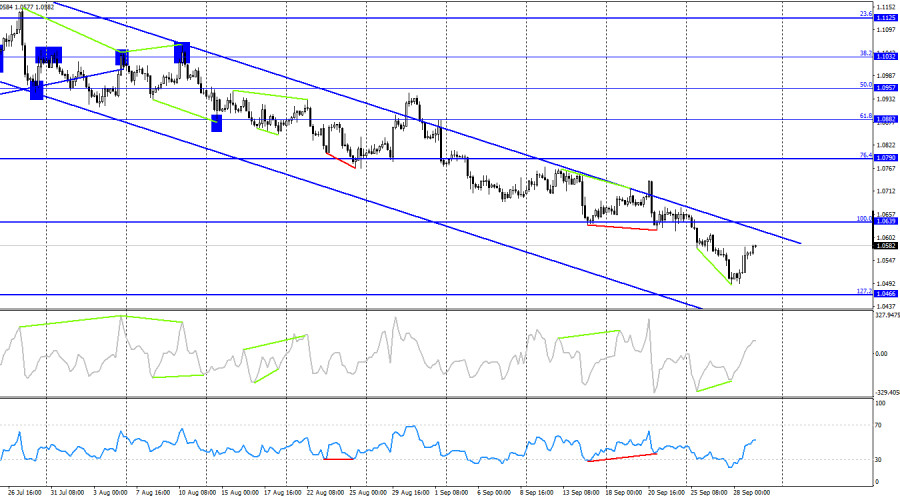

The EUR/USD pair made a reversal in favor of the European currency on Thursday, returning to the corrective level of 161.8% (1.0561). The consolidation above it allows us to expect further growth towards the next level at 1.0637. A rebound from the 1.0637 level will favor the US currency and a resumption of the decline towards the levels of 1.0561 and 1.0489. Closing above 1.0637 allows us to anticipate further growth towards the Fibonacci level of 127.2% (1.0714).

A new upward wave has begun. However, at the moment, this wave does not change anything in the overall picture. The "bearish" trend remains and will continue until the last peak is surpassed (around the 1.0665 level). Theoretically, this is possible today. Another possible sign will be the formation of a new downward wave that does not break the lows of yesterday. Thus, the beginnings of a new "bullish" trend are now present, but it is still too early to draw conclusions, especially considering the information background of Friday, which is quite strong.

Yesterday, there were two interesting reports that traders paid attention to. In Germany, the Consumer Price Index for September was released, and official data showed a decrease to 4.5%, which was even lower than expected. The Harmonized Index of Consumer Prices slowed down to 4.3% y/y. I don't consider this very good news for the euro from the ECB's point of view, but traders may have been buying the euro based on this report.

The GDP in the United States in the second quarter turned out to be more predictable, as the actual value coincided with the forecast: +2.1%. I believe that yesterday, the desire of the bears to take a break and rest played a bigger role than the two reports mentioned above.

On the 4-hour chart, the pair has made a reversal in favor of the EU currency after the formation of a "bullish" divergence on the CCI indicator. The growth process can continue towards the upper line of the descending trend corridor and the correction level of 100.0% (1.0639). A rebound from any of these barriers will maintain the "bearish" trend and suggest a resumption of the decline towards the corrective level of 127.2% (1.0466). Closing above the 1.0639 level is likely to indicate the end of the "bearish" trend.

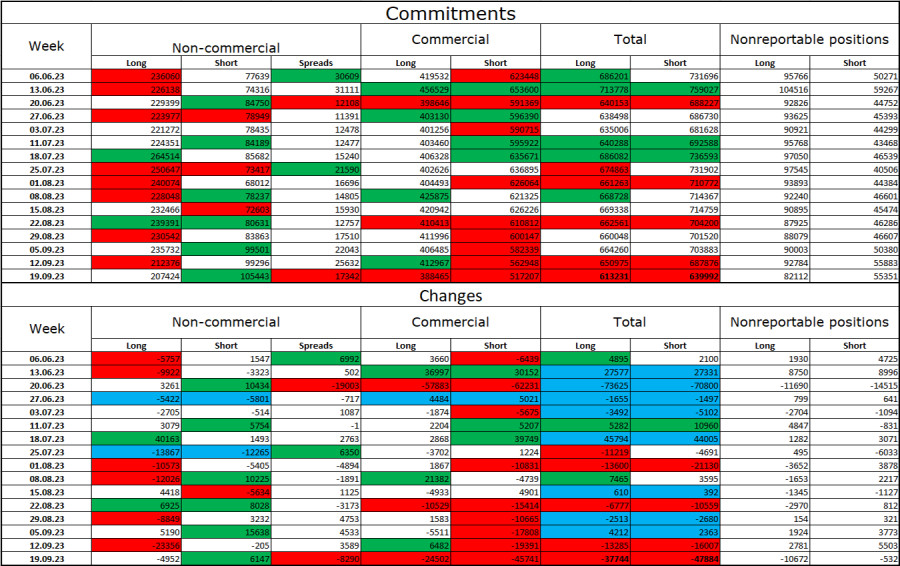

Commitments of Traders (COT) report:

In the last reporting week, speculators closed 4952 long contracts and opened 6147 short contracts. The sentiment among large traders remains "bullish," but it has noticeably weakened in recent weeks and months. The total number of long contracts held by speculators now stands at 207 thousand, while short contracts amount to 105 thousand. The difference is now only twofold. I believe that the situation will continue to shift in favor of the bears over time. Bulls have dominated the market for too long, and now they need strong news to sustain the "bullish" trend. There is no such news. The high value of open long contracts indicates that professional traders may continue to close them in the near future. I believe that the current figures allow for further declines in the euro in the coming months.

News calendar for the United States and the European Union:

European Union - Change in the number of unemployed in Germany (07:55 UTC).

European Union - Unemployment rate in Germany (07:55 UTC).

European Union - Consumer Price Index (CPI) (09:00 UTC).

USA - Core Personal Consumption Expenditures Price Index (12:30 UTC).

USA - University of Michigan Consumer Sentiment Index (14:00 UTC).

European Union - ECB President Lagarde will deliver a speech (16:00 UTC).

On September 29th, the economic calendar includes numerous important entries, with particular highlights being Lagarde's speech and inflation in the European Union. The impact of the information background on traders' sentiment today can be quite significant.

Forecast for EUR/USD and trader recommendations:

Sales of the pair are possible today if there is a bounce from the 1.0639 level on the 4-hour chart, with targets at 1.0561 and 1.0489. As for buying, we are already a bit late today, but the correction could be strong if there is a close above the 1.0639 level on the 4-hour chart.