As concerns rise about Bitcoin's inability to increase this week beyond $24,000, which pushes for a deeper drop following active growth earlier this year, the price of bitcoin faces a significant risk of falling. However, we shall discuss the technical image below.

Now that the UK has formally announced its plans to regulate the cryptocurrency market, I'd like to discuss how the government is making every effort to curb risky business practices in the wake of what happened with FTX.

The government has put out several proposals to bring the regulation of crypto asset businesses into line with that of traditional financial firms. One of the suggestions would be to reinforce the laws governing financial intermediaries and businesses that store cryptocurrency on behalf of customers in their wallets.

The expansion of dangerous loans made by cryptocurrency companies to one another on the security of their assets was another significant concern that influenced the regulators' views on the overgrowth and caused FTX to collapse when serious issues in the industry started to emerge. The whole cryptocurrency market was impacted, and its structure was severely harmed, by the lack of due diligence of the counterparties involved in these transactions.

The UK's proposals aim to restrict such activity while strengthening consumer safety and business viability. They want to establish the world's first trustworthy regulatory body to oversee the laws governing lending to crypto assets.

Treasury Secretary Andrew Griffith stated in a statement, "We remain steadfast in our commitment to build the economy and support technological transformation and innovation, including crypto-asset technologies." But we also need to provide trustworthy, open, and equitable norms to protect consumers who utilize this new technology.

It is important to note that the failure of FTX has accelerated efforts by international regulators to seize control of the cryptocurrency market, although so far this has only resulted in the imposition of restrictions. Although the implementation of these suggestions at the legislative level has not yet occurred, both the European Union and the United States have already made proposals to enhance consumer protection regarding the usage of bitcoin assets.

The British regulator's plans also call for more stringent transparency standards for cryptocurrency exchanges, which will ensure accurate disclosure of data about these businesses' operations.

Regarding the technological state of bitcoin right now, pressure is progressively building. The level of $23,255, which was missed yesterday, is the bulls' closest target. If you fixate on it, the bullish trend will return, and you'll have the chance to update $23,950 and $24,400. The $25,034 area will be the farthest target, where significant profit-taking and a rollback of bitcoin may take place. In the case of renewed pressure on the trading instrument, protecting the $22,500 level will take priority because a breach by sellers would be detrimental to the asset. This will put pressure back on bitcoin and create a direct path to $21,840. The first cryptocurrency in the world will "drop" about $20,900 if this threshold is broken.

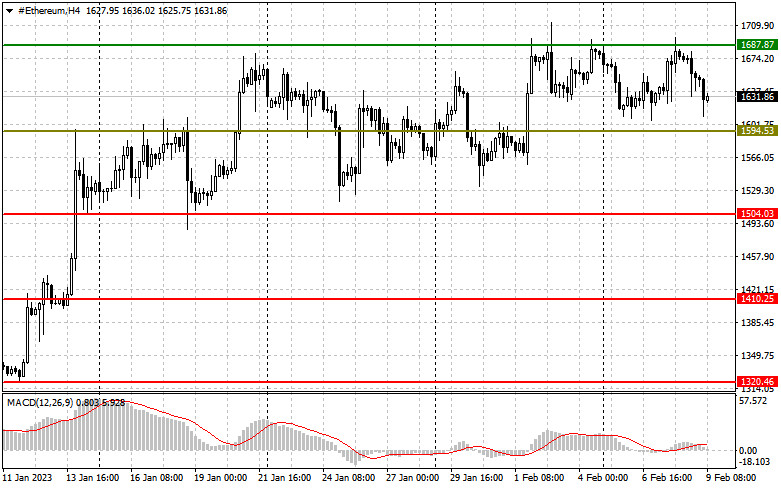

The collapse of the nearest resistance level of $1,670 is what ether buyers are concentrating on. This is going to be sufficient to establish a foothold at the current highs and keep the bullish trend going. The market will undergo considerable adjustments as a result of this. The balance will be returned to the ether upon consolidation above $1,670, with the possibility of an increase up to a maximum of $1,758. Longer-term targets will be at the $1,819 level. The $1,594 mark, which is just below where $1,504 is shown, will come into play when the pressure on the trading instrument resumes. If it succeeds, the trading instrument will rise to a minimum of $1,410. It will be very difficult for bitcoin owners below $1,320.