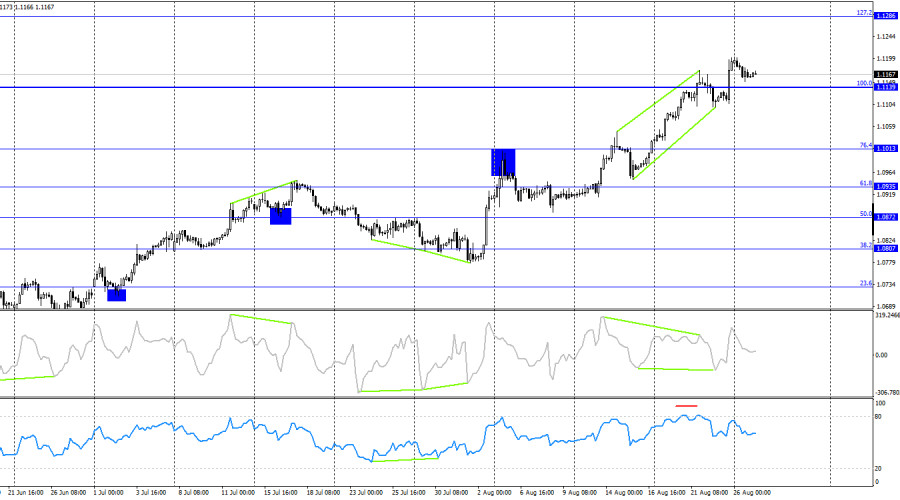

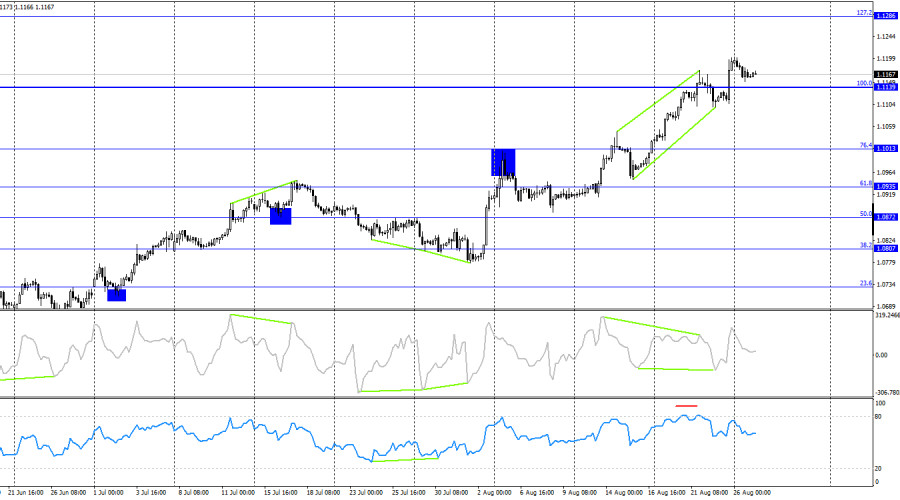

On Friday, the EUR/USD pair reversed in favor of the European currency and secured itself above the 200.0% corrective level at 1.1165. On Monday, however, it neither rose nor fell. Thus, the upward movement could continue towards the next target level of 1.1240. If the quotes consolidate below 1.1165, it would give the dollar a new chance to strengthen slightly towards the support zone of 1.1070–1.1081. However, the market sentiment remains "strictly bullish."

The wave situation has become a bit more complicated, but overall, there are no major concerns. The most recent completed downward wave did not break the previous wave's low, while the latest upward wave broke the peak from August 14. Thus, the "bullish" trend is currently intact. For the "bullish" trend to reverse, the bears would now need to break the low of the last downward wave, which is around the 1.0950 level.

Monday's news background was quite interesting but had almost no impact on trader sentiment. The primary interest was centered on a single report—the durable goods orders in the U.S. Orders increased by 9.9% in July, against an expectation of 5%. This should have been an excellent opportunity for the dollar to recover slightly, but the bears remain inactive. Today, weak GDP data and a weak consumer climate index were released in Germany, but these data also did not affect the euro's exchange rate. Thus, the pair did not start to decline, the dollar did not begin to rise, and everything remained in its place. It's hard for me to say what needs to happen for the U.S. dollar to recover even a small part of the positions lost in recent weeks. As we can see, even strong reports from the U.S. do not lead to any bear activity. The market remains focused on the upcoming Fed meeting in September, where the rate is expected to be cut by 25 basis points. Traders see nothing else beyond this. This increasingly resembles an obsession or unwarranted fixation. However, this is the current state of affairs in the forex market.

On the 4-hour chart, the pair secured itself above the 100.0% Fibonacci level at 1.1139. A "bearish" divergence formed on the CCI indicator, and the RSI entered overbought territory. Thus, there are still many factors pointing to a potential decline in the pair this week. However, can the dollar expect a strong rally? In my opinion, no. If a downtrend does begin, it will take considerable time to confirm it. For now, I expect only a small correction downward.

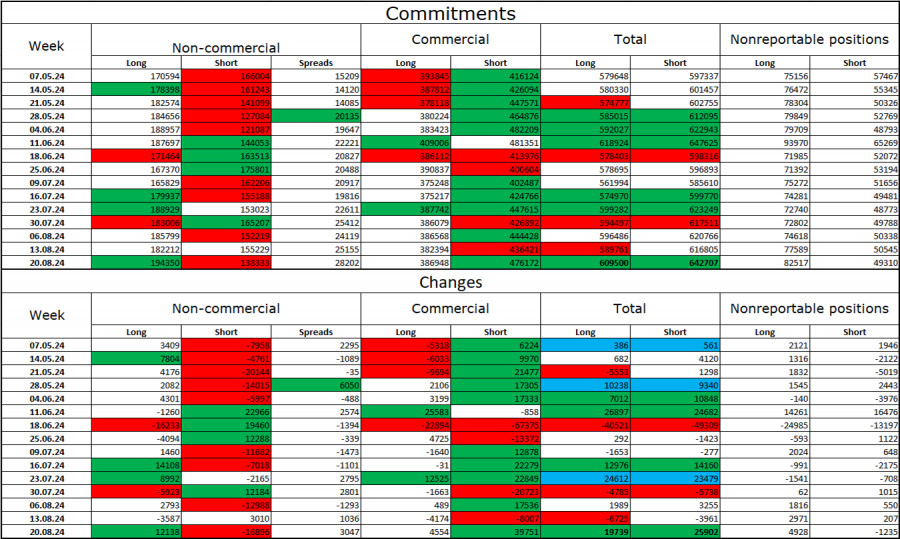

Commitments of Traders (COT) Report:

During the last reporting week, speculators opened 12,138 long positions and closed 16,896 short positions. The sentiment of the "Non-commercial" group became "bearish" several months ago, but bulls have once again taken the lead. The total number of long positions held by speculators now stands at 194,000, while short positions total 138,000.

I still believe the situation will continue to shift in favor of the bears. I don't see any long-term reasons to buy the euro, as the ECB has started to ease monetary policy. In the U.S., rates are expected to remain high at least until September 18. I also want to note that the market has already priced in a September rate cut with 100% certainty. The potential for a decline in the euro appears substantial. However, one should not forget about technical analysis, which currently does not suggest a strong fall for the euro.

News Calendar for the U.S. and Eurozone:

Eurozone – Germany's GfK Consumer Climate Index (06:00 UTC).Eurozone – Germany's Q2 GDP (06:00 UTC).

The economic calendar for August 27 includes two entries, both of which have already been released and had no impact on the euro. The impact of the news background on trader sentiment for the rest of the day will be absent.

Forecast for EUR/USD and trading advice:

Selling the pair can be considered if it closes below 1.1165 on the hourly chart. The targets would be at 1.1070–1.1081. Buying was possible upon closing above 1.1165 on the hourly chart, with a target of 1.1240, but I would be cautious with long positions at this time. The bulls have been attacking for too long.

Fibonacci levels are plotted at 1.0917–1.0668 on the hourly chart and 1.1139–1.0603 on the 4-hour chart.