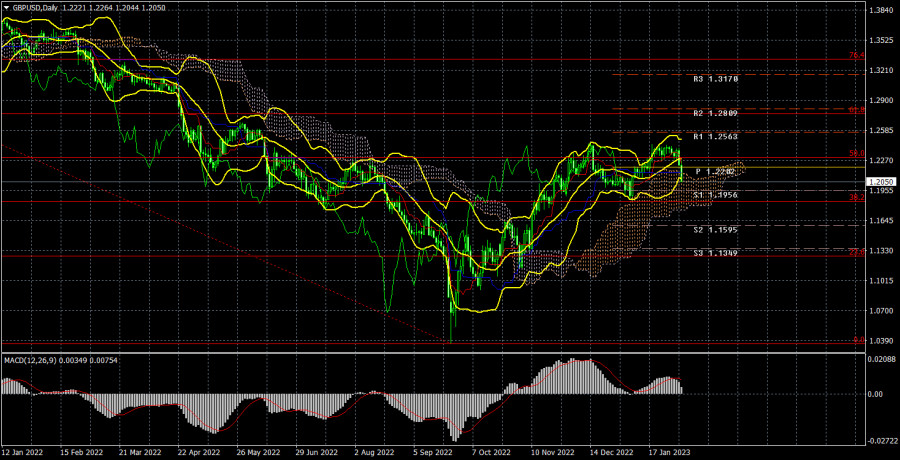

Long-term outlook.

The GBP/USD currency pair has also begun a very strong decline this week. Despite its drop from about a month ago, we also anticipated a decline in the value of the pound. Both the euro and the pound sterling were at overbought levels. It was able to increase by 2,100 points in a short period, accounting for 50% of the overall upward trend that has been growing for the past two years. Even if the pound sterling has been trading a little more sensibly lately than the euro, we nevertheless anticipated another decline from it. It has now started. Despite the Bank of England raising interest rates by 0.5%, the pair dropped nearly 330 points in just two days. To be completely honest, we don't even want to consider how much the BA rate will rise. This is no longer that important, from our perspective. The BA rate has already increased to 4%, and the market has been actively buying the pound recently as a result of expectations that the Fed's rate increases will slow down. It won't increase by more than 5%, so we can only expect an increase of up to 0.25%. Additionally, the phase of tighter monetary policy will shortly come to an end.

I'd like to add something regarding the UK's ongoing high inflation separately. Andrew Bailey, however, predicts a significant drop in the consumer price index in 2023. Although we cannot be certain the decline will be rapid and severe, inflation should nevertheless continue to decline after ten rate increases. Simply slower than in the US or the EU. According to our estimates, the UK's inflation rate might fall to 5–6% in 2023, which would already be an excellent accomplishment given the current situation. An inflation rate of 2% over the next two years is unlikely. To accomplish this, the Bank of England will be unable to hike the rate indefinitely. To maintain a normal, non-concessional state of the economy, the European Union and Britain will likely just have to accept the reality that inflation will be above the target level for several years. The UK will inevitably experience a recession, but there is a difference between one that lasts five quarters and one that lasts five years.

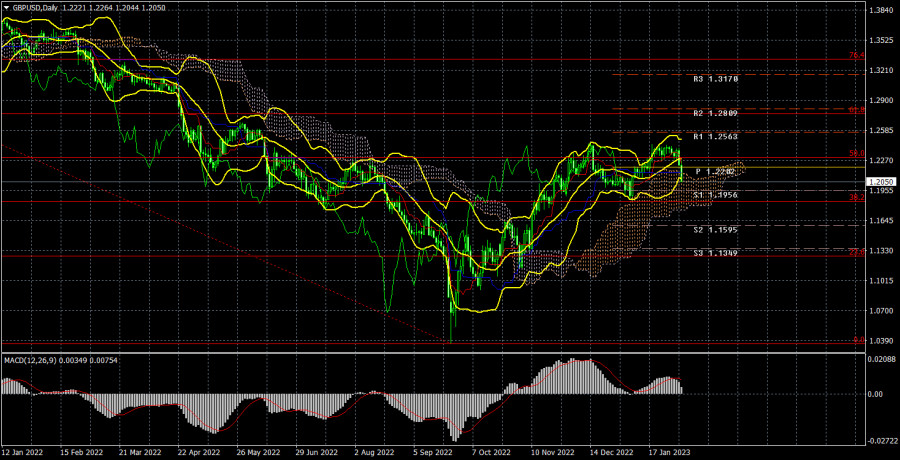

COT evaluation.

The "bearish" mood appeared to be weakening in the most recent COT report on the British pound. The non-commercial group concluded 6,700 buy contracts and 7,500 sell contracts throughout the week. As a result, non-commercial traders' net position climbed by 0.8 thousand. The net position indicator has been slowly rising over the past few months, and although it hasn't yet, it suggests that significant players' attitudes may soon turn "bullish." Although the value of the pound against the dollar has increased recently, it is quite challenging to identify the basic reasons behind this growth. There is a need for adjustment, therefore we cannot completely rule out the possibility that the pound would decline in the near (or medium) term. There are no questions because COT reports have generally matched the trend of the pound sterling in recent months. Purchases could continue for several months in the future, as the net position is still not even bullish. A total of 59 thousand sales contracts and 35,000 purchase contracts have now been opened by the non-commercial group. While there are technical reasons for this, geopolitics certainly do not support such a significant and quick rise of the pound sterling, thus we continue to be wary about the currency's long-term growth.

Analysis of fundamental events

Except for the Bank of England meeting, there is nothing noteworthy happening in the UK this week. As we've already mentioned, Andrew Bailey's rhetoric was both "hawkish" and optimistic. Forecasts for the recession's duration and GDP decline in particular were downgraded. The central bank anticipates a decline in inflation in 2023. Despite what Andrew Bailey claims, rates will rise and the Bank of England will have to slow down its tightening in March. Despite all of the "hawkishness," the pound sterling has decreased, and there is only one explanation for this: as we have often warned, the market has already anticipated all of the regulator's choices. There is no reason to worry about a recession because strong American figures released on Friday once again demonstrated that the labor market and unemployment in the country are both fine. Additionally, this comes after the Fed's rate increased to 4.75%. We think that even though the Fed will increase interest rates by 0.25% twice or three times more, the US dollar will continue to be well supported by fundamental factors. One of the few growth factors for the British pound has vanished.

1) The pound/dollar pair has consolidated below the Kijun-sen line, making long positions irrelevant for the trading week of January 30 to February 3. We should wait for the price to consolidate back above the key line or, for instance, a comeback from the Senkou Span B line, before we start trading again for an increase. So far, we anticipate that the fall will continue.

2) On the other hand, sales are now significant. The Senkou Span B line, which is located at the level of 1.1800, is the closest target for heading south. About 250 points remain, which does not appear to be an insurmountable task. The pound can move in the direction of its all-time lows if the bears are successful in breaking through the Ichimoku cloud. The pair may well hit the $1.13–$1.15 level, but we do not anticipate a decline in the price parity area because there is no equivalent fundamental basis for such a scenario.

Explanations of the illustrations:

Price levels of support and resistance (resistance /support), Fibonacci levels – targets when opening purchases or sales. Take Profit levels can be placed near them.

Ichimoku indicators(standard settings), Bollinger Bands(standard settings), MACD(5, 34, 5).

Indicator 1 on the COT charts is the net position size of each category of traders.

Indicator 2 on the COT charts is the net position size for the "Non-commercial" group.