-year Treasury bonds, which has been established since the Fed under the leadership of Paul Volcker defeated inflation, has ended. The Fed's complaints about the "inability to overcome the two percent inflation threshold" became the property of history.

A similar situation was already developing in 2007, ahead of the mortgage housing crisis that swept the world a year later. But the credit crisis that followed, on the contrary, caused the effect of minimizing the yield of treasury bonds. It's not like that now: high inflation in 2022 will make this historic feint prohibitively difficult to repeat.

There are many ways to measure the trend, you can choose any of the favorite methods of technical analysis. And with any reasonable method, you will notice that the trend has been finally broken. Fed Chairman Jerome Powell is already being called the new Paul Volcker, so maybe (just maybe) he will be able to launch a new downward wave. But this will be a new global cycle, not a resumption of the previous one.

Of all the methods, the first thing to look out for is the various trendlines that can link the highs of 10-year returns since Black Monday in 1987. As you can see, any option shows a surge that breaks the trend. And importantly, after a series of lower highs, the current cycle marked a level of return significantly higher than at the top of the previous cycle. Traders can no longer rely on strategies that have worked since 1987, which explains why the Fed is resorting to the legendary chairman's crackdown.

The yield is now well above the 200-day moving average, which means that we are not facing a single spike, but a long-term trend. Since Volcker, the gap between yields and the moving average has only been larger than it is today since 1987, in 1994, when the Fed, under Alan Greenspan, surprised the market with a series of aggressive, experimental rate hikes. But what matters today is that the most important indicator in finance has reversed the trend of the past 28 years.

Another strong indicator for the markets was the losses caused by the current sell-off. The established position in the market means that the rise in Treasury yields from lower levels could take a bigger hit to the price, and this is showing in peaks this year.

So, Bespoke Investment Group has compiled a chart of the biggest losses in one calendar year that holders of 10-year bonds have suffered since 1961. And for you, for sure, it will not be a discovery that the losses of bondholders this year have already exceeded the losses of bondholders in 1987 by 4 points, giving the largest loss in all countable years.

With 2022 not yet three-quarters over, this is already the worst year for bond investors in sixty years.

In the face of this news, the opinion of Albert Edwards, the chief investment strategist of the international bank Societe Generale, a well-known "bear", is interesting. He certainly had a negative view of stocks for a long time, but at the same time he had a fondness for bonds. His opinion, based on his experience in Japan in the 1990s, was that the US and the rest of the advanced economies were facing an "Ice Age" in which yields remained consistently low.

You know that there was a whole cabal of economists who prophesied the end of the era of high returns. Well, never say never. The theme of age-old stagnation that had kept the ice age narrative alive for so long was dealt a death blow as politicians began to throw off the tight fiscal framework. Until recently, economic ideology prevented them from abandoning fiscal austerity. This has forced central banks to fill the economic void with over-expansive monetary policy. Those days are over and aggressive fiscal activity reigns, most notable at the moment in the UK.

Significantly, Edwards is now the first to announce that the Bond Yield Ice Age is over. He believes that bond yields will continue to rise. By the way, this does not mean that he now evaluates the stock positively, not at all. The stock markets are facing, in his opinion, hard times.

Edwards believes that the new policy of the Fed and other central banks will lead to higher growth, higher inflation and higher interest rates across the curve. The cheap dollar party for investors is over. The Great Melt will not only melt the ice in the Ice Age, but investor returns as well.

Yields reversed – bonds behave abnormally

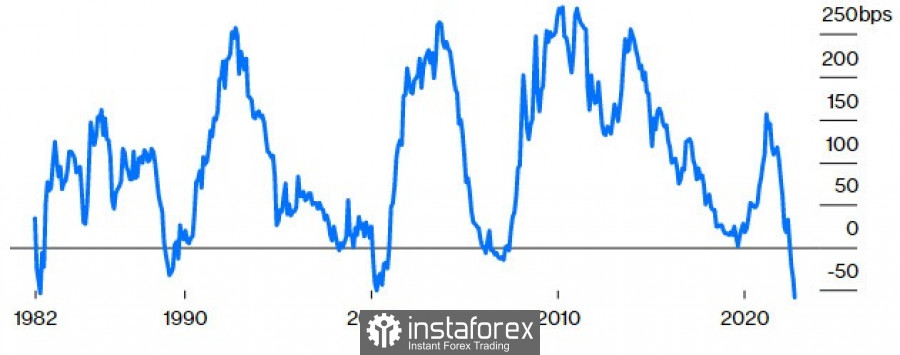

Another reason to think that everything is going to hell is that we now have an extreme degree of yield curve inversion: a ten-year yield is now lower than a two-year yield, although by default it is higher - due to the additional uncertainty associated with distant investments in the future.

When the curve inverts, it is commonly seen as an indicator of a recession. It is also a sign that the market believes that the Fed is going to overdo it by raising rates significantly in the short term to slow growth in the long term.

It is significant that the yield curve has now turned over by more than 50 basis points for the first time in more than 40 years, exceeding the values in 1982, 1998 and 2000 (it is no coincidence that Volcker resorted to raising rates to combat inflation). As you can see from the graph, the curve has become even a little steeper since then, so the main idea of the market is clear.

Why is the bond market so concerned?

Obviously, due to the fact that this is the fastest tightening by the Fed in terms of the number of basis points added since Volcker in the summer of 1980 (so you can assume that the current situation is much harsher than in Volcker's time). There were only two more aggressive cases of rate hikes from the Fed – in December 1972 and February 1999. However, the profitability of these two periods was not as extremely inversive as it is now.

So from the point of view of the last four decades, this time everything is really different. This is not so different from what happened in the US economy before, but the rules that most traders working in the market have learned to live by now do not work yet.

How bad is it really?

There are many opinions about how far the Fed will have to raise rates from now on, but the critical question is how to get to a level where rates become substantially restrictive in order to finally subdue the stubborn bulls.

The general theory is that federal funds must rise to exceed the rate of inflation. If this is so, then "we got it": all this nonsense with overcoming bullish sentiment is dragging on. With both the federal funds rate and the 10-year yield still well below the rate of inflation, real rates are still negative. In other words, those increases that you have been observing for a little less than a year - all of them still have not brought a tangible result in the form of overcoming the inflation threshold.

Historically, none of these key rates have been this low compared to general consumer price inflation since the Burns era in the mid-1970s. And that says something.

Naturally, such a situation cannot but cause heated discussions on the topic "so for how much longer?". Alas, opinions are quite diverse - even among Fed officials.

They are echoed by the Bank of England Monetary Policy Committee, which on Thursday was divided into three opinions about what the rate should be now; one member voted for a 25 basis point increase, three voted for 75 basis points, and five - the minimum required by a majority - chose 50 basis points. As a result, securities yields rose, but the pound still managed to fall to another 37-year low against the dollar. This worries analysts.

Of course, let's not forget that the UK has a particular problem with the conflict of fiscal and monetary policy due to the fact that a new government has come to work. Now the BoE is forced to tighten measures despite gloomy economic conditions as the new government, led by Liz Truss, says it is about to start fiscal spending, focusing on tax cuts and handouts of aid to mitigate the effects of the energy crisis. Will they coexist or will the British financial authorities cancel each other out, creating a collapse? Only time will tell. At the very least, Truss has proven herself to be a very flexible politician, able to adjust to the current agenda, but this may ultimately work against her.

Japan suffers from a variation of this dynamic.

The Bank of Japan and the Ministry of Finance are traditionally at odds. Following the expected Fed rate hike, the BOJ confirmed that it is doing nothing at all to change the monetary policy, which remains the loosest in the world. This prompted the ministry to intervene for the first time in 24 years to support the yen, bringing the currency back to levels it started last week. Ultimately, however, Japan could benefit from such a policy if it refrains from raising itself.

The Swiss National Bank met and agreed to a 50 basis point hike, meaning it is leaving the ranks of countries with a negative base rate. This was an event, as Switzerland is a low-inflation haven in the center of Europe, and its currency continues to be regarded, like the yen, as a safe haven. But thanks to intervention in the yen and an environment in which other central banks have acted even more aggressively, the yen has risen, while the unsupported franc has fallen. And if you're thinking the same thing I'm thinking right now, then you're also worried that what's happening is the exact opposite of what should have happened when the yen was supported by the central bank and the franc was supported by a historically important rise in rates.

The direction is clear, but the differences between central banks are still large and could cause a big market reaction. This is a dangerous environment for any kind of speculation on assumptions. And this is definitely not an environment in which technical analysis works any good on large time frames.

Loans and margins are a heavy burden

A stronger dollar (the strongest in 20 years) usually means tighter conditions on US credit. It is harder for exporters to sell, harder for manufacturers to produce, harder for traders to trade.

But until now, the credit market has been quietly silent in the corner. High-yield spreads - an additional risk that is felt in weaker loans - have risen, but not by much, given the strength of the dollar. First of all, we should thank the banks for this, which have accumulated enough money from past low-interest loans from the government over the past two years.

But what happens if and when dollar supplies from yesteryear finally run out? Lending rates will skyrocket, discouraging traders and forcing real sector producers to save, save, save again... and raise prices. Oh yes, real inflation is still ahead, my friends!

The situation is even more complicated in emerging markets (to which, by the way, although contrary to tradition, cryptocurrencies can already be attributed).

Emerging market currencies have been under pressure for some time, and central banks in many cases have been on the rise much earlier than the Fed. A stronger dollar is clearly bad for dollar-denominated credit in emerging markets, as it directly makes it more expensive to repay. A stronger dollar generally means higher credit spreads in emerging markets. And yet, emerging market debt barely declined when the dollar rose. Right now, the relationship between dollar and emerging market spreads is very similar to the US high-yield spread pattern.

This is a risk that many are very willing to take. Emerging market countries have worked to create domestic markets for local currencies and reduce their dependence on dollar debt over the past decade, but fear of a possible credit crisis in developing countries remains real.

Companies' revenues are overstated

The US stock market is still above the June lows. But will the situation continue after the release of earnings data for the third quarter, when companies will report on their profitability and offer forecasts — or lack thereof? Estimates for the third quarter were revised downward, as is usually the case, but remain quite high, probably based on loans at low rates. So managers still expect the profits of S&P 500 companies to grow next year, while independent economists are already sounding the alarm: the forecasts of companies are too optimistic.

Overall, so far, S&P 500 earnings per share can be expected to be $226.50, which is 0.7% below the peak, while S&P 500 earnings per share will suffer more next year, falling by more than 3% compared to the peak in mid-summer.

Major firms including Ford Motor, FedEx, General Electric, as well as chemical companies, consumer goods firms have recently issued profit warnings. The worst part of this process is that their forecasts are based on smooth charts, without taking into account the sharp reactions of the market. Now competent investors are wondering if the bad news has already been taken into account in prices. Many analysts believe that the market reaction to early profit and loss reports indicates that the slowdown in economic activity is far from being taken into account in prices, which means that forecasts will decline until we see the bottom of the leading economic indicators. We're not there yet.

Another deterrent will be the impact of the Inflation Reduction Act, adopted last month. JPMorgan Chase analysts already expect that in 2023 the law will reduce from $4 to $5 per share, largely due to a minimum tax of 15% for companies with a book profit of more than $1 billion per year and a one percent excise tax on share repurchases.

Now that the hawkish direction of the Fed is accepted by the markets, the attention of the stock sector will shift to profit. As a result, the S&P 500 has already closed at its lowest level since June, and many analysts believe it will test the June lows. And even after that, forecasts for stock returns should be revised downward.

Earnings sentiment has already suffered a lot: the rate of upward revision of earnings per share estimates during the summer was close to the lows of previous crises (about 30%). Usually, during severe periods of stress in the stock market, the main lows of the S&P 500 and Russell 2000 are set 3-6 months before EPS forecasts become positive again. It is also worth noting that the upward revision level began to recover and was again close to 50% in early September. Then we warned that this was a short-term surge, and we were right.

The income recession that was so feared did not affect the results of the second quarter, which contributed to the stock market's summer rally. Will corporate America be able to repeat this trick in the third quarter? My opinion is that amid mobilization in Russia, the probability of this is likely to be zero.