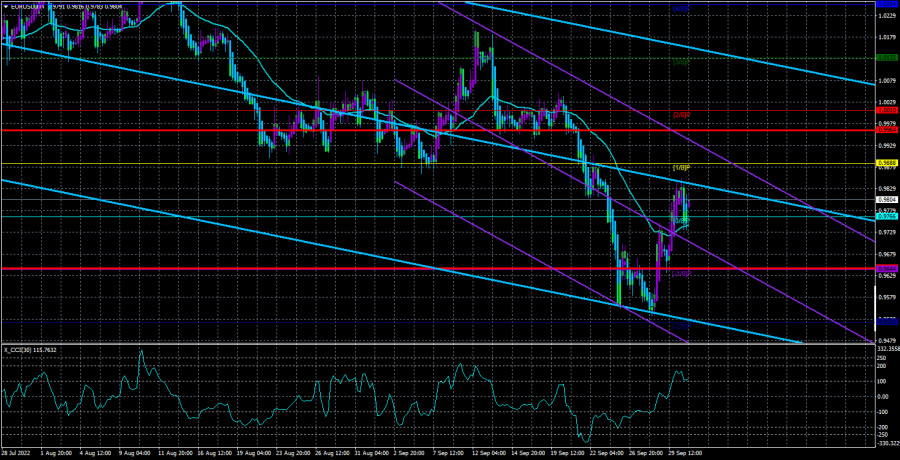

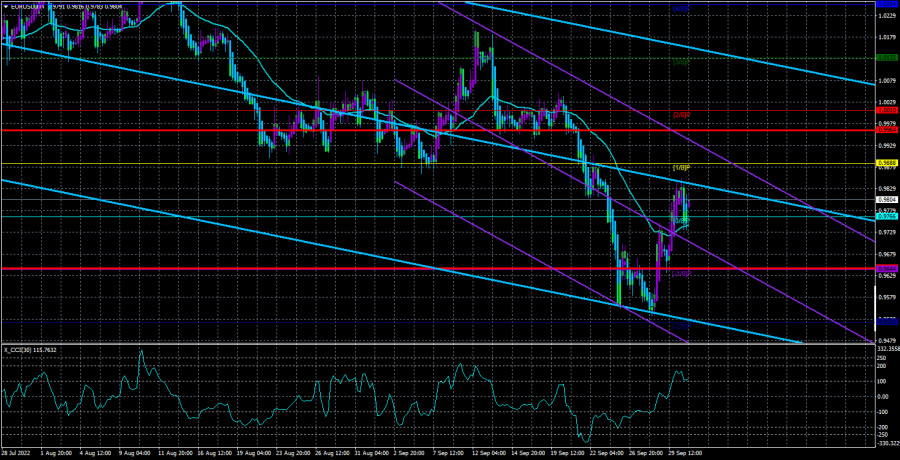

The EUR/USD currency pair was trading upwards on Friday, as it had been for the previous two days. It can be seen that traders made a pretty good leap up, but are they ready to continue buying the euro currency, or was it only a partial fixation of short positions by bears? So far, the euro has managed to rise in price by "as much as" 300 points, which is very little to talk about the beginning of a new upward trend. So formally, the trend changed to an upward one. Still, we recall that before the beginning of the last round of the upward movement, the euro currency fell significantly, so now we can talk about another round of technical correction. If this is the case, the fall of the euro currency may well resume since the fundamental global background has not changed for the euro and the dollar, and the geopolitical one has worsened, which is primarily dangerous for the euro currency. The pair had previously been fixed from time to time above the moving average, but this did not even lead to significant corrections. We still believe that it will be possible to count on the serious growth of the euro currency no earlier than the end of 2022, when the Fed, in theory, should announce a slowdown in the increase in the key rate or a refusal to increase it further. In this case, there will be fundamental reasons to expect a rise in the euro.

But at the same time, we do not know and cannot know what will happen to geopolitics by that time. We have already mentioned that three of the four strands of the Nord Stream pipeline were blown up last week. It is still unclear who is behind this terrorist attack. One thing is clear – the European Union will suffer from it. Gas supplies from Russia have been stopped and are unlikely to be resumed in the near future. Recall that the main plan of Brussels was to fill gas storage facilities as much as possible before gas supplies from the Russian Federation stopped to spend the current winter without problems and then solve the problem with gas over the next year. However, either the Kremlin has escalated the "gas conflict," or Washington has thus decided to accelerate the increase in LNG supplies from the United States to the EU. Still, the fact remains that the Nord Stream is not functioning, and if it is not repaired in the near future, it will never function.

The European economy will start to stall without Russian gas.

There will be practically no macroeconomic statistics in the EU next week. Of the relatively important events, we can single out only the indices of business activity in the service and manufacturing sectors, another speech by Christine Lagarde, and a report on retail sales. The market is now primarily interested not in macroeconomics but in geopolitics. Therefore, it will play an important role in the prospects of the euro/dollar pair. From our point of view, the situation may deteriorate dramatically in October. First, Moscow and Kyiv have taken the path of escalation of the military conflict. The Kremlin said that any strike on the territory recognized by it would be regarded as an encroachment on the integrity and security of the Russian Federation, so a tactical nuclear strike could follow in response. Kyiv immediately responded with an application to join NATO, and NATO itself announced the principle of an open door. The AFU took the strategically important city of Liman the next day, so, as we see, the Ukrainian side continues to go on a counter-offensive. Consequently, the deterioration of the geopolitical situation is a very likely development of events, given the mobilization of several hundred thousand Russians. And this means that there will be new missile strikes, bloody battles, new Western sanctions, and so on.

In addition, the European Union energy crisis may become a catastrophe when gas supplies from the Russian Federation can only be carried out by sea and through Ukraine. It is unclear how long the pipeline, which passes through Ukrainian territories, will live now, given the terrorist attacks in the North Sea. But one way or another, the EU may be left without gas this winter, which will affect its industrial production, GDP, and the satisfaction of European citizens. Based on all of the above factors, we believe that the euro currency may resume depreciation against the US currency.

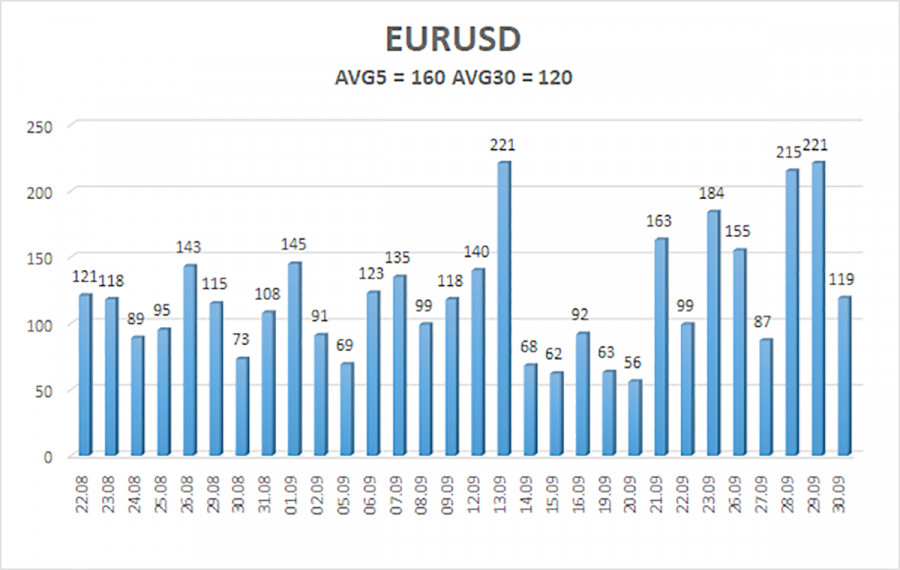

The average volatility of the euro/dollar currency pair over the last five trading days as of October 3 is 160 points and is characterized as "very high." Thus, on Monday, we expect the pair to move between 0.9644 and 0.9964 levels. A reversal of the Heiken Ashi indicator upwards will signal a new round of upward movement.

Nearest support levels:

S1 – 0.9766

S2 – 0.9644

S3 – 0.9521

Nearest resistance levels:

R1 – 0.9888

R2 – 1.0010

R3 – 1.0132

Trading Recommendations:

The EUR/USD pair has consolidated above the moving average line and may continue to move up. Thus, now we should consider new long positions with targets of 0.9888 and 0.9964 if we see a price rebound from the moving average and a reversal of the Heiken Ashi indicator upwards. Sales will become relevant again no earlier than fixing the price below the moving average with a target of 0.9644.

Explanations of the illustrations:

Linear regression channels – help determine the current trend. The trend is strong if both are directed in the same direction.

The moving average line (settings 20.0, smoothed) identifies the short-term trend and the direction in which trading should be conducted now.

Murray levels are target levels for movements and corrections.

Based on current volatility indicators, volatility levels (red lines) are the likely price channel in which the pair will spend the next day.

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.