The U.S. inflation did not disappoint, but it did not surprise traders with a breakout growth either. Almost all components of the macroeconomic report came out in accordance with the forecast, so they did not cause much excitement in the market. And yet Friday's release plays a crucial role in determining the future prospects of the greenback.

Inflation in the U.S. is still at a high level, and this fact suggests that the Fed will not limit itself to an early tapering of QE. The probability of an interest rate increase within the next year is growing "by leaps and bounds," especially since many representatives of the Fed openly advocate the implementation of this scenario. Some of them also allow the option of a double increase, and with a fairly short interval in order to curb the spike in inflation.

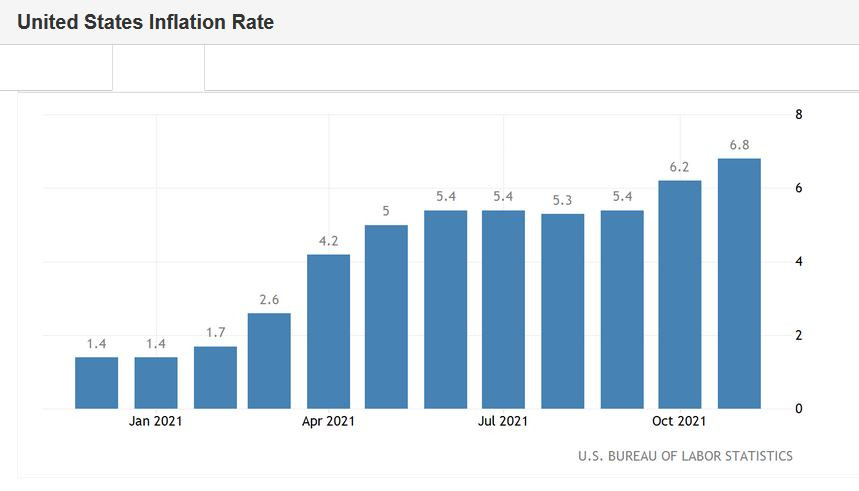

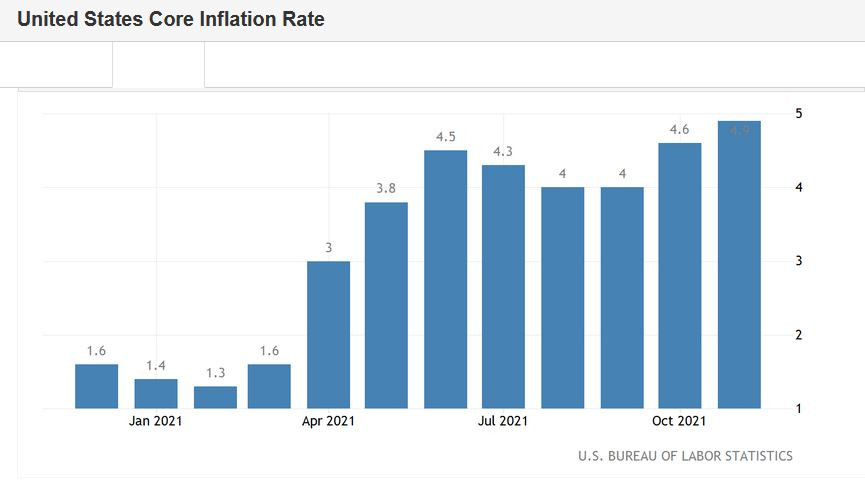

The consumer price index is indeed at the level of multi-year highs. Thus, according to published data, the overall CPI in November accelerated to 6.8% YoY. This is the maximum value of the indicator for the last 39 years. The last time this indicator was at this level was in 1982. On a monthly basis, the index also showed positive dynamics, rising to 0.8% (with a slight decline forecast to 0.7%). The core consumer price index, excluding volatile food and energy prices, similarly remained at a high level: an increase of up to 0.5% MoM, and 4.9% YoY was recorded. This is again a long-term record: the last time the index produced such results was in July 1991.

The structure of the released data suggests that energy prices have increased by 33% since November 2020, and by 3.5% over the past month. Over the year, gasoline has risen in price by 58%, groceries by 6%, and used cars and trucks by 31%. According to experts, these components have become the main reasons for high inflation (and not only last month, but also in previous ones). However, November still distinguished itself: the growth rate of food and energy prices (on an annualized basis) became the fastest in the last 13 years.

Also, recall that the most preferred inflation indicator by the Federal Reserve - the index of personal consumption expenditures (PCE) – also significantly exceeds the target level of the regulator. It is believed that this indicator is monitored by members of the U.S. regulator "with particular bias." The core PCE index, which does not take into account volatile food and energy prices, rose in October to 4.1% (in annual terms). At the same time, the result of September was revised upwards (from 3.6% to 3.7%). In August, July, and June, the indicator came out at 3.6%.

Against the background of such inflationary trends, there is no doubt that the Federal Reserve, at its last meeting this year (the results of which will be announced on December 16), will decide to accelerate the pace of curtailing the stimulus program – from $15 to $30 billion per month. Thus, QE will end its operation in March next year. Obviously, the next step of the Federal Reserve will be to tighten the parameters of monetary policy.

Fed Chairman Jerome Powell is in no hurry to talk about the fate of the interest rate at the moment. The relevant conclusions were made by the market, so to speak, "independently." Representatives of the "hawk wing" of the Fed, of course, add fuel to the fire, but still, there is a certain intrigue. Partly for this reason, dollar bulls are in no hurry to "uncork the champagne," creating a premature hype around the U.S. currency. The phlegmatic reaction to Friday's release is another confirmation of that.

In addition, the so-called "Friday factor" also played a role: traders take profits by closing short positions. There are also few people willing to go into sales on the eve of the weekend. Therefore, the EUR/USD pair reflexively reacted with a decline to the level of 1.1264, but then returned to the "neutral" territory again, having flown 12 and 13 figures on the border.

And yet, in my opinion, Friday's release has become another argument for further strengthening of the U.S. currency. This is a kind of "time bomb" that will work a little later – but it will definitely work.

At the moment, traders are looking back at the ECB, some representatives of which are urging their colleagues to react to the record increase in inflation in the eurozone. A certain informational illusion is being created that the European Central Bank will follow in the footsteps of the Federal Reserve.

But I would venture to assume that the EUR/USD bulls will eventually be disappointed by the ECB's "hawkishness," which will only be expressed in the fact that the regulator will stipulate the limits of the increase in the asset purchase program (APP) after the completion of the pandemic emergency purchase program (PEPP). If, in turn, the Fed completes QE in March and announces a rate hike in June-July, then the divergence of the ECB and Fed positions will "sparkle with new colors," strengthening the position of the greenback.

Thus, in the long term, short positions on the EUR/USD pair will be in priority, due to the likely strengthening of the U.S. dollar. If we talk about the prospect for the coming days, emotions will come to the fore - emotional trading decisions on the eve of the Fed and ECB meetings. Most likely, the pair will continue to trade in the range of 1.1260-1.1360 (until December 16), starting from the boundaries of the echelon.