On Thursday, the EUR/USD currency pair continued to trade in the same side channel as two weeks before. Recall that our channel has boundaries of 0.9900 and 1.0080. Moreover, an upward slope is clearly traced inside this channel, so formally we are even dealing with an upward correction. Another thing is that this correction does not exceed even 200 points so far. Thus, the technical picture did not change completely on Thursday. Traders themselves have to decide: do they want to trade in a flat, or would they prefer to wait for its completion? We remind you that, in principle, it is possible to trade in flat conditions, but it is associated with increased risks. It is always easier and better to deal with the current trend. And the "Linear Regression Channels" trading system, like Ichimoku, is a trend system. That is why both generate false signals during a flat.

What can we say about the fundamental background now? It's just that it hasn't changed in the current week. More precisely, it has not changed for several months in a row. We mean, it doesn't change globally. In the last few days, reports have been coming to the market that the ECB is preparing three key rate hikes this year, which should add confidence to the euro and optimism to buyers. But, as we can see, the pair continues to be located near its 20-year lows, and it seems that it just took a break before a new prolonged fall. We have already said that trends, especially strong ones like the current downward one, end with a sharp movement in the opposite direction. The pair does not push around its extremes for several weeks before starting a new long-term trend. You can verify this personally by switching to a 24-hour TF and viewing the history over the past decade. Therefore, we are not waiting for the downward trend to end.

The Fed will continue to put pressure on the euro

As we said yesterday, the ECB rate hike, announced by some heads of central banks in the European Union, does not make much sense now. It doesn't make sense because the ECB is already very late in the fight against high inflation. In the US, Fed monetary committee members are already discussing the need to raise the rate to 4–4.5% instead of the originally planned 3.5%. It means that even in the States, more serious measures will have to be taken to combat inflation, although the Fed was the first to fight it. What can we say about the ECB, which, for the first time in 11 years, raised the rate (which was initially even lower than the Fed rate) six months later than the American regulator? It is easy to assume that the ECB will also need to raise its rate to 4–4.5%. So far, we are talking about bringing the rate to 1.5% by the end of the year.

In the States, they say there will be no rate cut next year, and the period of tight monetary policy will last for quite a long time. Therefore, for inflation to return to the target level, the rate should rise to at least 4% and remain at this "restrictive" level for a long time. At the same pace as now, the European Union will raise the rate to 4% by 2024 or 2025. And then we'll have to keep it at the achieved value for another couple of years. As a result, the fight against inflation will not be quick. While the Fed is already starting to ease monetary policy, the European Union will continue to strangle its economy and live with a high consumer price index, stimulating unemployment, which is already twice as high as the American one. And what surprises will the energy crisis bring this winter? We can only guess. In general, we would say that the situation in the European Union is now much more complicated than in the relatively independent (of imported energy resources) and more agile (in terms of trade) USA. From our point of view, the euro will be able to count on growth only when the Fed begins to signal the end of the rate hike cycle.

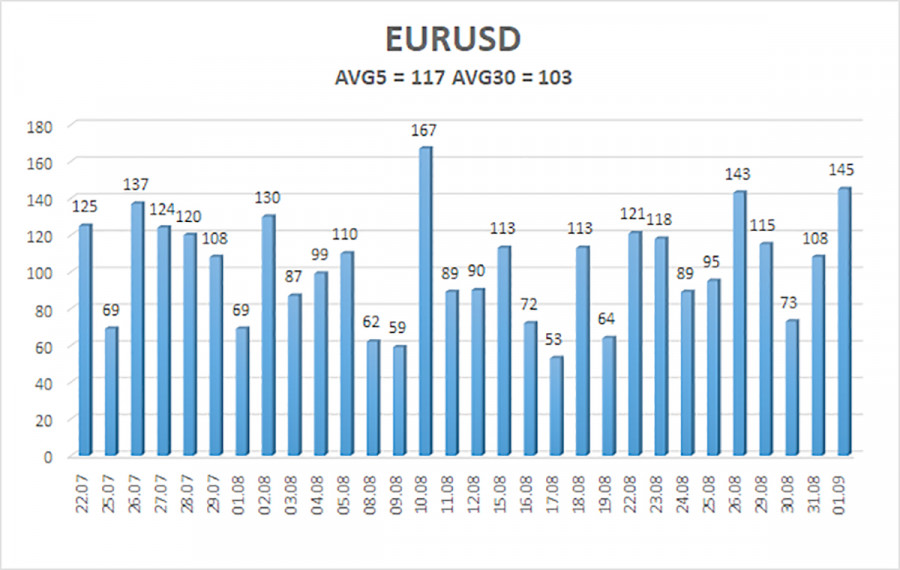

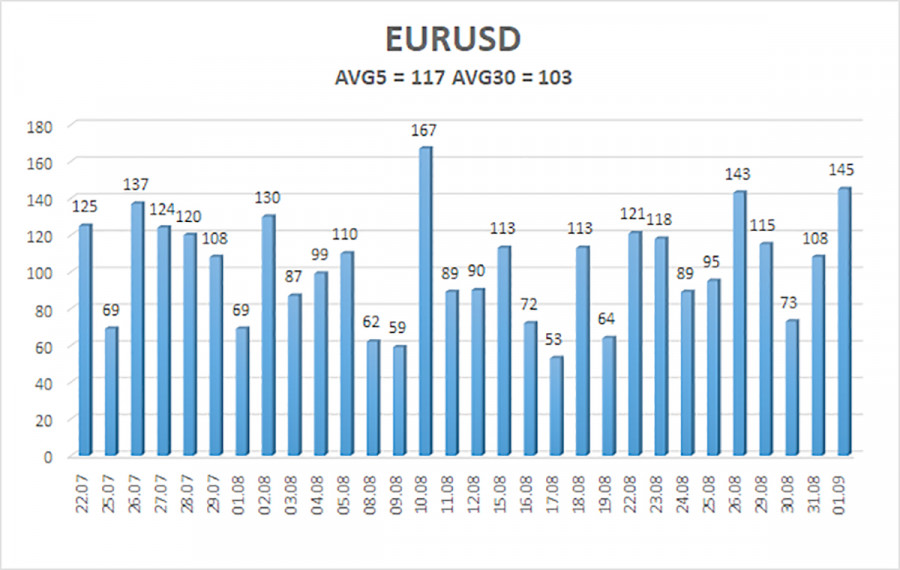

The average volatility of the euro/dollar currency pair over the last five trading days as of September 2 is 117 points and is characterized as "high." Thus, we expect the pair to move today between 0.9823 and 1.0057. A reversal of the Heiken Ashi indicator upwards will signal a new round of upward movement.

Nearest support levels:

S1 – 0.9949

S2 – 0.9888

Nearest resistance levels:

R1 – 1.0010

R2 – 1.0071

R3 – 1.0132

Trading Recommendations:

The EUR/USD pair continues to trade in the flat or "swing" mode. Thus, now it is possible to trade on the reversals of the Heiken Ashi indicator until the price leaves the 0.9900-1.0072 channel.

Explanations of the illustrations:

Linear regression channels – help to determine the current trend. If both are directed in the same direction, then the trend is strong.

Moving average line (settings 20.0, smoothed) – determines the short-term trend and the direction in which trading should be conducted now.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) are the likely price channel in which the pair will spend the next day, based on current volatility indicators.

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.