The GBP/USD currency pair has been rising for the past two weeks as well, but it remains limited to the side channel on the 24-hour TF. However, both euro currencies have experienced only a minor correction. Over the past few months, the euro currency has adjusted more strongly than the pound. The growth over the past six months has been too rapid and strong, far from always justified, and the correction that followed has been too weak and unconvincing. We can make the same claim about the pound as we can about the euro. The market indicates that it is not yet prepared for significant sales, although both pairs should logically soon start a new cycle of tangible decline. We have taken into consideration some of the factors in the article on the euro/dollar that prevent the growth of the euro and the pound at this time. Here, we'll speak solely of the pound sterling.

What is going on with the UK economy right now? The economy, like that of the European Union, is on the verge of a recession, which officials are working hard to avoid or at least smooth out. According to the official version, the recession will start in 2023 but last only five quarters, as opposed to the initial prediction of eight. The overall decline in the British economy won't be more than 1%. Unavoidably, a recession will occur, and its severity will depend less on predictions made by the Bank of England and Rishi Sunak and more on the size of the rate that BA will achieve this year. Since the British economy has not been stable for a very long time, anything can happen with the rate.

Inflation is becoming the most important statistic, not GDP. Even those who did not trade the pound this week were let down by this indication. A strong rate of growth has resumed for the consumer price index. And if we observed a more or less significant slowdown in the rate of price increase in the European Union or the United States, the UK experienced a fall in prices of 1% for three months, which is hardly even a "slowdown." All of this simply serves to indicate that the regulator must continue raising the rate at the fastest possible rate in addition to tightening monetary policy. However, since the rate has already risen to 4.25%, BA is no longer able to increase it by 0.5% at each meeting. The British pound no longer has even a theoretical advantage over the dollar because the Fed and BA can raise the rate at an equal rate for the remainder of this year.

The economy will be discussed next. It's hard to say that the American economy is in a worse state than the British one, notwithstanding the simultaneous failure of three banks in the United States. Many members of the cabinet, particularly Rishi Sunak, have said that the British economy has not even fully recovered from Brexit. In the UK, there is a severe shortage of professions that were previously filled by foreign workers. However, with Brexit, the requirements for staying in the nation became stricter, and as a result, migrants now prefer other European nations where obtaining a work permit is considerably simpler. Both the government and the British people agree that salaries are expanding very slowly and very quickly, respectively. The government considers the 6% wage increase to be problematic because they believe it would encourage inflation to continue rising. The British desire an increase in salaries because they perceive an issue with the 6% pay growth and the 10% inflation rate. All of this leads to new political issues because the Conservative Party may perform horribly in the upcoming legislative elections. As a result, we may say that the UK is no better than the US in terms of politics, the economy, or interest rates. It is quite challenging to predict why the pound is rising and the dollar is declining at the moment. Of course, two reasons somewhat support this action. The first is flat on a 24-hour TF, while the second represents the Fed's $300 billion QE program. However, none of these variables suggests that the pair will rise beyond 1.2440.

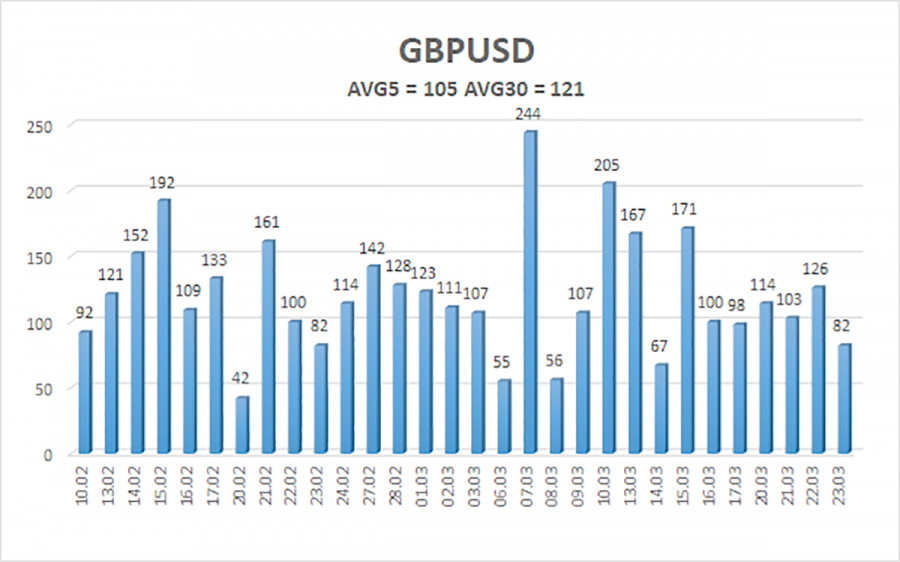

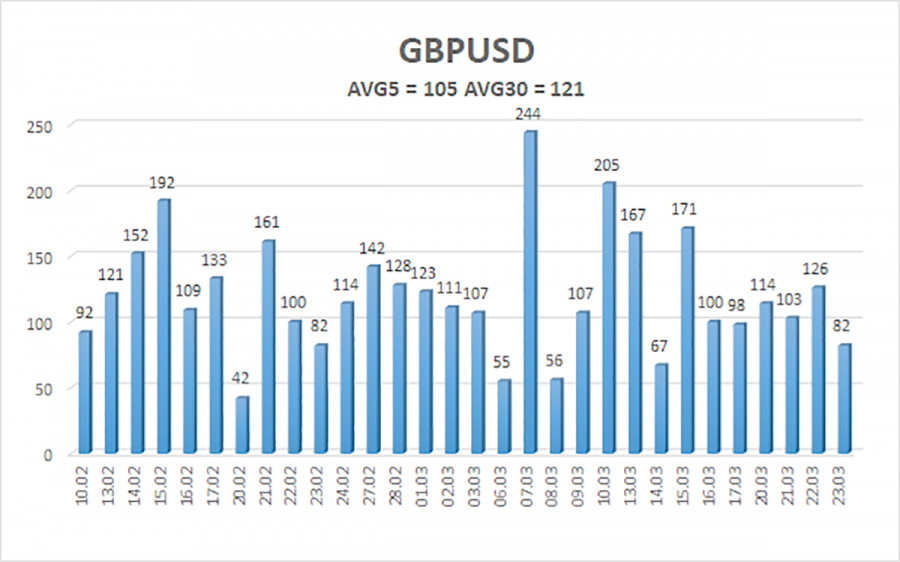

Over the previous five trading days, the GBP/USD pair has experienced an average volatility of 105 points. This figure is "high" for the dollar/pound exchange rate. Thus, we anticipate movement inside the channel on Friday, March 24, with the levels of 1.2183 and 1.2393 acting as resistance. The Heiken Ashi indicator's upward reversal indicates that the upward movement has resumed.

Nearest levels of support

S1 – 1.2207

S2 – 1.2085

S3 – 1.1963

Nearest levels of resistance

R1 – 1.2329

R2 – 1.2451

R3 – 1.2573

Trading Suggestions:

On the 4-hour timeframe, the GBP/USD pair has so far begun a weak downward reversal. Currently, long positions with targets of 1.2393 and 1.2451 can be taken into consideration if the Heiken Ashi indicator reverses its trend upward. If the price remains below the moving average with a target of 1.2085, short positions may be considered.

Explanations for the illustrations:

Determine the present trend with the use of linear regression channels. The trend is now strong if they are both moving in the same direction.

Moving average line (settings 20.0, smoothed): This indicator identifies the current short-term trend and the trading direction.

Murray levels serve as the starting point for adjustments and movements.

Based on current volatility indicators, volatility levels (red lines) represent the expected price channel in which the pair will trade the following day.

A trend reversal in the opposite direction is imminent when the CCI indicator crosses into the overbought (above +250) or oversold (below -250) zones.