4-hour timeframe

Technical details:

Higher linear regression channel: direction - downward.

Lower linear regression channel: direction - downward.

Moving average (20; smoothed) - downward.

The GBP/USD currency pair on Thursday, as well as EUR/USD, traded very sluggishly, but still below the moving average line. And the euro currency, we recall, is higher. Thus, the downward trend in the pound sterling remains, which allows us to count on further movement to the south. Although, if we take into account the fact that the euro and the pound rarely move in different directions (only if there is a strong fundamental background from the European Union or the UK, which is not observed now), then we are still inclined to believe that either the euro will resume falling, or the pound will begin to grow. What can affect this? December is the last month of the year and all three central banks will hold meetings. It is these meetings that may allow us to answer the question of what to expect on monetary policy in the next six months. Recall that everything is clear with the Fed. It has embarked on the path of tightening because there is simply no other way. Even if the omicron strain provokes the fourth or fifth "wave" of the pandemic, inflation may continue to rise, the world economy is overflowing with money, demand exceeds supply, and so on. Of course, a new "wave" may cool the economy, which will lead to a pullback in inflation. But at the same time, it will also cause a new "wave" of layoffs, bankruptcies, and falls in the stock market. If this wave turns out to be destructive, then central banks can start stimulating their economies again to recover from the consequences of the last "wave". In general, while the "coronavirus" is with us, it is impossible to be sure of anything, and to make forecasts for several months ahead is impractical. The Bank of England may also embark on the path of tightening, as at the last meeting two and three members of the committee of nine voted for a rate hike and for curtailing the QE program. What will happen in December? The pound will receive support if the Bank of England starts tightening.

Relations between France and the UK continue to heat up.

This story began during the negotiations on the trade deal. France insisted on maintaining access to British waters to catch fish and seafood. It was the "fish issue" that was one of the most crucial in those negotiations. And it is this question that has again arisen before the participants of the transaction in the last month. It turned out that London refused to obtain a fishing license for about 100 French vessels, which may be an attempt to put pressure on the European Union to be more compliant on the issue of revising the "Northern Ireland Protocol". However, the European Union does not make concessions, and France, as one of the most influential members of the EU, threatens sanctions and the rupture of the Brexit agreement. Recently, another conflict has arisen between Paris and London. It turned out that when trying to cross the English Channel, a boat with 27 migrants from Paris, who were heading to the UK, died. Boris Johnson sent an open letter to Emmanuel Macron with five points on how to avoid similar cases in the future and called for "taking their migrants back to themselves," which caused a storm of indignation in Napoleon's homeland. The French President had a telephone conversation with the British Prime Minister, in which he called him "a clown who is looking for scapegoats after a disastrous Brexit." This was reported by one of the French newspapers. "It is sad to see that a large country, with which we could do a huge amount of business, is led by a clown. Brexit is the starting point of Johnson's circus," Macron said. The former French ambassador to the Kingdom, Sylvie Bermann, said that there had not been such bad relations between the countries since Waterloo. Thus, Boris Johnson continues to confidently follow the "Donald Trump path", spoiling relations with his key partners, rather than improving them. So far, Johnson, according to many experts and in our opinion, too, manages to mask the catastrophe from Brexit under the consequences of a pandemic. However, it won't be like this forever. Apart from the completion of Brexit and the trade agreement signed "on the knee", Johnson has practically no victories.

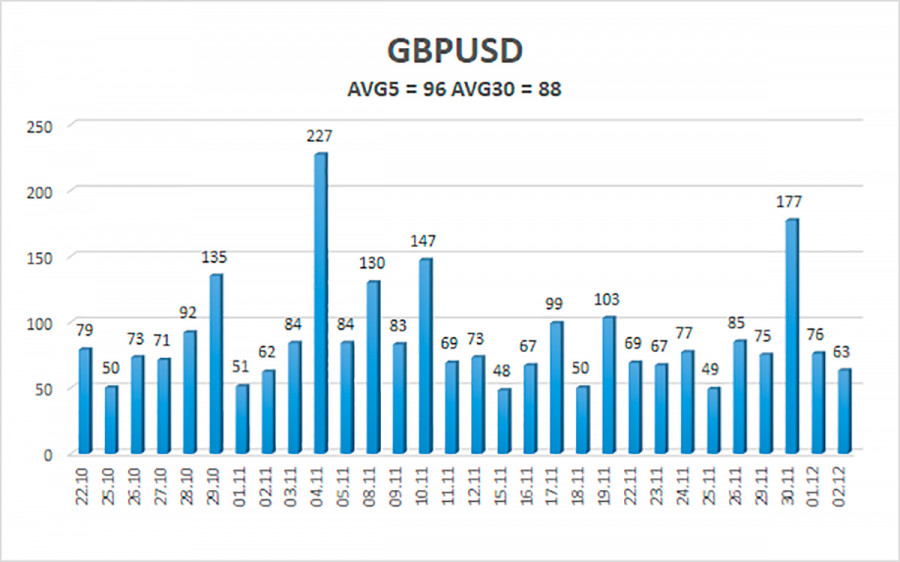

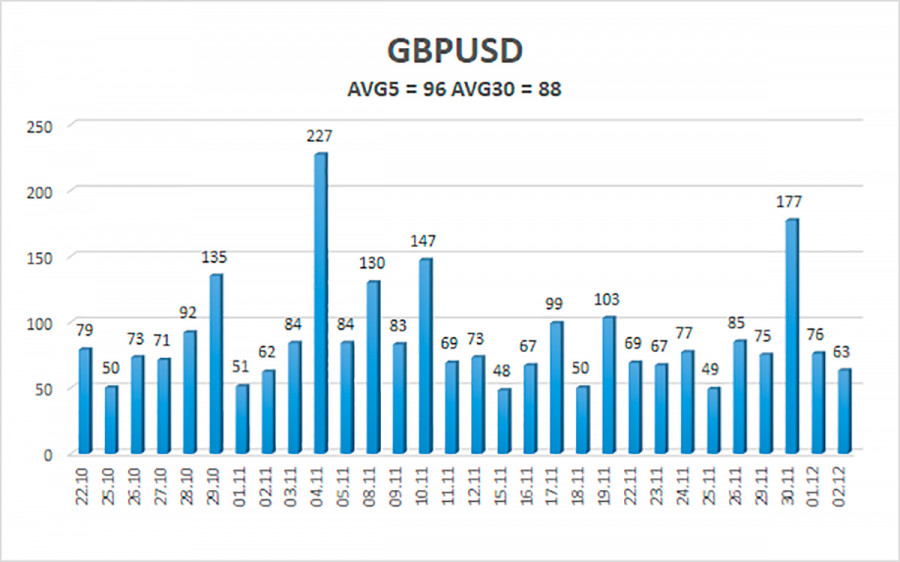

The average volatility of the GBP/USD pair is currently 96 points per day. For the pound/dollar pair, this value is "average". On Friday, December 3, we expect movement inside the channel, limited by the levels of 1.3214 and 1.3406. The reversal of the Heiken Ashi indicator downwards signals a possible resumption of the downward movement.

Nearest support levels:

S1 – 1.3245

S2 – 1.3184

S3 – 1.3123

Nearest resistance levels:

R1 – 1.3306

R2 – 1.3367

R3 – 1.3428

Trading recommendations:

The GBP/USD pair adjusted to the moving again on the 4-hour timeframe. Thus, new short positions with targets of 1.3245 and 1.3214 levels should be considered at this time if the price remains below the moving average line. Buy orders can be considered in the case of a confident consolidation of the price above the moving average with targets of 1.3367 and 1.3406 and keep them open until the Heiken Ashi turns down.

Explanations to the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which to trade now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.