After the Fed expectedly raised its interest rate by 0.50% on Wednesday, another major global central bank, the Swiss National Bank, also raised its key interest rate (on deposits) by 0.50% today, which was also in line with market expectations.

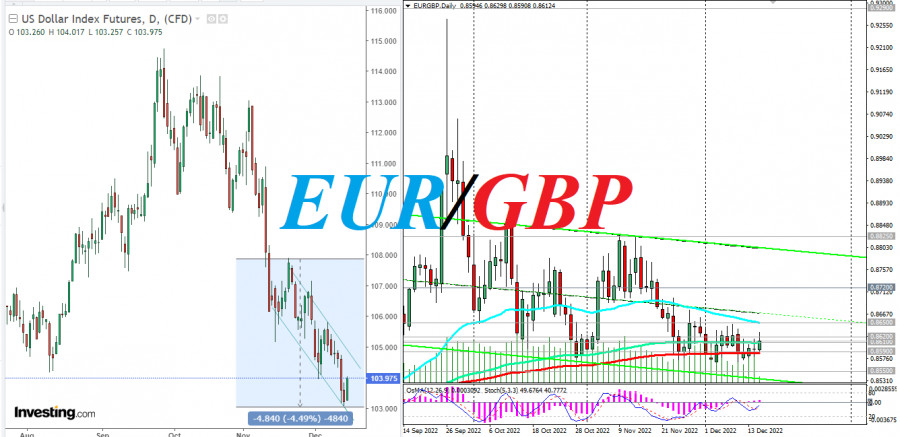

This was the third consecutive increase in the SNB interest rate this year. Immediately after the publication of this decision, the franc generally strengthened in the market, but fell against the dollar. However, the dollar is the market favorite today, at least in the first half of today's trading day. The reason for this was yesterday's decision of the Fed and the accompanying statements by its leaders. While the 0.50% interest rate hike was expected by the market, Fed Chairman Jerome Powell's statements during the press conference that followed gave confidence to the dollar buyers. As of writing, the DXY index is testing the local round resistance level of 104.00, having rebounded from yesterday's local (since July) low of 103.07.

As Powell said yesterday, "The inflation data received so far for October and November show a welcome reduction in the monthly pace of price increases, but it will take substantially more evidence to give confidence that inflation is on a sustained downward path." At the same time, the greatest pain, in his opinion, will bring the inability to raise rates high enough.

According to Powell, how high to raise rates depends on progress in inflation, financial conditions and how restrictive the Fed should be. "The strong view on the committee is that we'll need to stay there until we're really confident that inflation is coming down in a sustained manner," he said.

Powell's other key quotes suggest that "a 4.7% unemployment rate is still a strong labor market", the Fed "has not reached a sufficiently restrictive level of policy yet," and "there is some rate hike to go." At the same time, "FOMC continues to view inflation risks as upside."

The summary of Powell's speech is that "ongoing increases in the target range will be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2% over time."

After this meeting, Fed officials revised their forecasts for the interest rate peak. Now, they assume an increase to 5.1% at the end of 2023 instead of the 4.6% announced in September.

The general conclusion that can be drawn from the results of the December Fed meeting is that the interest rate in the United States will continue to rise, at least to the level of 5.1% (by the end of 2023), but much will also depend on the current situation in the economy, the labor market and the dynamics of inflation. If it continues to decline steadily, then the pace of interest rate increases will also slow down. "Our decisions will depend on the incoming data in their entirety," said Powell.

Thus, the grounds for the dollar's strengthening were laid yesterday. However, how the dollar index (DXY) will actually behave will also depend on the dynamics of the dollar's main competitors in the foreign exchange market. And here, the actions of the respective central banks, the issuers of these currencies, come to the fore.

As we noted above, the Swiss National Bank held its meeting today. And a little later (at 12:00 and 13:15 GMT), the European Central Bank and the Bank of England will publish their decisions on interest rates. Both central banks are expected to make similar decisions and raise interest rates by 0.50%. But in the dynamics of the pound and the euro, much will depend on what will be said in the accompanying statements.

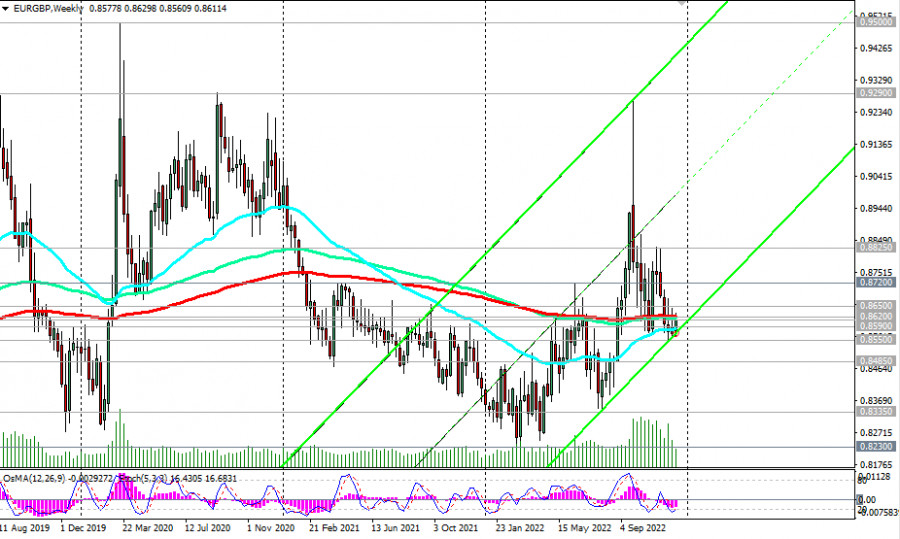

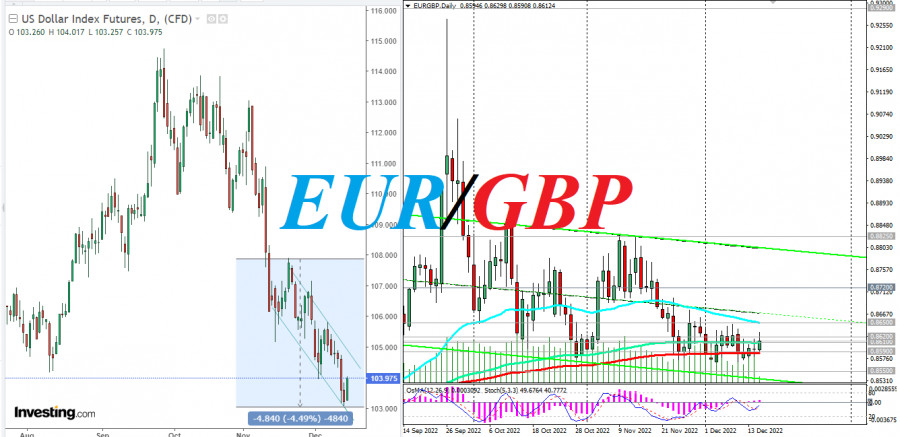

And here, it will be interesting to observe the EUR/GBP dynamics. If economists think that the pound's reaction to the Bank of England's interest rate hike is restrained, then the dynamics of the euro is not clear. Economists believe that this currency has the potential to grow, given that the ECB also has more room for maneuver in the field of combating high inflation. The current interest rate of the BoE is at 3.0% and will stand at 3.50% after today's expected 0.50% increase. The ECB's deposit rate is at 1.5% and is expected to be 2.0% after today's meeting.

Also today, the ECB is likely to signal readiness to continue tightening monetary conditions. By the way, tomorrow, the final estimate of inflation in the Eurozone will be released (November forecasts predicts a figure of 10% YoY). And the euro, according to economists, has the possibility of further growth, if not right now, then in the medium and long term.

From a technical point of view, since the beginning of the month, EUR/GBP has been squeezed in a narrow range between 0.8650 and 0.8550, and in an even narrower range between the key levels 0.8620 and 0.8590. The conditional spring is clamped very strongly. The situation requires detente, which can result in a breakout of the boundaries of the indicated ranges and in a strong movement. But in which direction—a lot will depend on the results of today's meetings of the Bank of England and the ECB. We are leaning in favor of the growth of EUR/GBP and long positions, not forgetting about the limiting stops below 0.8550.