The currency pair GBP/USD also corrected slightly upwards on Tuesday, but there are two important differences from the similar movement of the EUR/USD pair. First, the pound could not overcome the moving average line even by a few points. Thus, the bounce off the moving average from below can be quite eloquent and a strong sell signal. Second, the British currency had fewer reasons to grow yesterday than the euro. And the euro had none at all. So, for now, the pound has excellent chances of continuing to decline.

Recall that the GBP/USD pair also grew for more than a month and often did so groundlessly. In the past week, it has been evident that the ascending impulse is on the verge of completion, as each subsequent peak is closer to the previous one. The last price consolidation below the moving average was the deepest during the upward trend. Considering the pair's ceaseless growth, we believe there can be no other option than a decline. Of course, no forecast has a 100% probability of fulfillment. We can also be wrong, and the market may have a different opinion on this matter. But what reasons could there be for the further decline of the dollar and the growth of the British currency? The Bank of England has lowered the rate hike pace to the minimum, the same as the current pace of the Federal Reserve. The Federal Reserve's rate is higher than the Bank of England's. Inflation in the US is much lower than inflation in the UK. The labor market and unemployment are in a much more satisfactory state. Economic growth rates are 3-4%, unlike the UK, which is approaching zero. And with all this, the pound has grown by 700 points and cannot correct itself. Even if the market had some reasons to buy the pound for so long, they have already been more than exhausted.

British statistics disappointed traders.

In principle, the only thing that could interest traders yesterday was the morning statistics from the UK. Three far from the most important reports were published at once. Yesterday we warned that the market reaction could only occur if the actual values of the reports deviated significantly from the forecasted ones. But whether there was a reaction to the reports or not, the pound moved in a direction that did not correspond to the nature of the data. Let's start with the fact that two out of three reports turned out to be worse than the forecasts. British inflation rose by 0.1%, unemployment benefit claims increased by almost 30,000, while the market expected a decline of 10. Thus, the pound should have continued to fall yesterday, not grow. One could assume that the euro pulled the pound up with it, but on what basis did the European Union's currency itself grow? Did the pound pull the euro with it? So it shouldn't have grown at all. Thus, yesterday, we saw a classic technical retracement unrelated to macroeconomic statistics.

However, this very statistic shows us that the UK's economic situation has begun to deteriorate. GDP has long been less than desirable, but the economy is still balancing on the edge of a canyon called "recession." Thus, another factor contributing to the medium-term decline of the pound is obtained. It should also be remembered that another political crisis and scandal are brewing in the UK. The day before yesterday, it became known that a parliamentary investigation was initiated against Rishi Sunak concerning budget subsidies for his wife's company, which Sunak should have mentioned in his declaration of assets and income for his family. Even if we forget that the British electorate cannot approve of the desire for personal gain at such a high position, the mere indecent behavior of the head of state is a reason to try to remove him from power. Especially since the Conservative Party has been so feverish in recent years, no one doubts the obvious: the next parliamentary elections will be lost to the Labor Party. All of this can also work against the pound.

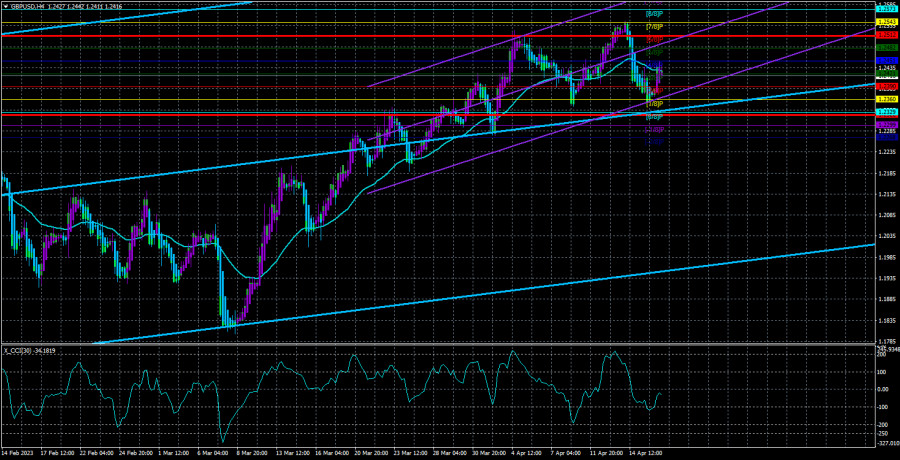

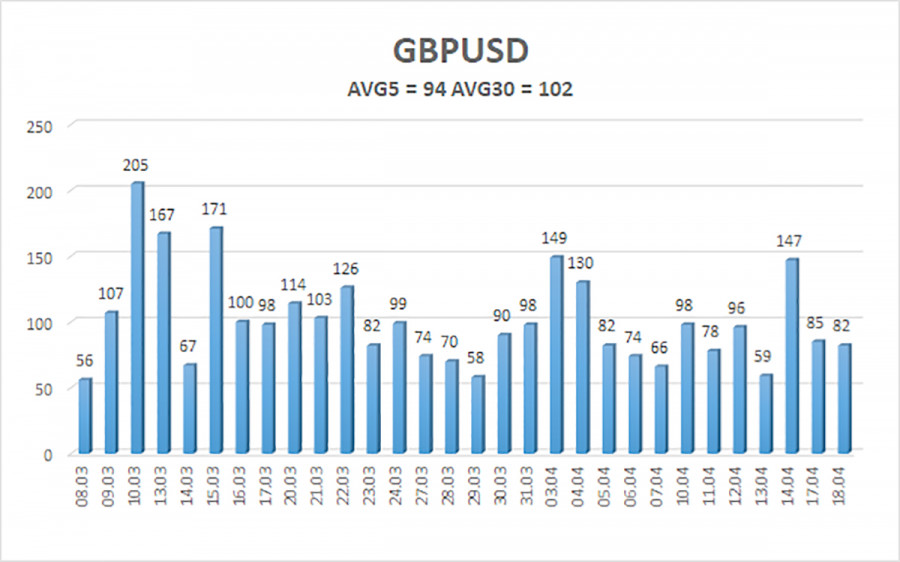

The average GBP/USD pair volatility for the last five trading days is 94 points. For the pound/dollar pair, this value is "medium." On Wednesday, April 19, we thus expect movement within the channel, limited by the levels of 1.2322 and 1.2510. The reversal of the Heiken Ashi indicator back down signals the possible resumption of the downward movement.

Nearest support levels:

S1 – 1.2421

S2 – 1.2390

S3 – 1.2360

Nearest resistance levels:

R1 – 1.2421

R2 – 1.2451

R3 – 1.2482

Trade recommendations:

The GBP/USD pair in the 4-hour timeframe continues to be below the moving average line. New short positions with targets of 1.2360 and 1.2322 can be considered in case of a price bounce from the moving average. Long positions can be considered if the price consolidates above the moving average with targets of 1.2482 and 1.2512.

Explanations for the illustrations:

Linear regression channels – help determine the current trend. The trend is strong now if both are directed in the same direction.

Moving average line (settings 20.0, smoothed) – determines the short-term trend and the direction to trade now.

Murray levels – target levels for movements and corrections.

Volatility levels (red lines) – the probable price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator – its entry into the oversold area (below -250) or overbought area (above +250) means that a trend reversal is approaching in the opposite direction.