In my morning forecast, I highlighted the level of 1.1052 and planned to base my trading decisions on it. Let's look at the 5-minute chart to see what happened. The rise to 1.1052 occurred, but it fell short by a couple of points for a test and false breakout at this level, so I ended up without entry points into the market. The technical picture for the second half of the day has not changed.

To open long positions on EUR/USD:

The data from Germany have predictably kept the market balanced, and this is likely to continue given the economic calendar for the second half of the day. The only key report ahead is the NFIB Small Business Optimism Index, which is not expected to move the market significantly. However, the speech by FOMC member Michael S. Barr will attract more attention. For this reason, I plan to open long positions only after a decline and a false breakout around 1.1029, the low of this week, aiming for a correction and recovery to 1.1052—the resistance formed at the end of yesterday, where the moving averages are located. A breakout and update of this range, from top to bottom, will lead to the pair's growth, with a chance to test 1.1091. The highest target will be 1.1119, where I will take profit. In the event of a decline in EUR/USD and a lack of activity around 1.1029 in the second half of the day, sellers will regain full control of the market, leading to a larger sell-off. In that case, I will only open positions after a false breakout forms around the next support at 1.1008. I plan to open long positions immediately on a rebound from 1.0984, targeting an upward correction of 30-35 points within the day.

To open short positions on EUR/USD:

Sellers showed themselves in the first half of the day, but a large-scale sell-off did not occur. If the euro rises after the U.S. data, only the formation of a false breakout around 1.1052 will be a suitable condition for opening short positions, targeting the new support at 1.1029—the weekly low. A breakout and consolidation below this range, as well as a retest from bottom to top, will provide another selling point with movement toward 1.1008. The lowest target will be 1.0984, which will completely negate buyers' short-term plans for a euro rise. I will take profit there. If EUR/USD rises and there are no sellers at 1.1052, buyers will have a chance for a correction with an update of the resistance at 1.1091. I will sell there as well, but only after a failed consolidation. I plan to open short positions immediately on a rebound from 1.1119, targeting a downward correction of 30-35 points.

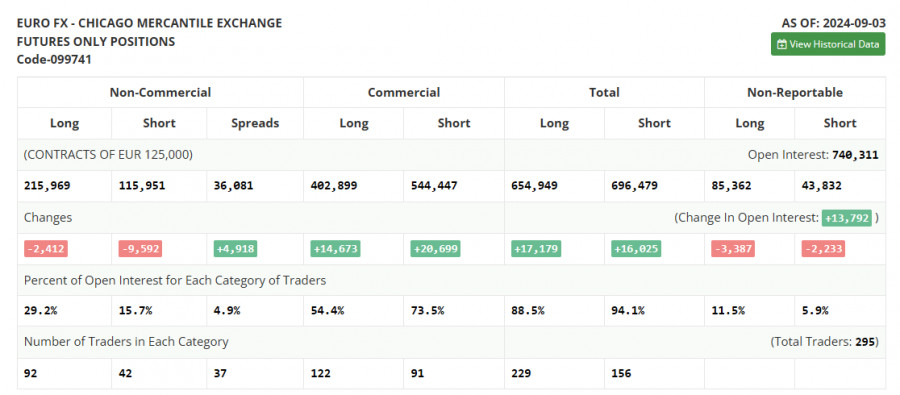

The COT report for September 3 showed a reduction in both long and short positions. Despite the significant decrease in euro sellers, this did not affect the pair's downward technical outlook. The euro will likely continue to weaken against the dollar this week, as the European Central Bank meeting is ahead, where further interest rate cuts and monetary policy adjustments will be announced. However, this does not cancel the medium-term upward trend for the euro, and the lower the pair moves, the more attractive it becomes for buyers. The COT report indicated that long non-commercial positions decreased by 2,412 to 215,969, while short non-commercial positions dropped by 9,592 to 115,951. As a result, the gap between long and short positions increased by 4,918.

Indicator Signals:

Moving Averages:

Trading is occurring below the 30 and 50-day moving averages, signaling a further decline in the euro.

Bollinger Bands:

If the pair declines, the lower boundary of the indicator around 1.1029 will serve as support.

Indicator Descriptions:

- Moving Average: Determines the current trend by smoothing volatility and noise. Period 50. Marked in yellow on the chart.

- Moving Average: Determines the current trend by smoothing volatility and noise. Period 30. Marked in green on the chart.

- MACD (Moving Average Convergence/Divergence): Fast EMA period 12. Slow EMA period 26. SMA period 9.

- Bollinger Bands: Period 20.

- Non-commercial traders: Speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes.

- Long non-commercial positions: Total long open positions held by non-commercial traders.

- Short non-commercial positions: Total short open positions held by non-commercial traders.

- Total non-commercial net position: The difference between long and short positions of non-commercial traders.