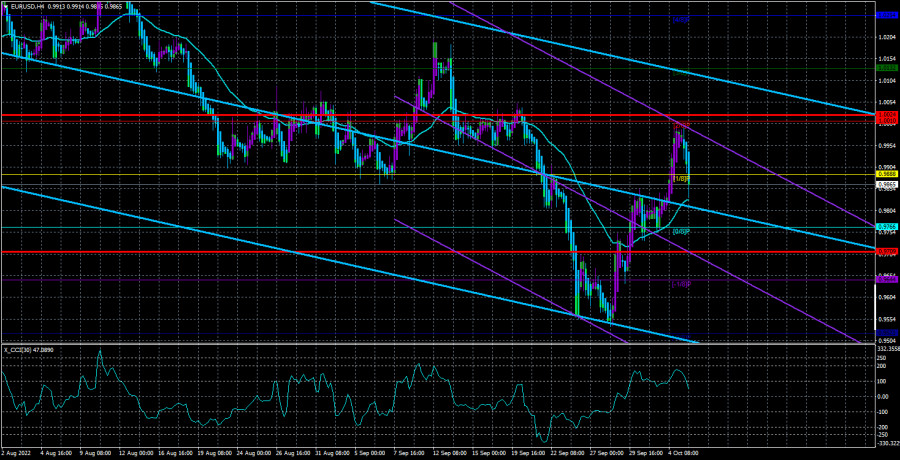

The EUR/USD currency pair finally began to adjust on Wednesday. It is important to understand what it will be: a simple downward correction or the resumption of a long-term downward trend. As can be seen from the illustration above, the price has not yet been able to reach its last local maximum. Thus, everything may end this time with a resumption of the downward trend. Considering the entire movement of the last few days as a correction, it is 450 points. That's how much the pair has shown on average in each of its corrections over the past year and a half. Thus, the return of the euro quotes to the area below the moving average may mean a rapid retreat of the bulls from the market. The pair has been fixed above the moving average from time to time before, but this has never led to the beginning of an upward trend. And now, both linear regression channels continue to be directed downward.

Approximately the same applies to the fundamentals with a geopolitical background. If there are certain questions and doubts about the "foundation," nothing good can be expected from geopolitics. The Fed is close to the end of its key rate cycle. Respectively, the market can already consider the remaining 2-3 increases. This gives grounds for the euro currency to grow in the following months. But we cannot be sure that the market has already considered at least two more rate increases. Maybe it's not.

The situation with geopolitics is much more complicated as the APU continues to move forward and win back lost territories. Recall that four regions of Ukraine were recognized as Russian, and Moscow announced the possibility of nuclear strikes if Ukraine attacked these areas. As we can see, the attacks continue, so the market has the right to expect a worsening of the geopolitical conflict in Ukraine. In addition, the Kremlin has repeatedly stated that the West is on the verge of directly entering the conflict because of its huge arms supply to Ukraine. The European Union has agreed on a new eighth package of sanctions against Russia in response to the annexed territories. It is hardly worth expecting an improvement in geopolitics in the near future. But deterioration is quite possible.

The situation with the "Northern Streams" may worsen

In addition to the problems of a geopolitical nature mentioned above, another one has been added to this list. So far, it is still unclear who exactly is behind the "Northern Streams" sabotage. According to one version, Washington may be behind it since it has the necessary equipment and capabilities to carry out such an operation. As Douglas McGregor, a former senior adviser to the US Secretary of Defense, explained, a gas pipeline is not just an ordinary pipe. "These pipes are incredibly strong, and the shell is concrete and very thick. Therefore, it is impossible to throw a grenade on a string and undermine it to damage the Nord Stream," McGregor believes. "It was about a hundred kilograms of TNT that had to be delivered to the site of the explosion, secured, and then detonated. A technically equipped power is behind this. Also, the UK had access to the pipelines, and it made no sense for the European Union to undermine the pipe through which gas goes to it," McGregor believes.

At the same time, there is another version of what happened in the West. Many countries believe that Moscow may be behind the undermining of the gas pipeline to not pay the penalty on unfulfilled gas contracts. It isn't easy to judge how far these contracts have not been fulfilled, but several experts said the pipe could have been undermined from the inside. Since no one has yet seen the site of the explosion of the gas pipeline, it is impossible to even conclude whether it was an internal explosion or an external one. Moreover, Sweden is conducting an official investigation, and experts from Russia and other countries are not allowed to the accident site. Therefore, it remains only to wait for official information, but there is no doubt that the parties involved in the pipeline will still express the same thought: they are not to blame. Their enemies are to blame. Relations between the West and Russia continue to deteriorate. In the current case, the European Union will suffer from this.

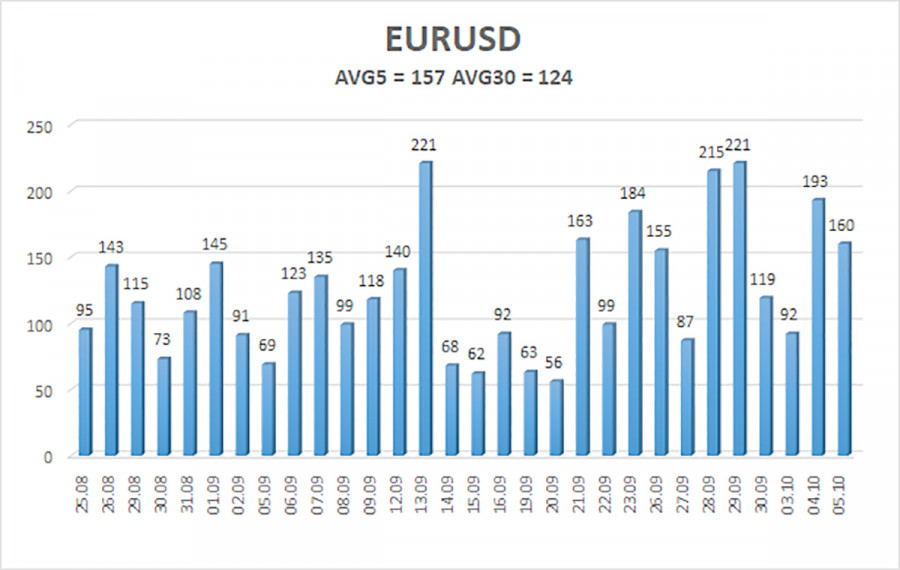

The average volatility of the euro/dollar currency pair over the last five trading days as of October 5 is 157 points and is characterized as "very high." Thus, on Thursday, we expect the pair to move between 0.9709 and 1.0024 levels. The reversal of the Heiken Ashi indicator back to the top will signal the resumption of the upward movement.

Nearest support levels:

S1 – 0.9766

S2 – 0.9644

S3 – 0.9521

Nearest resistance levels:

R1 – 0.9888

R2 – 1.0010

R3 – 1.0132

Trading Recommendations:

The EUR/USD pair remains above the moving average line but has started to adjust. Thus, now we should consider new long positions with targets of 1.0010 and 1.0124 in the case of a reversal of the Heiken Ashi indicator up or a rebound from the moving. Sales will become relevant again no earlier than fixing the price below the moving average with goals of 0.9766 and 0.9709.

Explanations of the illustrations:

Linear regression channels help determine the current trend. The trend is strong if both are directed in the same direction.

The moving average line (settings 20.0, smoothed) identifies the short-term trend and the direction in which trading should be conducted now.

Murray levels are target levels for movements and corrections.

Based on current volatility indicators, volatility levels (red lines) are the likely price channel in which the pair will spend the next day.

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.