US stocks end day with modest losses

US stocks ended Wednesday with modest declines as investors remained cautious amid the latest labor market data and comments from Federal Reserve officials that fueled speculation about a potential interest rate cut.

Job openings fall raise expectations for Fed policy changes

US job openings fell to the lowest in three and a half years in July, according to the Labor Department. That points to further easing of labor market tensions, which could provide additional leverage for the Fed to ease monetary policy. The decision is expected to be considered at the regulator's next meeting, scheduled for the end of the month.

Markets ended mixed

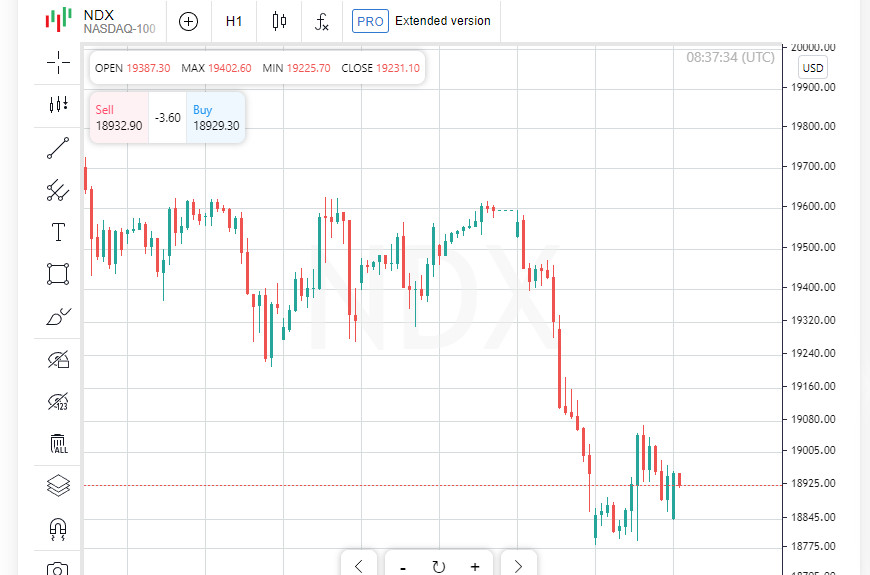

The S&P 500 and the Nasdaq ended the day lower, while the Dow posted a slight gain. Utilities and consumer staples were the best performers, while energy and technology companies came under pressure. In total, six of the 11 S&P 500 sectors ended in the red.

The economy is showing resilience

"September has always been a tough month for the stock market, but the economy continues to show resilience," said Bill Strazzullo, chief market strategist at Bell Curve Trading in Boston. "The consumer sector looks strong, and the labor market remains healthy. I remain generally optimistic about the market outlook," he added.

Nvidia Under Attack

Nvidia (NVDA.O) shares, which had previously lost about $279 billion in market value, fell again by 1.7% by the end of the day. This happened amid the company's denial of a report that it allegedly received a subpoena from the US Department of Justice, which led to additional volatility in the stock. Thus, despite the current instability, the market continues to hold positions, waiting for further steps from the Fed and other important economic data.

Tech giants under pressure

Shares of the largest companies in the tech sector continued to decline. Apple (AAPL.O) ended the trading session with a decline of 0.9%, Microsoft (MSFT.O) fell by 0.1%, and Alphabet (GOOGL.O) shares lost 0.5%. Amazon.com (AMZN.O) also fell by 1.7%. However, Tesla (TSLA.O) stood out among the megacaps, bucking the trend by adding 4.2%.

High rates threaten the labor market

Raphael Bostic, head of the Atlanta Federal Reserve, warned that keeping interest rates high for too long could hurt employment. He said waiting for inflation to fully decline to the 2% target before cutting rates could backfire on the labor market, causing "unnecessary pain" among workers.

Wall Street awaits key decisions

Amid market instability, the previous trading session was extremely unsuccessful for all three key Wall Street indexes, which recorded their biggest losses since early August. Investors began selling tech stocks en masse, making September, known for its negative impact on stock markets, an especially tough month for stock exchanges.

Rate Cut Hopes Rise

With employment data weakening, experts expect the Fed to take steps to cut rates at its next meeting. "The rise in utility stocks shows the market is reacting to the weak labor market data, which reinforces expectations for a rate cut of at least 25 basis points," said Eric Beirich, chief investment officer at Sound Income Strategies.

Indices End Day With Mixed Results

The U.S. trading session ended with mixed results for key indices. The Dow Jones Industrial Average (.DJI) showed a slight increase of 38.04 points, or 0.09%, reaching 40,974.97. Meanwhile, the S&P 500 (.SPX) lost 8.86 points, or 0.16%, to close at 5,520.07, and the Nasdaq Composite (.IXIC) fell 52 points, or 0.30%, to close at 17,084.30.

Semiconductors Rebound

After a big drop in the previous session, the Philadelphia SE Semiconductor Index (.SOX) managed to partially recover, rising 0.25%. This gain came after a significant decline caused by COVID-19 concerns.

New Appointments Support AMD Shares

Advanced Micro Devices (AMD.O) posted a gain of nearly 3%. The company gained ground after appointing former Nvidia executive Keith Strayer as senior vice president of global artificial intelligence markets. The move signals AMD's serious ambitions in AI, which has had a positive impact on investor confidence.

Big Losses for Zscaler and Dollar Tree

Zscaler (ZS.O) shares tumbled nearly 19% after the company provided fiscal 2025 revenue and profit guidance that fell short of analysts' expectations. Meanwhile, Dollar Tree (DLTR.O) fell 22% after cutting its full-year sales and profit forecasts, sparking a negative reaction in the market.

Stock Exchange Turnover Declines

Total trading volume on U.S. exchanges was about 10.5 billion shares, below the 20-day average of about 11 billion shares, suggesting investors are cautious amid market uncertainty.

Oil Futures Continue to Fall

Oil futures fell more than 1% again, continuing a three-day slide. They had fallen more than 4% on Tuesday, on concerns about a drop in fuel demand in the coming months.

Treasury Yields Fall

Treasury yields were also under pressure. A notable event occurred earlier in the day: the yield curve between two-year and ten-year bonds turned positive again. This comes as new data shows that the number of job openings in the US has fallen to the lowest in 3 1/2 years, raising expectations for action by the Fed to cut interest rates.

Wall Street suffers biggest drop since early August

US stocks on Tuesday posted their biggest single-day drop since early August, with investors taking profits as risk appetite weakened due to weak US manufacturing data. This situation has only increased market caution ahead of the release of important data. On Thursday, attention will focus on statistics on the service sector and new jobless claims.

Expectations for the jobs report are growing

On Friday, investors are eagerly awaiting the release of the August non-farm payrolls report, which will be a key indicator of the current state of the US economy. The report could provide a clearer picture of whether the Federal Reserve will take steps to cut interest rates. Speculation that the Fed could cut rates by a quarter or even half a percentage point continues to gain traction.

Cautiousness in a Weak Market

"September is traditionally weak for equities, with investors becoming more cautious, focusing more on growth than inflation," said Anthony Saglimbene, chief market strategist at Ameriprise Financial. That reflects a sentiment that while inflation risks have eased, the outlook for a slowdown in economic growth is more of a concern.

Mixed Economic Data

Reports on Wednesday were mixed. The Commerce Department reported that new orders for U.S. goods rose more than expected in July, driven by orders for military aircraft. But demand was significantly weaker elsewhere, and high borrowing costs continue to weigh on the economy.

Labor Market Weakens, Traders Await Fed Action

Labor market data showed that U.S. job openings hit their lowest level since January 2021 in July. This signals that the labor market is losing momentum and reinforces expectations that the Fed may cut interest rates more aggressively. Many traders are already pricing in a half-percentage-point rate cut at their next meeting.

Fed Urges Monetary Policy Caution

On Wednesday, Atlanta Federal Reserve President Raphael Bostic said that keeping interest rates high for too long could put serious pressure on the labor market. He stressed that maintaining tight monetary policy risks hurting employment, which calls for a cautious approach to future rate decisions.

Global Stock Markets in the Red

The MSCI Global Stock Market Index (.MIWD00000PUS) fell 4.40 points, or 0.54%, to close at 815.07. European markets also ended the day in negative territory, with the STOXX 600 Index (.STOXX) down 0.97%, reflecting a general weakening of risk appetite amid global uncertainty.

The Dollar Weakens on Rate Cut Expectations

In the currency markets, the US dollar weakened significantly against most major currencies. Following the release of data on the decline in US job vacancies, market participants began to count more on the Fed cutting interest rates, which led to a weakening of the US currency. At the same time, the Japanese yen, traditionally considered a safe haven asset, strengthened its positions. The dollar index, which tracks the dollar against major currencies including the euro and yen, was down 0.39% at 101.30. The euro was up 0.34% at $1.108, while the dollar fell 1.17% against the yen at 143.77 yen.

Treasury yields fall

In the government bond market, the yield on the 10-year U.S. Treasury note fell 8.9 basis points to 3.755%, down from 3.844% the previous day. Meanwhile, the yield on the 2-year note, which is closely linked to expectations for interest rate changes, was down 12.8 basis points to 3.76%. The changes reflect growing expectations for a rate cut from the Federal Reserve. Thus, the combination of weak labor market data and expectations of monetary easing continues to weigh on the dollar and Treasuries, with global markets trending lower.

Employment report in focus

The key event this week will be the release of the employment report on Friday, which, according to Ian Lingen, head of U.S. rates strategy at BMO Capital Markets, will provide a clear indication of the likely actions of the Federal Reserve. "This report will be the most important one for the outlook, overshadowing even the inflation risks that have previously been the main guide for short-term policy," Lingen said.

Oil falls amid demand concerns

Oil prices continue to slide amid growing pessimism about demand in the coming months. Oil producers have not given clear signals about their intentions to increase supply, adding to uncertainty. Weak economic data from the U.S. and China have added to the negative impact, bolstering expectations of a slowdown in global growth.

US crude fell 1.6% to $69.20 per barrel. Brent crude also fell 1.4% to $72.70 per barrel.

Gold strengthens on weak dollar

Amid a weaker dollar and falling Treasury yields, gold prices managed to recover their positions. After the publication of weak job data in the US, demand for the precious metal increased. Spot gold rose 0.07% to $2,494.43 per ounce, demonstrating stability in the face of declining market sentiment.

Thus, markets continue to be influenced by expectations of economic data, and investors' attention is increasingly shifting to the upcoming employment report, which will be an important indicator of the Fed's further actions and the overall state of the economy.