On Monday, the GBP/USD currency pair corrected to the moving average line and resumed the upward movement. In the case of the British pound, the movements on Monday can be called logical, as after the rise on Friday, we saw a noticeable correction. Nevertheless, the pound continues to grow. Yesterday, it updated its annual highs, although there was no corresponding fundamental or macroeconomic background in the US or the UK. Remember that only speeches by several representatives of the Federal Reserve were scheduled for yesterday, which took place in the evening. Accordingly, they could not have any effect on movements during the day. Therefore, the pound is growing baselessly again.

Of course, one can assume (which we did) that the market started working out the report on American inflation on Wednesday, which will likely announce a slowdown to 3.1%. Still, frankly, this is just a hypothesis. It should be remembered that core inflation also matters for the regulator, and it remains above 5%. Thus, two Fed rate hikes are the minimum needed for core inflation. Therefore, no "dovish" information came from the US yesterday and will not come on Wednesday. So why is the pound growing again?

However, we have been asking this question for several months now. The pound is growing too quickly and strongly and rarely corrects. Of course, the market cannot be ordered, but the current fundamental background weakly relates to what is happening.

Andrew Bailey again did not make loud statements

The Bank of England was and remains a "dark horse" for traders. It unexpectedly raised the key rate at the last meeting by 0.5% in response to a slowdown in the decline of the consumer price index. The British regulator cannot be accused of an insufficiently tough reaction to high inflation since the rate has already risen to 5%. And, most likely, it will continue to grow as the British economy still balances on the brink of "negative growth." If there is no recession, the rate can continue to be raised. We did not count on the option with such a serious tightening of monetary policy, but in any case, it should be understood that the Fed has also been raising the rate all this time. If the BoE does increase it at a slightly higher pace in 2023, then the pound will grow against the dollar almost non-stop if we look at the long-term perspective.

Yesterday evening, Andrew Bailey made a speech that could have clarified how much longer tightening will continue. However, once again, Mr. Bailey spoke about everything except monetary policy. He noted that all cryptocurrencies and stablecoins should be regulated like traditional fiat currency. He also mentioned that inflation remains excessively high, hinting at a potential rate increase. However, all this is just "water" and beating around the bush. As the Bank of England provides no clear information, the market must speculate about the peak rate in the UK. Its current speculation is one-sided – tightening will continue.

If the market staunchly believes that the rate in Britain will continue to rise for a long time and then remain at peak values for a while, nothing can be done. The pound will continue to rise, ignoring the state of the economy. The most interesting thing is that even monetary flows cannot now be counted in favor of the pound. If the rate in Britain was already higher than in the US, investors are directing their funds to British banks to gain maximum profit from deposits. But the rate is higher in the States, and inflation is lower, so investing in the American economy and banks is more profitable. The fact that several banks in the US have collapsed does not matter, as the Federal Reserve quickly resolved all issues with depositors. The inertial growth of the pound continues.

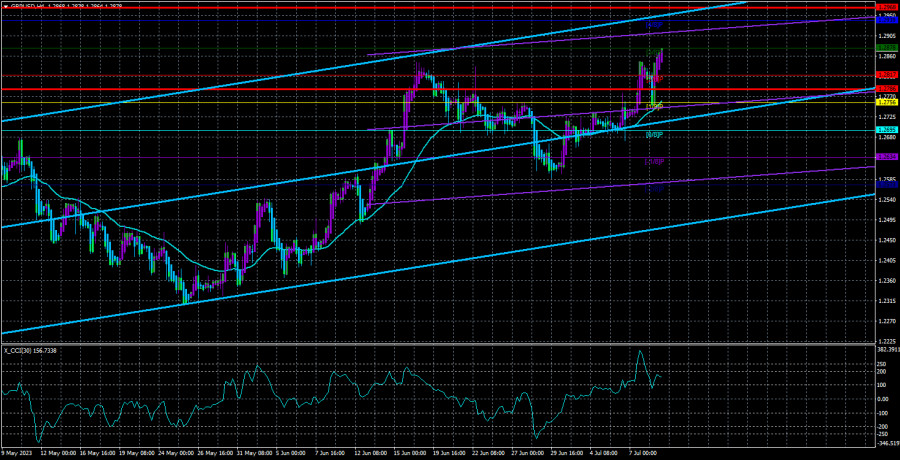

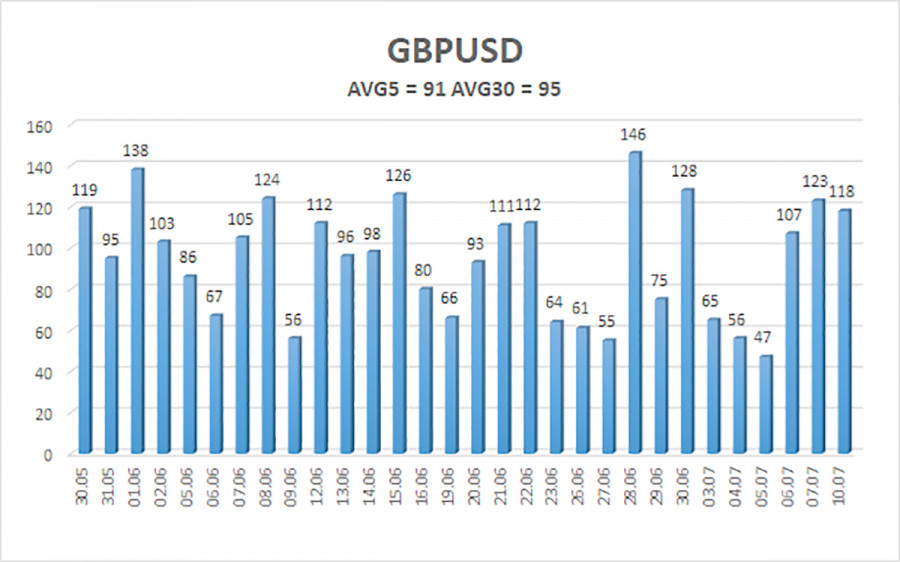

The average volatility of the GBP/USD pair over the last five trading days is 91 points. For the pound/dollar pair, this value is "average." On Tuesday, July 11, thus, we expect movement within the range limited by levels 1.2786 and 1.2968. A turn of the Heiken Ashi indicator down will signal a new round of downward correction.

The nearest support levels:

S1 – 1.2817

S2 – 1.2756

S3 – 1.2695

The nearest resistance levels:

R1 – 1.2878

R2 – 1.2939

R3 – 1.3000

Trading recommendations:

The GBP/USD pair in the 4-hour timeframe remains above the moving average. Long positions with targets 1.2939 and 1.2968 remain relevant, which should be held until the Heiken Ashi indicator turns down. Short positions can be considered if the price consolidates below the moving average with targets of 1.2695 and 1.2634.

Explanation of illustrations:

Linear regression channels help determine the current trend. If both are directed in one direction, the trend is strong now.

The moving average line (settings 20.0, smoothed) determines the short-term trend and direction to trade now.

Murrey levels - target levels for movements and corrections.

Volatility levels (red lines) - the probable price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or overbought area (above +250) means a trend reversal in the opposite direction is approaching.