The EUR/USD currency pair fell on Wednesday evening and Thursday. Earlier, it was fixed below the moving average line, so we already had reason to expect a continuation of the fall of the euro currency. However, the Fed meeting is so important that it can easily break any trend and change the market's mood. Therefore, yesterday's article recommended not to rush to conclusions and wait at least a day after the meeting results become known. We also said that the market could work out a rate hike and Jerome Powell's rhetoric for a long time. The results of the Fed meeting became known late on Wednesday evening when European markets were already closed. Therefore, with the opening of "Europe" the next day, their traders also rushed to buy the dollar and sell the euro. Only last night was it possible to draw the first conclusions, which was very disappointing for the euro/dollar pair.

First, the price has dropped very much, and now the pair is only 200–250 points from its 20-year lows. When the price is so close to values many traders have never even seen, this is a weak reason to expect a new, strong, long-term upward trend. Second, on the 24-hour TF, the pair failed to overcome the Senkou Span B line, and according to yesterday's results, it also fell below the critical line. Therefore, almost all technical indicators indicate the resumption of the downward trend. Third, the pair adjusted by only 550 points, which is very little to reflect more global growth. Fourth, all those factors (as we have repeated more than once) that brought the pair so low remain relevant.

Two key conclusions are to be drawn after the Fed meeting.

A lot was said at the press conference after the Fed meeting. We will not focus on the truisms or the information that has been known to the market for a long time. The first point, which is of great importance, is that the rate has been increased by 0.75% for the fourth time in a row and now stands at 4%. No matter what anyone says about the fact that traders could already take into account all future rate hikes 100 times, the new tightening still plays a huge role in redirecting financial flows between the United States and the rest of the world. The cost of borrowing in the United States is growing, but the profitability of bank deposits is also growing. And deposits, as the safest asset, are in demand among investors at a time when all risky assets are "at the bottom."

The second important point is that Jerome Powell said the key rate might rise slightly more than the regulator planned a few months ago. Recall that according to the weighted average forecast, the rate was supposed to rise to 4.75% at the beginning of next year. Now it turns out it will grow to at least 5% or even more. Everything will depend, as always, on the inflation reports. If they continue to show a slowdown of 0.1-0.2% y/y every month, then a longer period of monetary pressure may be required. At the same time, the head of the Fed mentioned that "a decision on easing monetary pressure may be made as early as next week or at the next meeting." In other words, the rate may grow more slowly at the next meeting but will continue to grow.

Bottom line: the rate increased following the results of the penultimate meeting in 2022, and Jerome Powell promised to raise it longer than he had previously promised. Two "hawkish" factors out of two possibilities. And it turns out that the dollar is again taking the initiative in the foreign exchange market since the ECB will not be able to catch up with the Fed in terms of rates for a very long time. However, it also raises it at the highest possible pace. But look at the trend, at least for 2022: the pair is falling almost without corrections! The ECB has already raised the rate three times. What has it led to?

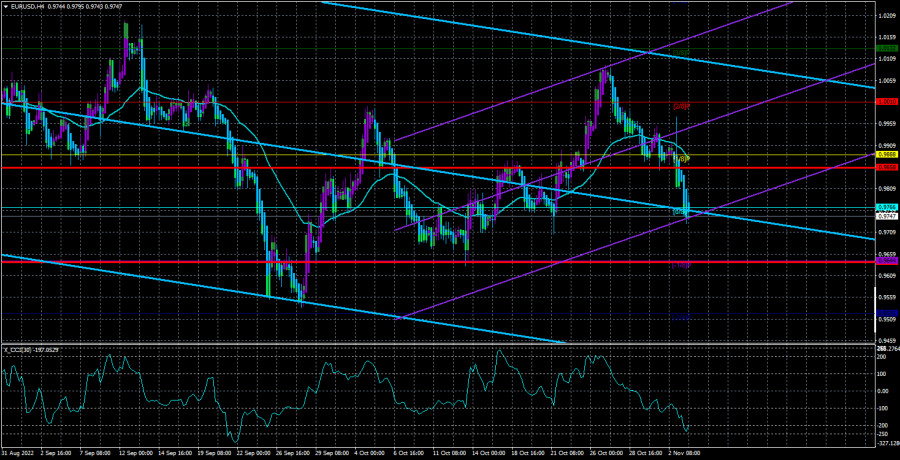

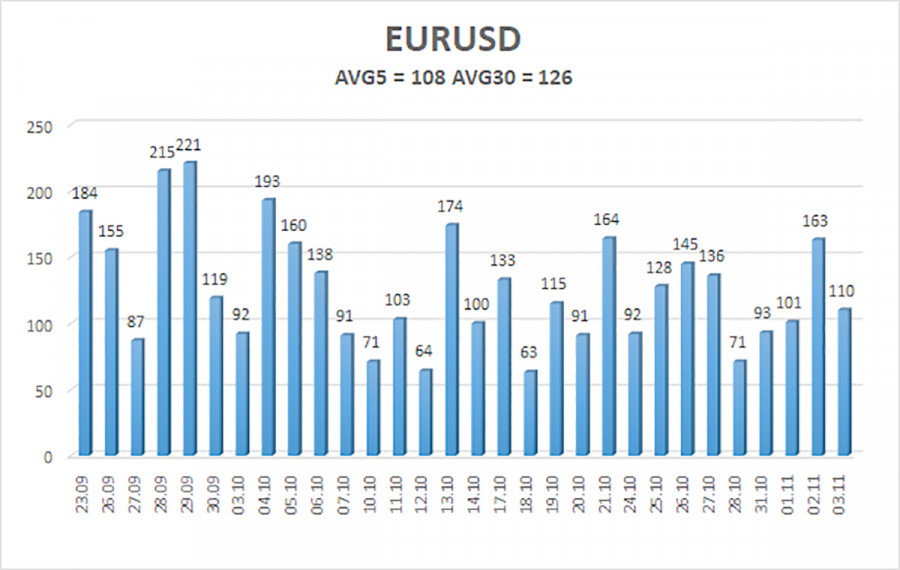

The average volatility of the euro/dollar currency pair over the last 5 trading days as of November 4 is 108 points and is characterized as "high." Thus, on Friday, we expect the pair to move between the levels of 0.9642 and 0.9858. The upward reversal of the Heiken Ashi indicator signals a round of upward correction.

Nearest support levels:

S1 – 0.9644

S2 – 0.9521

Nearest resistance levels:

R1 – 0.9766

R2 – 0.9888

R3 – 1.0010

Trading Recommendations:

The EUR/USD pair has consolidated below the moving average. Thus, it would be best if you stayed in short positions with a target of 0.9644 until the Heiken Ashi indicator turns up. Purchases will become relevant again no earlier than fixing the price above the moving average with a target of 1.0010.

Explanations of the illustrations:

Linear regression channels – help determine the current trend. The trend is strong if both are directed in the same direction.

The moving average line (settings 20.0, smoothed) – determines the short-term trend and the direction to trade now.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) are the likely price channel in which the pair will spend the next day, based on current volatility indicators.

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.