On Wednesday, the GBP/USD currency pair kept readjusting near the moving average line. Compared to the movement of the EUR/USD pair, we find this movement of the pair to be considerably more rational. Even if we have been anticipating a larger decline from the pound, it has been declining at least occasionally in recent weeks. However, these are already minor details; what matters is that the pair does not always move in the same direction. The British pound likewise increased completely illogically last Friday, but at least it did not continue this week. As a result, there is a risk that the pound could resume its downward trend, although it is unclear how the pound and the euro will interact in the near future. We want to remind traders that there is typically a correlation between the pound and the euro. When there is a solid fundamental foundation in the UK or the European Union regarding only one European currency, this typically occurs. There is currently nothing comparable. Of course, we need to keep in mind the extremely high likelihood of a recession in the UK, a medical strike, a new "coronavirus" breakout, and the fact that there have generally been more issues in the UK recently than anywhere else.

However, we continue to hold the opinion that traders should prioritize macroeconomic reasons; therefore, it is still unclear why the pound increased by 2,000 points towards the end of last year. The movement of the pound may, in reality, be very sensible. You must attempt to detach from the existing underlying context to view the issue objectively. After all, the Bank of England will keep tightening monetary policy despite having increased the rate eight times in a row. As in the case of the ECB, it is difficult to predict how much the rate will increase. According to some estimates, the rate will increase to 6%. Some claim that inflation will not even be half as high in 2023. Some claim that a two-year recession has already started. Only the Bank of England makes virtually no comments regarding the merits. This leads us to the conclusion that the bet's problem will be remedied "during play." Given the current situation, we can anticipate nearly any movement of the pair in the near term because it will be based on market expectations, which are quite challenging to foresee. Thus, technical analysis ought to occur first.

The most significant report of the week concerns US inflation.

Today is scheduled to be the first and only significant event of the week. Inflation data for December will be released in the US, and experts predict a further slowdown to 6.5–6.7%. Given that the QT program is still in place, the Fed rate is high, and energy prices have dramatically decreased, the inflationary pressure is also falling, leading us to anticipate that inflation may decline by 0.5-0.6% per month.

If the prediction comes true, it will be less likely that the Federal Reserve will retain its combative stance at the upcoming meetings. But we think the Fed Monetary Committee has already made decisions regarding its near-term strategy. The rate of rate increases has already started to slow down, but the crucial question is when the next slowdown will occur. It might occur as soon as February if inflation slows to 6% or higher. If inflation barely moderates by a few tenths of a percent, the rate may be increased once again by 0.5% in February. Although we don't think inflation influences the dollar as much as it did six months ago, the response of traders can be very powerful. Everything will be based on how much and in which direction the actual number deviates from the forecasted value. Thus, trading today is still doable using basic techniques up to the publishing of this report, but there may be a significant change in the direction of movement following it, for which one should be ready.

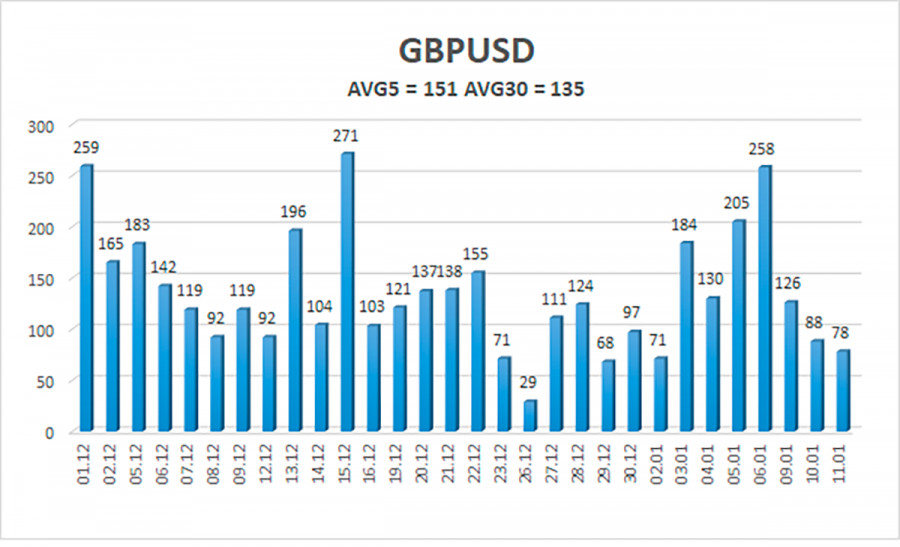

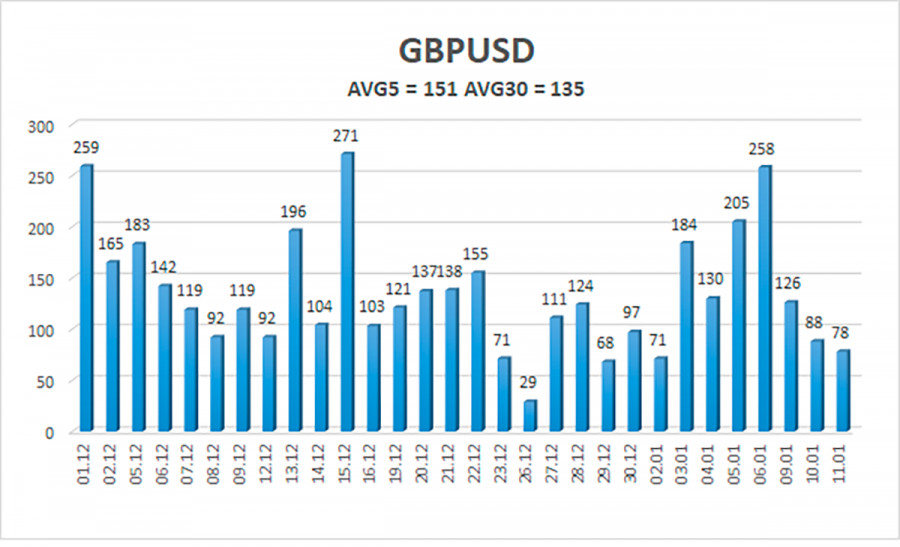

Over the previous five trading days, the GBP/USD pair has experienced an average volatility of 151 points. This figure is "high" for the dollar/pound exchange rate. As a result, on Thursday, January 12, we anticipate movement that is constrained by the levels of 1.1971 and 1.2274 to remain inside the channel. A potential continuation of the upward trend will be indicated by the Heiken Ashi indicator turning back to the top.

Nearest levels of support

S1 – 1.2085

S2 – 1.2024

S3 – 1.1963

Nearest levels of resistance

R1 – 1.2146

R2 – 1.2207

R3 – 1.2268

Trading Suggestions:

The moving average is presently being modified for the GBP/USD pair on the 4-hour time period. Therefore, in the event of an upward reversal of the Heiken Ashi indicator or a price rebound from the moving average, we can now think about new long positions with goals of 1.2207 and 1.2268. If the price is firmly anchored below the moving average, short trades can be opened with targets of 1.2024 and 1.1963.

Explanations for the illustrations:

Determine the present trend with the use of linear regression channels. The trend is now strong if they are both moving in the same direction.

The short-term trend and the direction in which you should trade at this time are determined by the moving average line (settings 20.0, smoothed).

Murray levels serve as the starting point for adjustments and movements.

Based on current volatility indicators, volatility levels (red lines) represent the expected price channel in which the pair will trade the following day.

A trend reversal in the opposite direction is imminent when the CCI indicator crosses into the overbought (above +250) or oversold (below -250) zones.