The EUR/USD currency pair continued to trade on Wednesday with the same minimal volatility. Recall that a resonant report on inflation for February was released in the United States days earlier, which the market practically did not notice. It didn't notice it consciously enough, as the report implied a strong strengthening of the dollar. Despite the fact that inflation increased within forecasts and core inflation decreased within forecasts, we believe that this report should have led to a strong rise in the American currency.

Why? Because for about a year now, the market has only been discussing "When will the Fed start cutting rates?" The market awaits this event, wants it as soon as possible, and constantly fails to guess the right answer. Recall that in January (as well as at the end of 2023), the market expected the Fed to start easing monetary policy first. And only then would the ECB and the Bank of England begin to cut rates. The market simply refused to take into account the fact that American inflation has practically not decreased for over half a year, the US economy is far from recession, and the labor market remains strong. What reasons does the Fed then have to cut rates?

The market was wrong for a long time, then admitted its mistake, and now expects the first easing no earlier than June. But the latest inflation report again showed that the indicator is not slowing down. Therefore, we believe that, in reality, the reduction of rates in the US may begin even in the autumn. After all, Jerome Powell and his colleagues have repeatedly stated that easing will begin only when there is confidence in reaching the inflation target. And what confidence can there be now? Therefore, the market can believe in anything and expect anything. The facts speak otherwise. But at the same time, it is the market that determines the quotes of currency pairs and instruments. If major players refuse to buy the dollar, then the US currency will not rise under any circumstances. And major players (market makers) are currently refusing to buy the dollar.

The situation with the ECB is the opposite. Inflation has slowed down to 2.5%, which is close enough to the target level to start talking about easing monetary policy. Representatives of the ECB's monetary committee have already mentioned June several times as the possible start date of the easing cycle, so they are unlikely to rush to lower rates. But hardly anyone will argue with the fact that the European regulator is much closer to easing than the American one. Recall that just two months ago, the market thought the opposite. And as a result of this "divergence of opinions and rates," the US dollar was supposed to show growth. For some time, it actually appreciated, but in the last month, regardless of any fundamental or macroeconomic background, it only depreciated. There is still hope that the monthly growth of the pair is a correction that will soon end, but the market continues to miss excellent opportunities to sell the EUR/USD pair. This means that it is not inclined to take short positions at the moment.

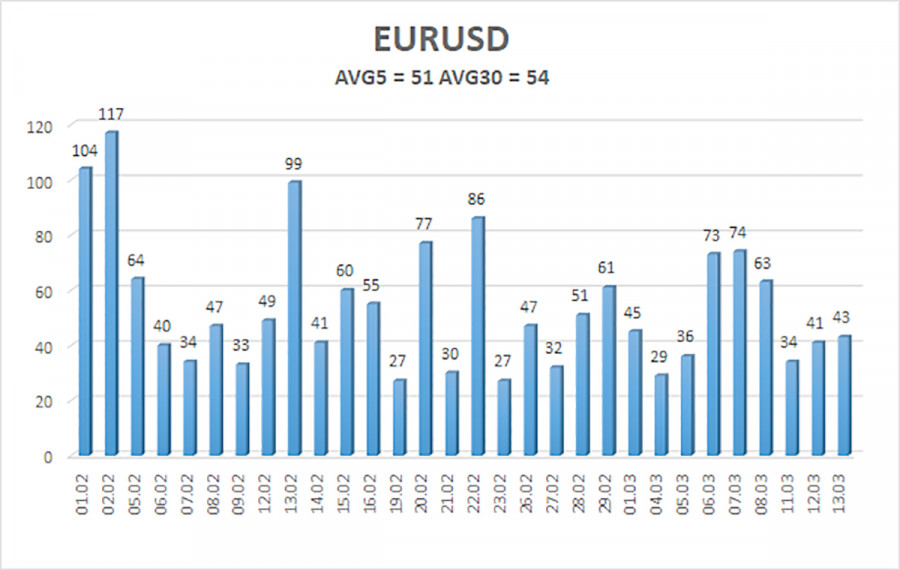

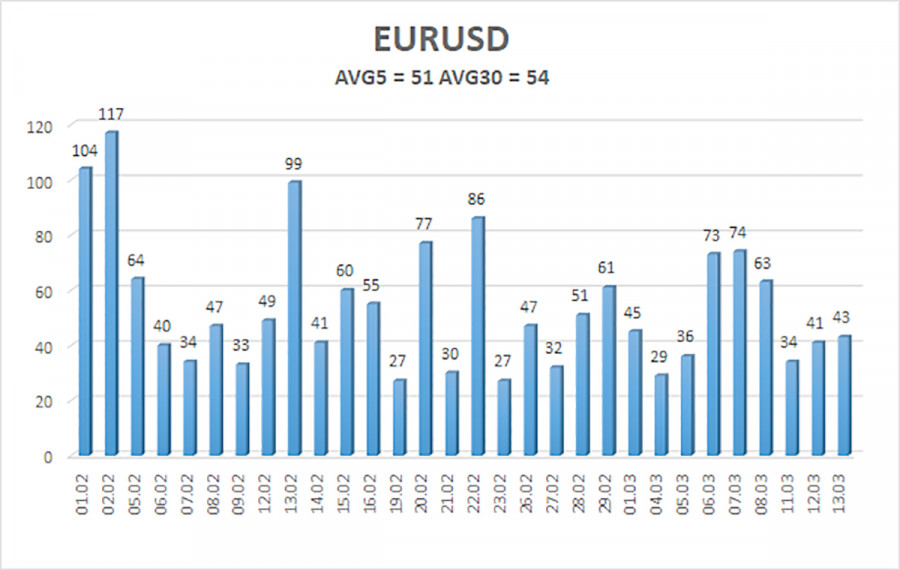

The average volatility of the euro/dollar currency pair for the last 5 trading days as of March 14th is 51 points and is characterized as "low." Thus, we expect the pair to move between the levels of 1.0911 and 1.1013 on Thursday. The senior channel of linear regression is still directed downward, so the global downward trend is still intact. The overbought condition of the CCI indicator indicates the need for a downward correction. But we need a downward trend, not a correction. In any case, the euro cannot consolidate even below the moving average for now.

Nearest support levels:

S1 - 1.0925

S2 - 1.0895

S3 - 1.0864

Nearest resistance levels:

R1 - 1.0956

R2 - 1.0986

R3 - 1.1017

Trading recommendations:

The EUR/USD pair continues to be positioned above the moving average line. Long positions can formally be considered until the price consolidates below the moving average, with targets at 1.0986 and 1.1017. However, we remind you that the current movement to the north is not only corrective but also completely illogical. Last week, the euro had almost no grounds for growth, and this week neither. Thus, we continue to expect a decline, but there are no sell signals. As long as there are none, it is natural to consider buying, not selling. Overcoming the moving average absolutely does not guarantee further movement to the south.

Explanations for illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, it means the trend is strong at the moment.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted at the moment.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the probable price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) indicates that a trend reversal in the opposite direction is approaching.