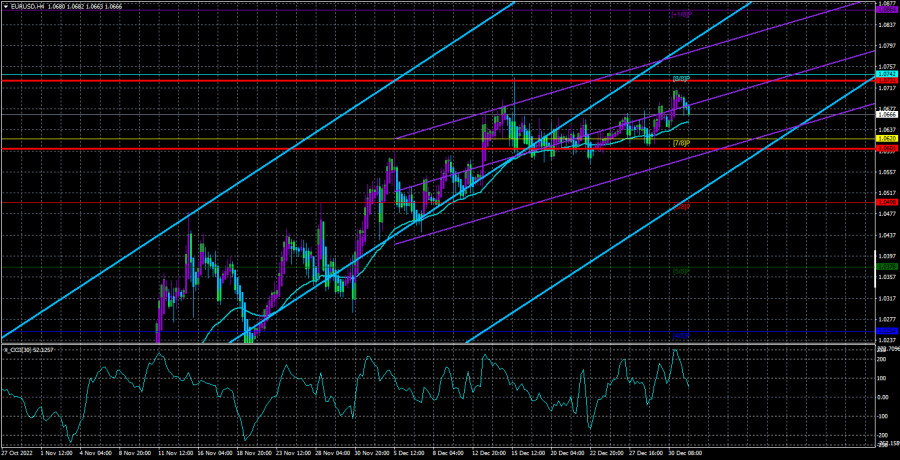

On Monday, the EUR/USD currency pair remained flat, but there was still a slight upward bias. The European currency largely decreased on the first trading day of the week, month, and year, although there was little volatility during the day and no macroeconomic or fundamental background. In comparison to the final week of last year, there have been no changes to the concept. If we merely look at the past two weeks, the pair's movement is still much more similar to a flat than a trend. There is no question about the upward trend if you look at the previous three to four months, and even though the price is near the moving average, it cannot be fixed below it. As a result, the technical situation is unchanged at this time. Due to the poor movement and nearly total flat, trading pairs on the 4-hour TF is still quite difficult. If the right signals are there, trading on the lower TF is conceivable.

Since there hasn't been any news over the past two weeks, it has been challenging to share any new information. Only China made the unfavorable decision on the eve of the New Year. In China, a new wave of the coronavirus epidemic started, and unverified reports indicate that by mid-December, there were already hundreds of millions of cases. Although it is impossible for us to determine whether this information is accurate, the market showed no signs of reaction. Therefore, we do not think that current market information on Chinese epidemiology is crucial.

A localized epidemic is not particularly terrifying, as we've already stated. It will be frightening if the epidemic spreads from China once more. Some nations have already started to stop flying to China since, after a few flights, it was discovered that roughly half of the passengers had coronavirus. Therefore, a new worldwide wave of the disease may be just around the corner. And after that, the market can experience another "storm," and the US dollar, which enjoys all kinds of catastrophes, will probably become more expensive.

Nonfarm may signal the start of a period of dollar growth.

The main source of information for this week's macroeconomic background is American news. Only the most significant inflation reports will be made public in the European Union. We want to gauge the likelihood that the pair will fall this week given the existing situation, in which the euro simply will not depreciate flatly. From our perspective, the market right now needs a "kick." Furthermore, it was "a shove from a high mountain," not just a "kick." The value of the euro has increased significantly compared to the fundamental backdrop that traders had at their disposal. Its frantic inability to adapt comes across as quite odd. It is unlikely that the "push" will be an inflation report, but it may be a nonfarm report. Without macroeconomic indicators, traders can certainly begin selling a pair, but since these articles are so significant this week, why not mix business with pleasure? The nonfarm payroll data, therefore, have a great probability of becoming this "push."

As always, forecasts for this report are as impartial as they can be. About 200,000 new positions outside the agriculture industry are anticipated to have been added in December. Although such a result was predicted a month ago and a failed ADP was released later, nonfarm finally turned out to be very strong. As a result, we do not rule out the possibility that something similar occurred last month. In any scenario, there is just no room for short-term euro growth. The construction of an upward worldwide trend must be kept up, so some adjustment is required. But for now, we don't see many reasons to keep the configuration going either. The slowing of the ECB's monetary policy tightening pace is the primary cause of concerns regarding the expansion of the euro.

If the pair manages to establish itself below the moving average this week; this could be a false breakdown, of which there have been quite a few in recent weeks. Because the price can frequently cross the moving average line because of the current flat movement, it should be kept in mind.

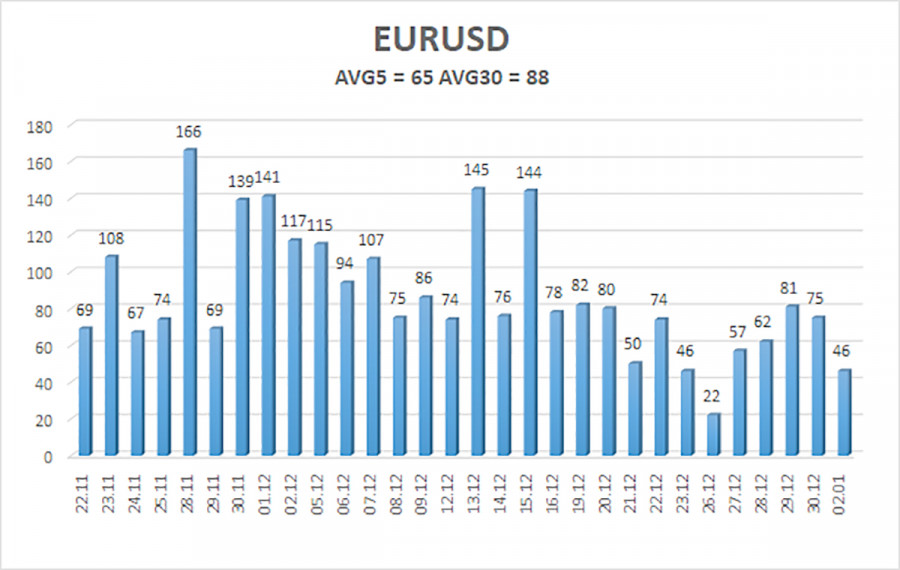

As of January 3, the euro/dollar currency pair's average volatility over the previous five trading days was 65 points, which is considered "normal." So, on Tuesday, we anticipate the pair to fluctuate between 1.0601 and 1.0731. A new round of upward momentum will be signaled by the Heiken Ashi indicator's upward reversal.

Nearest levels of support

S1 – 1.0620

S2 – 1.0498

S3 – 1.0376

Nearest levels of resistance

R1 – 1.0742

R2 – 1.0864

R3 – 1.0986

Trading Suggestions:

Although the EUR/USD pair continues to move upward, the movement is still sluggish and "flat." Trading can only be done on lower time frames because there are hardly any moves on the 4-hour time frame.

Explanations for the illustrations:

Channels for linear regression allow identifying the present trend. The trend is now strong if they are both moving in the same direction.

Moving average line (settings 20.0, smoothed): This indicator identifies the current short-term trend and the trading direction.

Murray levels serve as the starting point for adjustments and movements.

Based on current volatility indicators, volatility levels (red lines) represent the expected price channel in which the pair will trade the following day.

A trend reversal in the opposite direction is imminent when the CCI indicator crosses into the overbought (above +250) or oversold (below -250) zones.