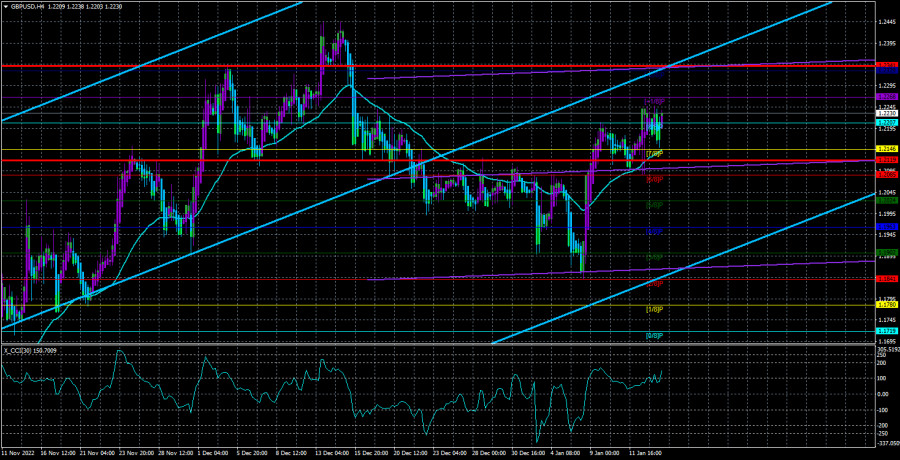

Last week, GBP/USD was able to stay above the MA. Therefore, we have a bullish continuation. The price will likely rise this week as fundamental factors could help boost the pound against the dollar. Still, a correction may occur. Although the pair retraced up, it can hardly be seen as the resumption of the uptrend. Since anything can happen, it is wiser to turn to technical analysis in a confusing situation. Currently, there are enough factors signaling the possibility of both an uptrend and a downtrend. It is important to understand that the market may ignore some factors. The fact that the Bank of England is highly likely to keep raising interest rates more aggressively than the US Federal Reserve in 2023 indicates that the pound will be on the rise against the greenback.

Notably, almost all technical factors are now signaling a bullish continuation. Consequently, there is no point in going short before consolidation below the MA. In the 24-hour time frame, the price is above the critical line. Therefore, it will become possible to open short positions only when the pair settles below it.

Interest rates haven't peaked yet

In early February, three major central banks will hold monetary policy meetings. The Federal Reserve is anticipated to hike rates by 25 basis points. Meanwhile, the Bank of England and the ECB are expected to raise rates by 50 basis points. The market is likely to price these increases in advance.

As for 2023 prospects for interest rates, the Federal Reserve is seen lifting rates up to 5% in the first quarter of 2023, according to a Bloomberg survey. The regulator will then consider whether another 25 basis point rate rise is needed. The ECB is predicted to increase interest rates by 50 basis points at the coming two meetings. Its further plans remain to be seen. Thus, by the end of the first quarter, the ECB's interest rate may reach 3.5%. The Bank of England is forecast to stay aggressive, which could harm the economy even more. The rate will most likely be raised from the current 3.5% to 4.25%, which implies three increases of 0.25%.

However, in the case of the ECB and the BoE, those rate hikes will not be enough to curb inflation. Therefore, the future of the pound and the euro will be determined when interest rates reach the forecast readings. If regulators sacrifice economic growth and keep up with the tightening cycle, both the euro and the pound may surge against the greenback in the first two quarters of the year as the Federal Reserve will be on the finishing line of the same process. If the ECB and the BoE change their stance, inflation may be stuck in the range of 5 to 7% for a long time. If the banks decide not to continue with rate increases, the euro and the pound will go south. So far, fundamental factors have shown good prospects for both currencies. However, everything may drastically change in a few months.

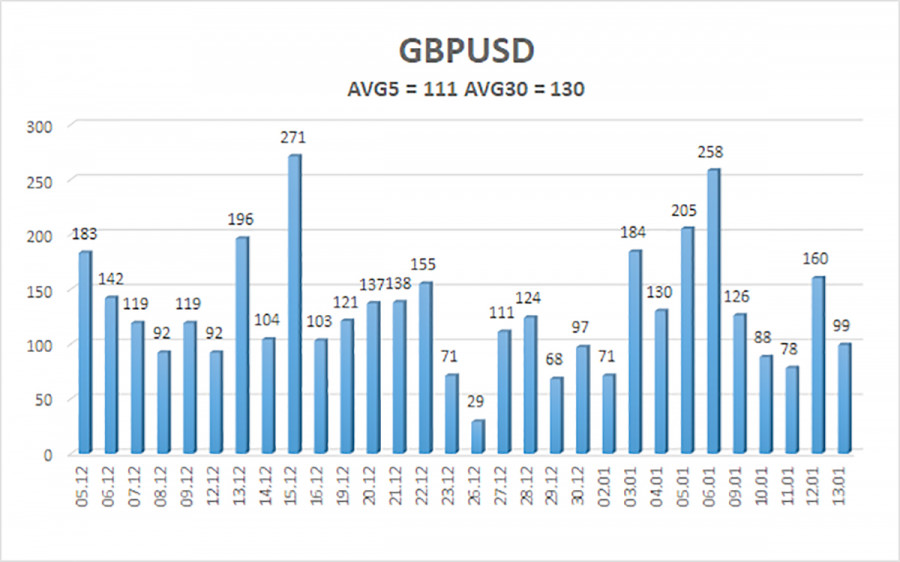

The 5-day average volatility of GBP/USD totaled 111 pips and was evaluated as high. On Monday, the pair is expected to move in a channel limited by the 1.2119 and 1.2341 levels. Heiken Ashi's upward reversal will signal the likelihood of an uptrend.

Support

S1 – 1.2207

S2 – 1.2146

S3 – 1.2085

Resistance:

R1 – 1.2268

R2 – 1.2329

Outlook:

The GBP/USD pair is trying to extend the uptrend in the 4-hour time frame. So, long positions could be opened with targets at 1.2329 and 1.2341 until Heiken Ashi reverses to the downside. Short positions could be considered after consolidation below the moving average with targets at 1.2085 and 1.2024.

Indicators on charts:

Linear Regression Channels help identify the current trend. If both channels move in the same direction, a trend is strong.

Moving Average (20-day, smoothed) defines the short-term and current trends.

Murray levels are target levels for trends and corrections.

Volatility levels (red lines) reflect a possible price channel the pair is likely to trade in within the day based on the current volatility indicators.

CCI indicator. When the indicator is in the oversold zone (below 250) or in the overbought area (above 250), it means that a trend reversal is likely to occur soon.