The EUR/USD currency pair is gradually increasing. There were no noteworthy events or publications in the United States or the European Union on Wednesday, but this did not deter purchasers, who, if slowly, kept buying the euro/dollar pair. Therefore, if anyone else had any doubts about how absurd the expansion of the euro in recent weeks or months has been, they can now be assured of it. However, the current growth is not sufficiently significant to indicate that traders have a deliberate desire to purchase the EU currency. Let's be clear: the "market noise" is not a one-way recoilless movement. Although it is no longer even about reversing the trend but rather at least about a dull decline, the pair is still unable to even break below the moving average. From our perspective, the euro has generally continued to increase unjustly.

Any movement can be justified. For instance, at this precise moment, exactly one week before the ECB and Fed meetings, we may say that the market anticipates a 0.5% rate increase by the ECB but does not anticipate a corresponding tightening by the Fed. But keep in mind that the market has fluctuated between periods of belief and disbelief. It transpires that one element of belief or skepticism propels the pair upward. This is, from our perspective, excessive. The market, however, is wiser than us, and all we can do is point out once more that there are no technical indications available for purchase right now, making it pointless to sell a pair based on fundamental assumptions. What keeps the market from buying even if we have been anticipating a significant downward correction for more than a month? What stops it from continuing to buy for another month, two months, or even three months? Additionally, the European Union continues to provide some encouraging news.

The EU economy can largely avoid hardship after 2023.

Recall that there has been discussion of an impending recession ever since the summer of last year. Furthermore, not just in terms of the European economy. Everyone knew "troubled" times were ahead as soon as the central bank started to hike interest rates to reduce inflation to a level that satisfied them. Due to the high appeal of secure investment vehicles, investment volumes are dropping, forcing the economy to respond to the tightening of monetary policy. In other words, investors confront high-interest rates, making saving far more beneficial than borrowing money to invest. The likelihood of a severe recession increases as interest rates increase. However, economists from all across the world were concerned about more than just rate increases. The fact is that prices for "blue fuel" and "black gold" have significantly increased as a result of the breakdown of commercial relations between the EU and Russia (particularly in the oil and gas industry). Although the average price was expected to be $300–400 per 1,000 cubic meters through 2022, the cost of gas has risen to $4,000 per 1,000 cubic meters. Naturally, rapidly rising oil costs have put a strain on the economies of nearly all nations without an adequate level of domestic energy output. Everything started to become more expensive, which accelerated general inflation and compelled the Central Bank to boost interest rates even higher, further cooling the economy. For the European Union, the "energy crisis" was a very serious possibility. You can still breathe a sigh of relief, though, at the beginning of 2023.

First off, Europe's winter turned out to be once again warm, which allowed us to save a significant amount of gas. Second, on the eve of winter, gas storage tanks were 80–90% full. Third, it is obvious that Ursula von der Leyen and other authorities did not stand by and do nothing when they decided on the delivery of "blue fuel" from other nations, which mostly evened out the losses of Russian gas. Christine Lagarde was able to speak with guarded confidence at the global summit in Davos thanks to the decline in oil and gas prices. She claimed that a severe recession could be avoided and that subjective expectations for the current period were much worse than the actual situation. The ECB predicts that while there won't be a significant recession, the ECB economy will endure a brief period of weakness. This is good news for the value of the euro.

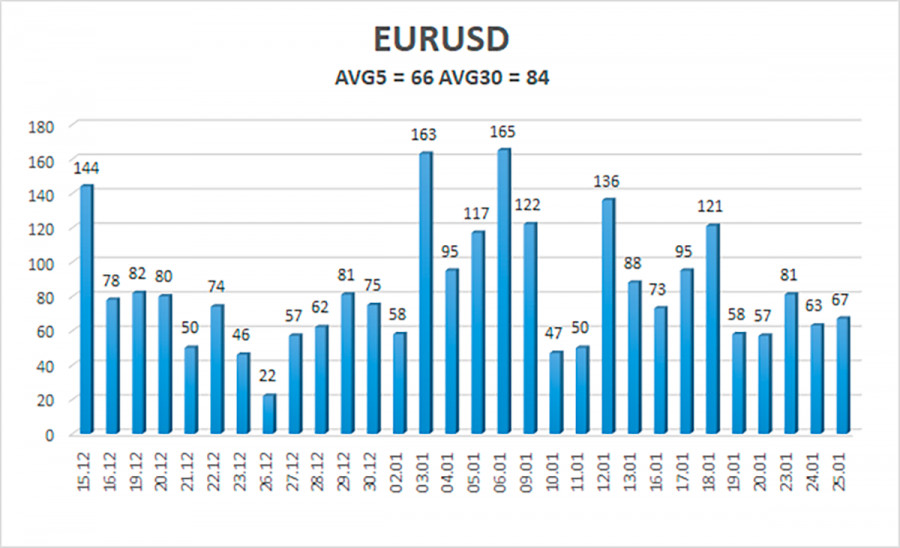

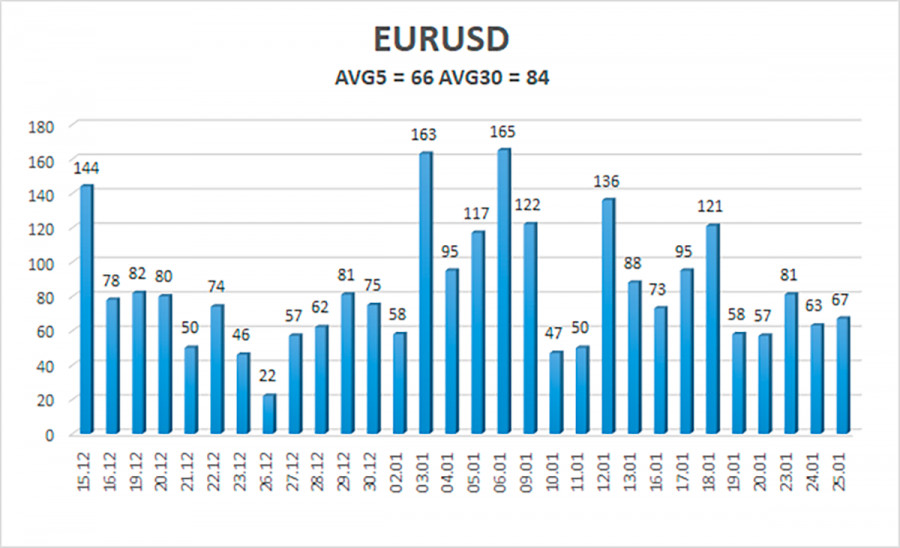

As of January 26, the euro/dollar currency pair's average volatility over the previous five trading days was 66 points, which is considered to be "normal." So, on Thursday, we anticipate the pair to fluctuate between 1.0735 and 1.0967. A new round of moving corrective will be indicated by the Heiken Ashi signal turning downward.

Nearest levels of support

S1 – 1.0864

S2 – 1.0742

S3 – 1.0620

Nearest levels of resistance

R1 – 1.0986

Trading Suggestions:

The EUR/USD pair is still moving upward. Until the price is fixed below the moving average, long positions with goals of 1.0967 and 1.0986 can currently be taken into consideration. After putting the price below the moving average line and setting a target price of 1.0742, you may start opening short bets.

Explanations for the illustrations:

Determine the present trend with the use of linear regression channels. The trend is now strong if they are both moving in the same direction.

Moving average line (settings 20.0, smoothed): This indicator identifies the current short-term trend and the trading direction.

Murray levels serve as the starting point for adjustments and movements.

Based on current volatility indicators, volatility levels (red lines) represent the expected price channel in which the pair will trade the following day.

A trend reversal in the opposite direction is imminent when the CCI indicator crosses into the overbought (above +250) or oversold (below -250) zones.