On Friday, the EUR/USD pair continued to rise. This is no longer surprising to anyone. We anticipated that the dollar might strengthen a bit on Friday simply because the market had been anticipating Federal Reserve Chair Jerome Powell's speech all week. However, we underestimated the market's constant desire always to sell the US dollar. Even on Friday, when Powell's speech took place, the market was still getting rid of the American currency. Was there a reason for this?

It is worth mentioning that we see no real reason for the dollar's decline, even in the context of the Fed's upcoming monetary policy easing. Let's look at the daily or weekly time frame and synchronize it with the inflation indicator. US inflation peaked at 9.1% in June 2022. It began to slow down in July 2022. What do we see on the charts? On September 28, 2022, the dollar rose against the euro to 0.9536 and has fallen since then. Thus, it can be said that the market has been pricing in the anticipated easing of Fed monetary policy for almost two years. Indeed, as soon as inflation started to slow, expectations of easing in the US began.

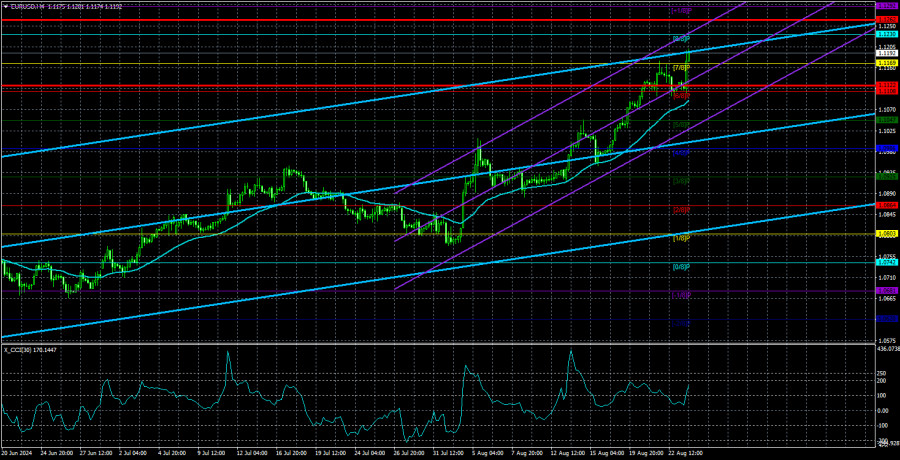

Therefore, it turns out that the American currency has already depreciated by 1600-1700 points simply in anticipation of a Fed rate cut. The Fed hasn't even started cutting rates yet, and the dollar has already fallen by 16 cents against the euro. This is why we believe the US dollar is unjustifiably cheap, the euro is unjustifiably expensive, and the EUR/USD pair is extremely overbought. By the way, this overbought condition is evident in the 4-hour time frame. The CCI indicator entered the "above 250" zone thrice last month.

Moreover, it hasn't just entered weakly or tentatively; each time, it has broken through by 50-100-200 points. In other words, the overbought condition is not just triple but extremely strong. Nonetheless, the dollar continues to fall, and the market continues to price in an easing of the FOMC that has yet to happen.

However, when it does start, the dollar might begin to recover and restore balance. Once the Fed starts lowering rates, the market will have nothing left to price in, as it has already been pricing in the rate cuts in advance for two years. Therefore, we still cannot believe that the European currency will continue to rise.

It should be remembered that the market is controlled by market makers who can trade as they see fit rather than based on fundamentals or macroeconomics, unlike most individual traders. Therefore, price movements can be utterly unpredictable because no one can forecast the actions of large players. However, if we talk about logical movements, the euro should not have risen even to the 10th level. The 10th level was at least the upper boundary of a range channel, but it is extremely difficult to say what has triggered a new upward trend (if one has started). Also, it's worth noting that the European Central Bank is also lowering rates and is doing so now, unlike the Fed. Yet, we haven't seen a decline in the euro over the past two years. Therefore, this factor has not been priced in.

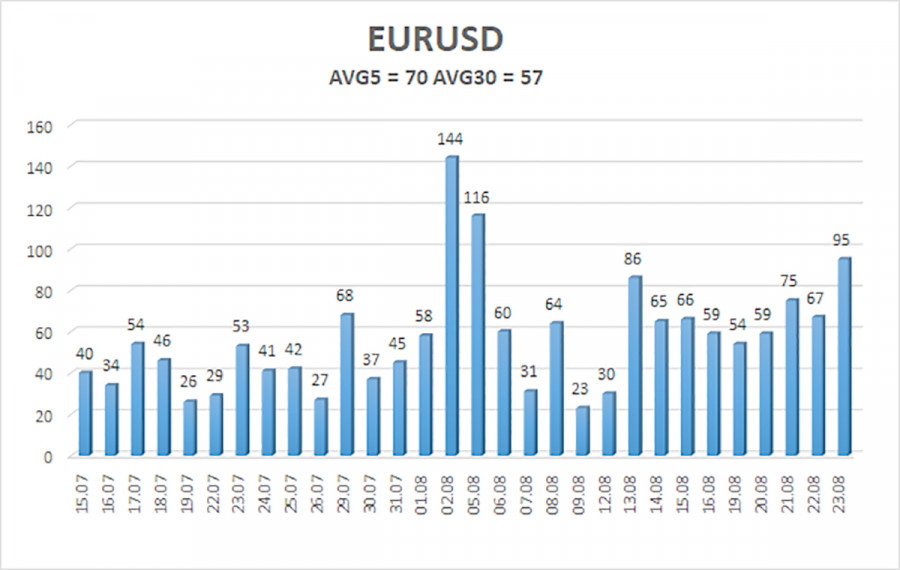

The average volatility of EUR/USD over the past five trading days as of August 26 is 63 pips, which is considered average. We expect the pair to move between the levels of 1.1122 and 1.1262 on Monday. The upper channel of the linear regression is directed upwards, but the global downtrend persists. The CCI indicator entered the overbought area three times, warning not only of a possible trend reversal to the downside but also of how the current rise is illogical.

Nearest Support Levels:

- S1 – 1.1169

- S2 – 1.1108

- S3 – 1.1047

Nearest Resistance Levels:

- R1 – 1.1230

- R2 – 1.1292

- R3 – 1.1353

Trading Recommendations:

The EUR/USD pair continues its strong and uninterrupted upward movement, thanks to the market's unrestrained desire to continuously buy euros and sell dollars. In previous reviews, we mentioned that we only expect declines from the euro in the medium term, but the current rise now seems almost like a mockery. However, it would be foolish to deny that the price is in an upward movement, and there are no signs of its end yet. The market continues to use every opportunity for purchases, but the technical picture warns of a high probability of the local upward trend ending. Short positions may be considered after the pair settles below the moving average, with targets at 1.1047 and 1.0986.

Explanations for Illustrations:

Linear Regression Channels: help determine the current trend. If both are directed in the same direction, it means the trend is strong.

Moving Average Line (settings 20,0, smoothed): determines the short-term trend and the direction in which trading should be conducted.

Murray Levels: target levels for movements and corrections.

Volatility Levels (red lines): the probable price channel in which the pair will spend the next 24 hours, based on current volatility indicators.

CCI Indicator: Entering the oversold area (below 250) or the overbought area (above +250) means a trend reversal is approaching.