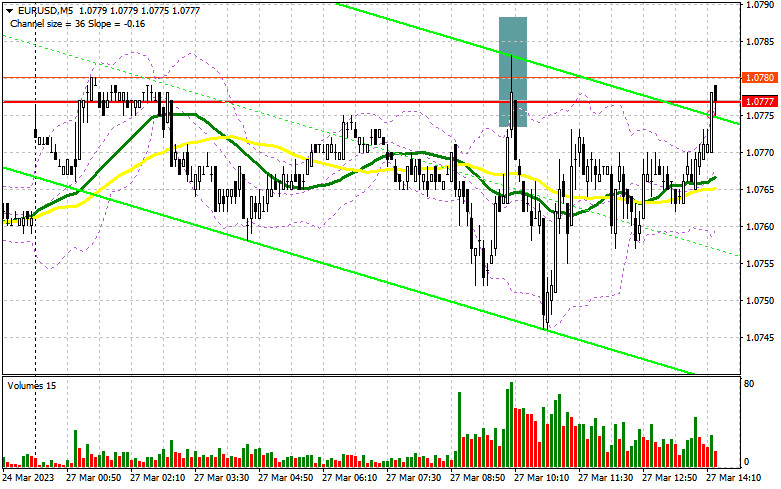

I focused on the 1.0777 level and suggested making market entry decisions from it in my morning forecasts. Let's take a look at the 5-minute chart to see what happened. Growth and a false breakout at this level created a sell signal, which caused the price to move down by 20 points, but the euro never saw a significant decline as a result. The technical situation and the strategy itself have not changed at all for the second half of the day.

If you want to trade long positions on EUR/USD, you will need:

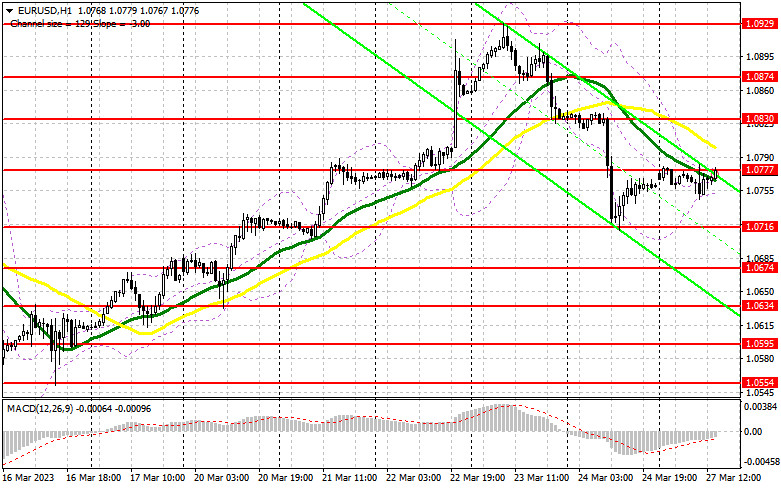

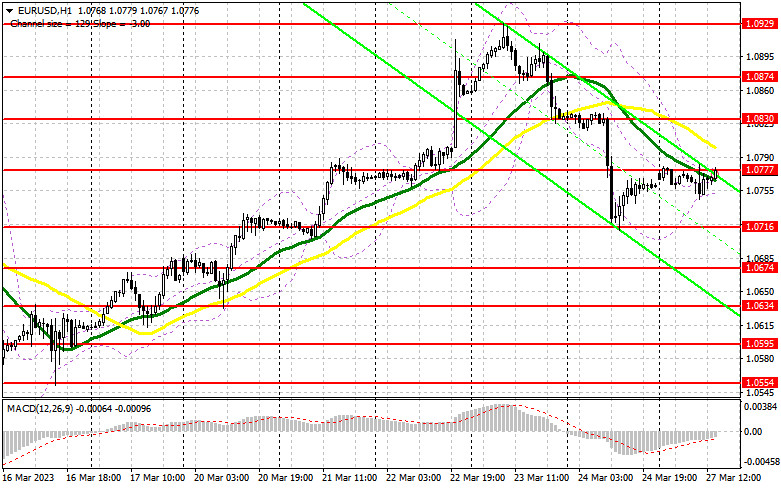

However, as you can see, there was no significant increase in the euro's value as a result of the IFO's disclosed data on Germany outperforming economists' expectations. There are no statistics at all in the afternoon, so the comments of the officials of the European Central Bank will command all attention. This is another justification for trying to break through 1.0777 again. Only the formation of a false breakout there will give us a good entry point into long positions, which will result in an upward movement to the area of the nearest resistance of 1.0777. If the pressure on the pair resumes and we see another breakthrough in the area of the nearest support of 1.0716. A breakout and a top-down test of this level create an extra entry point for establishing long positions with a rise to 1.0830, where the moving averages are playing on the side of the bears. The bulls will find it quite challenging there. The bears' stop orders will be hit if 1.0830 is broken, which would restart the bullish trend and provide another buy signal with a potential move to 1.0874, where I will fix the profit. The euro will come under a lot more pressure, and a new bear market will begin if EUR/USD drops and there are no buyers above 1.0716 in the afternoon. If this level is broken, the EUR/USD exchange rate will drop to the next support zone of 1.0674. The only indication to buy the euro will be the development of a false collapse there. I will open long positions right away in anticipation of a rebound from the low of 1.0634 or even lower, near 1.0595, with a target of a 30- to 35-point upward corrective during the day.

If you want to trade short positions on EUR/USD, you'll need:

While trading will take place below this level, sellers have done an excellent job of handling their tasks, and you may expect a short-term decline in the euro. Therefore, bears must protect the 1.0777 resistance. By analogy with what I discussed above, if the pair rises in response to the hawkish remarks made by ECB executive board members Frank Elderson and Isabelle Schnabel, only the formation of a false breakdown at 1.0777 will serve as the entry point for short positions to drive the pair down to the area of the nearest support of 1.0716. The pair will drop by 1.0674 on a breakdown and reverse test of this range. A decrease to the area of 1.0634 will result from consolidation below this level, which will intensify the market's bearish trend. I'll set the profit there. I encourage you to delay opening short positions until the level of 1.0830 if the EUR/USD rises throughout the American session and there are no bears at 1.0777. Only after an unsuccessful consolidation can you sell there. In anticipation of a rebound from the high point of 1.0874, I will open short positions right away with a 30- to 35-point corrective in mind.

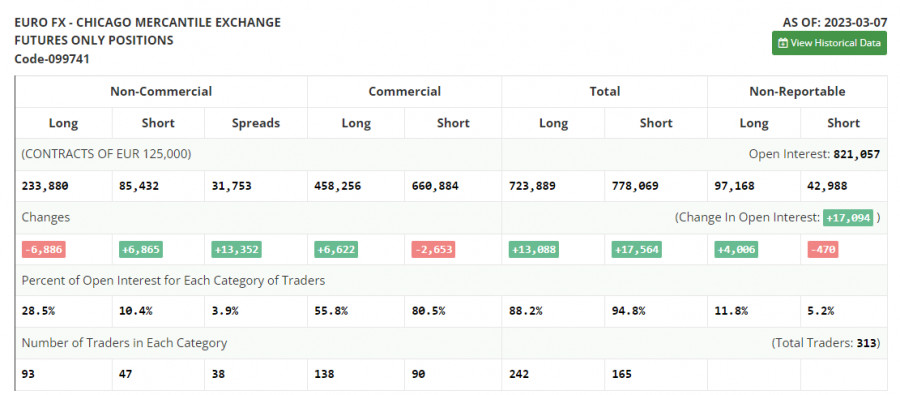

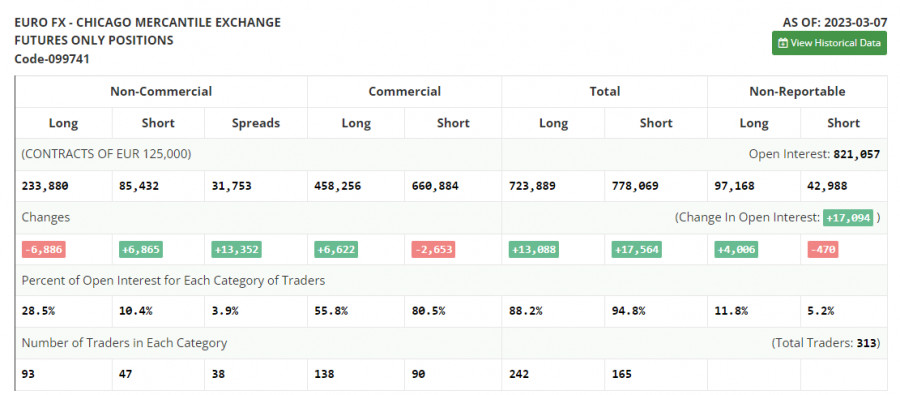

According to the COT report (Commitment of Traders) for March 7, there were fewer long positions and more short ones. It should be clear that the data are of no interest at the moment because, amid the CFTC cyberattack, statistics are only now starting to catch up, making the information from two weeks ago somewhat out of date. I'll hold off till new reports are released and rely on more recent data. We will have a meeting of the Federal Reserve System this week, and there are rumors that the committee may decide against raising rates at all given the problems in the banking industry and the opening of a new credit swap line for other central banks to provide them with liquidity. These developments make us seriously consider what lies ahead for the economy. If Jerome Powell surprises the markets and continues to raise rates, the dollar will suffer because investors are already betting on the Fed's tightening grip and policy easing by the end of the year. According to the COT data, the number of long non-commercial positions fell by 6,886 to 233,880, while the number of short non-commercial positions rose by 6,865 to 85,432. The total non-commercial net position dropped from 165,038 to 148,448 at the end of the week. The weekly ending price dropped and was $1.0555 as opposed to $1.0698.

Signals from indicators

Moving Averages

The formation of a bear market is indicated by trading below the 30 and 50-day moving averages.

Notably, the author considers the time and prices of moving averages on the hourly chart H1 and departs from the standard definition of the traditional daily moving averages on the daily chart D1.

Bands by Bollinger

The indicator's upper limit, which is located around 1.0780, will serve as resistance in the event of growth.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions, use the futures market for speculative purposes and to meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.