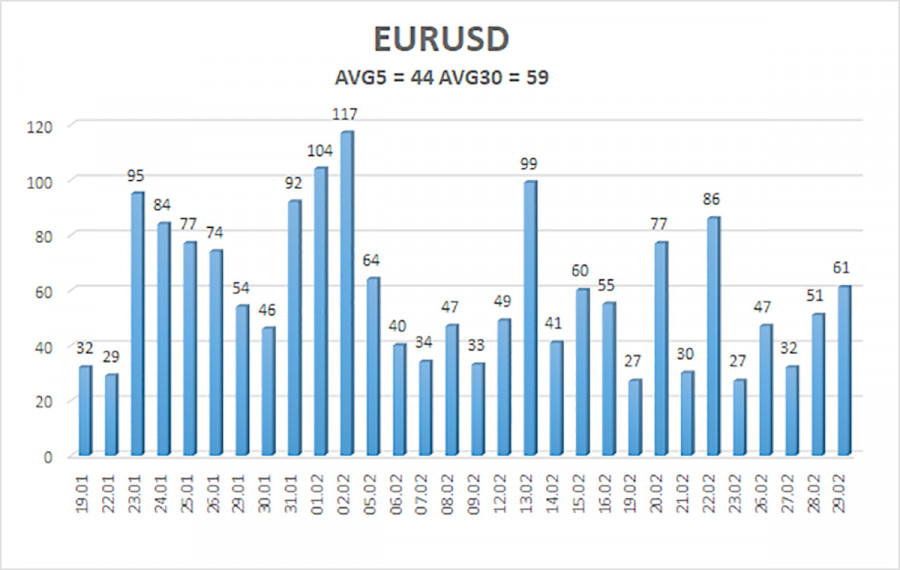

The EUR/USD currency pair continued to trade with fairly low volatility on Thursday. Even the morning block of macroeconomic statistics in Germany did not help, although it contained resonant reports. Germany is just one of the 27 countries in the European Union, but at the same time, it is the country with the largest economy in the bloc. However, the illustration below clearly demonstrates that the market has not had a strong desire to trade in the past few weeks. And it can hardly be said that there have been no important reports or fundamental events for three weeks already. If market participants refuse to make transactions, then there will be no movement, regardless of the background of the movements.

We have a feeling that the market is simply tired. Over the past few months, it has had to change its expectations for key ECB and Fed rates several times. At first, it was expected that the Fed would be the first to ease, and then, after a few months at a minimum - the ECB. However, as objective reality shows, both central banks may start cutting rates in June. It turns out that the Fed will start cutting rates two meetings later than the market expects, and the ECB - several meetings earlier.

There is already open talk about the first easing in June by ECB representatives and, most importantly, by Christine Lagarde. Of course, by June, there will be enough important information published that could affect this plan. If inflation in the European Union or the United States continues to rise in the coming months, regulators may wait a little longer. However, it will be difficult for the ECB to wait even longer. Its economy continues to slowly but surely slide into a recession. Of course, one or two months of weather will not change anything, but inflation in the EU is already close enough to the target level.

In the United States, the situation is diametrically opposite. Despite the slowing pace of its growth, the economy is in good shape. Inflation is 1% above target and has not been in a hurry to slow down for the last six or seven months. Therefore, the Fed may well keep rates at their maximum value for even longer.

We continue to believe that the updated market expectations for rates should support the US dollar. We maintain a downward trend on a global scale, so it is reasonable to expect a new decline. The economy of the European Union is weaker than the American one, and the Fed has many more reasons to keep the rate at its maximum than the ECB. Today, the inflation report for February will be released in the EU, which may indicate a slowdown in the indicator to 2.5%. At this level, it is quite reasonable to move on to easing monetary policy.

Thus, the baseline scenario now is a rate cut by the ECB and the Fed in June. The correction for the euro/dollar may continue for some time, but, for example, today's inflation report could significantly affect market sentiment. Also, we remind you that logic is logic, but in the event of the market's refusal to sell, the pair will not move south. It is very important for the euro not to follow the example of the pound, which does not fall against any background.

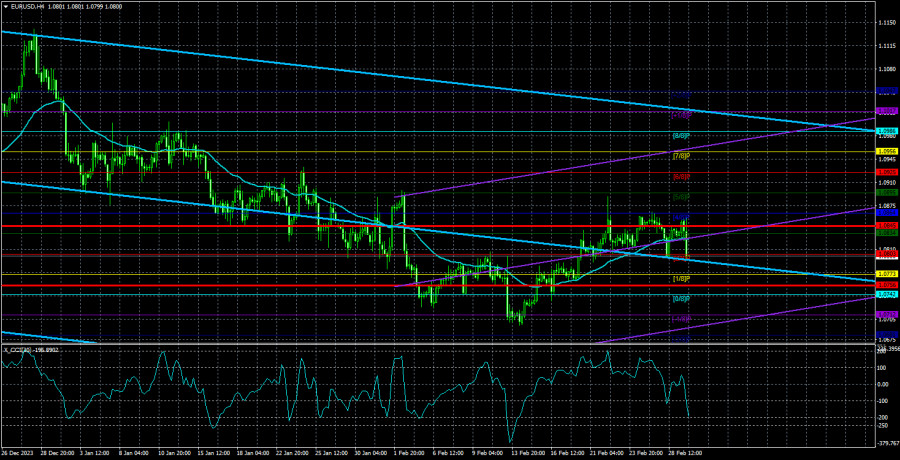

The average volatility of the euro/dollar currency pair for the last 5 trading days as of March 1st is 44 points and is characterized as "low." Thus, we expect the pair to move between the levels of 1.0756 and 1.0845 on Friday. The senior linear regression channel is still pointing downward, so the downward trend persists. The oversold condition of the CCI indicator provoked a small upward correction, which may already be completed.

Nearest support levels:

S1 - 1.0803

S2 - 1.0742

S3 - 1.0681

Nearest resistance levels:

R1 - 1.0864

R2 - 1.0925

R3 - 1.0986

Trading recommendations:

The EUR/USD pair has settled below the moving average line, and we continue to look towards short positions targeting 1.0681. The decline of the European currency is stable but slow, with frequent corrections. We see no reason for a global increase in the euro. Long positions are unlikely to be considered soon, as any pair growth is corrective. Even if the price consolidates above the moving average.

Illustration explanations:

Linear regression channels - help determine the current trend. If both are pointing in the same direction, the trend is currently strong.

The moving average line (settings 20.0, smoothed) - determines the short-term trend and direction in which trading should be conducted.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the probable price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or the overbought area (above +250) indicates that a trend reversal in the opposite direction is approaching.