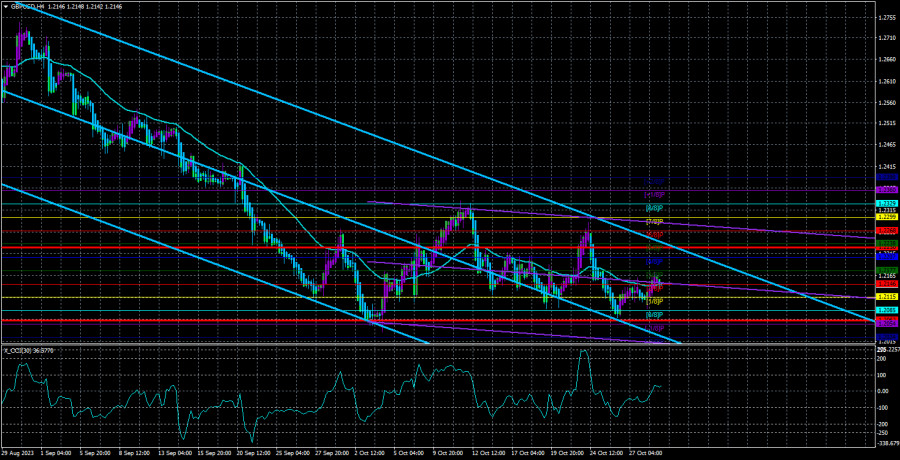

The currency pair GBP/USD also showed a slight increase on Monday, which had absolutely no impact. Movements remain quite weak, and the price couldn't even hold above the moving average. The British pound also continues to make attempts at a slight upward correction, but it's evident that any northward movement is happening with great effort. Thus, we stick to our initial opinion: the medium-term downward trend will continue. Whether it happens now or a bit later doesn't matter. The pair may find the strength to form another correction loop this week, but it won't have a significant impact on the larger picture.

As we've mentioned earlier, there are numerous truly important events and reports this week. Therefore, the British currency theoretically has a basis for strengthening. Perhaps Andrew Bailey will hint at new tightening, or the number of monetary committee members voting in favor of a rate hike will be higher than the market expects. Alternatively, macroeconomic statistics from across the ocean could disappoint. Various scenarios are possible, but they all suggest a resumption of the pound's decline. We still believe that the target of 1.1844 is achievable this year.

In the 24-hour timeframe, the technical picture is quite interesting. While the euro is making attempts to correct upward and consequently crosses the Kijun-sen line or the Fibonacci level of 38.2%, the pound has been pushing the price down along similar lines. The pound has not crossed the critical line or the Fibonacci level of 50.0% for weeks. Therefore, at the moment, there is no reason to expect a strong pair's rise.

The chances of the British currency rising are slim, but they exist. In our previous articles, we've already mentioned that we shouldn't expect much from the Federal Reserve and the Bank of England. The American regulator is likely to keep the rate unchanged with a 99% probability, and Jerome Powell is unlikely to talk about the need for further tightening. The Bank of England is also expected to keep the rate unchanged with a 99% probability, but there are still some possibilities. The BOE Chairman may signal to the market that the tightening cycle is not yet complete, and the voting results on the rate may show that the number of policymakers supporting tightening is still significant. At one of the upcoming meetings, the balance may tip in favor of the "hawks." In the current circumstances, even such information is like a gift from heaven for the British currency.

As for macroeconomic statistics from the United States, we have repeatedly stated that, in most cases, they are strong and, accordingly, provide support for the dollar. Thus, the U.S. currency should continue to rise overall. However, there are exceptions to every rule or trend. This week, we might see weaker data, which could provoke a dollar's rise.

So, all we can do now is wait. On Monday and Tuesday, there will be no significant information from the United Kingdom or across the ocean. However, Wednesday, Thursday, and Friday will be absolutely crazy in terms of macroeconomic and fundamental background. There are also concerns that the pair may enter into a prolonged consolidation and trade within the range of 1.2050–1.2329 for a long time, but at the moment, the option of continuing the downward trend is still preferable.

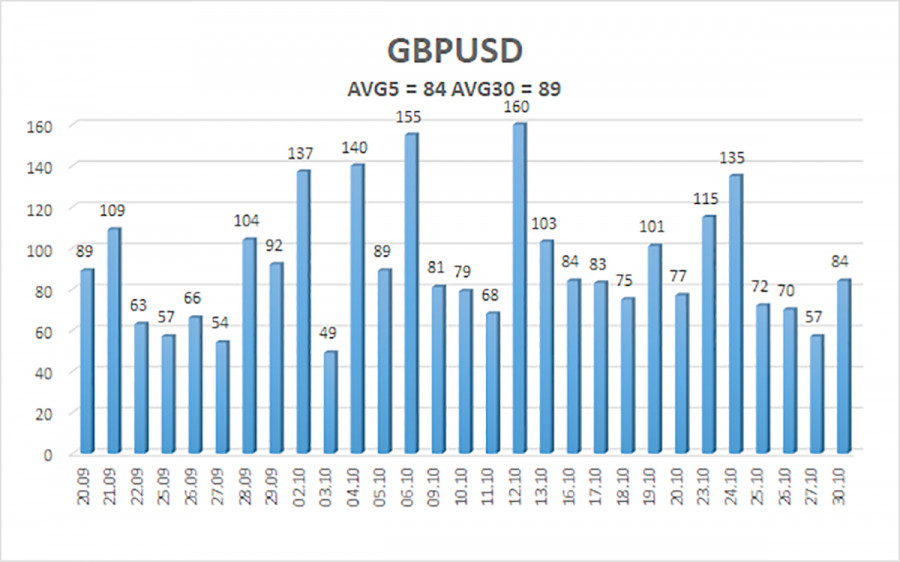

The average volatility of the GBP/USD pair over the last 5 trading days as of October 31st is 84 points. For the pound/dollar pair, this value is considered "average." As a result, we anticipate movement within the range defined by the levels of 1.2062 and 1.2230 on Tuesday, October 31. A reversal of the Heiken Ashi indicator downwards will signal a possible resumption of the downward movement.

Nearest support levels:

S1 - 1.2115

S2 - 1.2085

S3 - 1.2054

Nearest resistance levels:

R1 - 1.2146

R2 - 1.2177

R3 - 1.2207

Trading recommendations:

In the 4-hour timeframe, the GBP/USD pair may have completed its sluggish correction attempts. Therefore, it is currently possible to maintain short positions with targets at 1.2085 and 1.2054 in case the price rebounds from the moving average. In the event of the price consolidating above the moving average, long positions with targets at 1.2207 and 1.2238 may become relevant. However, there are no grounds to expect a strong dollar's rise today.

Explanations for the illustrations:

Linear regression channels - help determine the current trend. If both channels are pointing in the same direction, it indicates a strong trend.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the probable price channel in which the pair will trade over the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or overbought area (above +250) indicates that a trend reversal in the opposite direction is approaching.