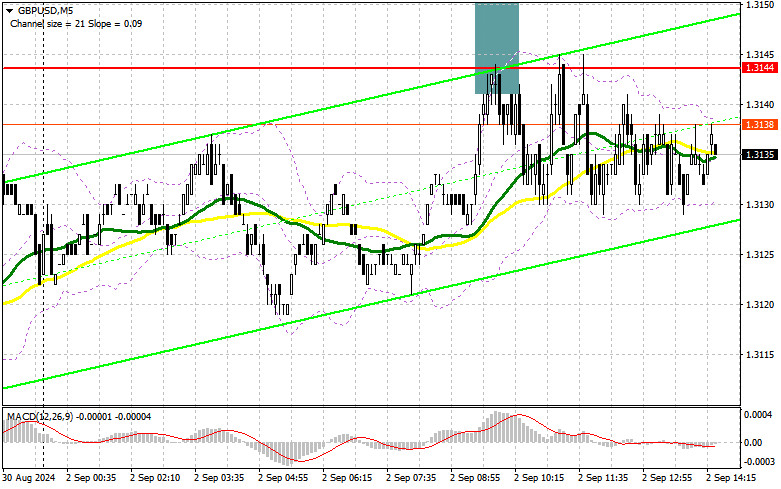

In my morning forecast, I focused on the 1.3144 level and planned to make trading decisions based on it. Let's take a look at the 5-minute chart and analyze what happened. The rise and formation of a false breakout around 1.3144 led to a sell entry point for the pound and a move down of approximately 15 points, after which sellers retreated. The technical outlook for the second half of the day remains unchanged.

For Opening Long Positions on GBP/USD:

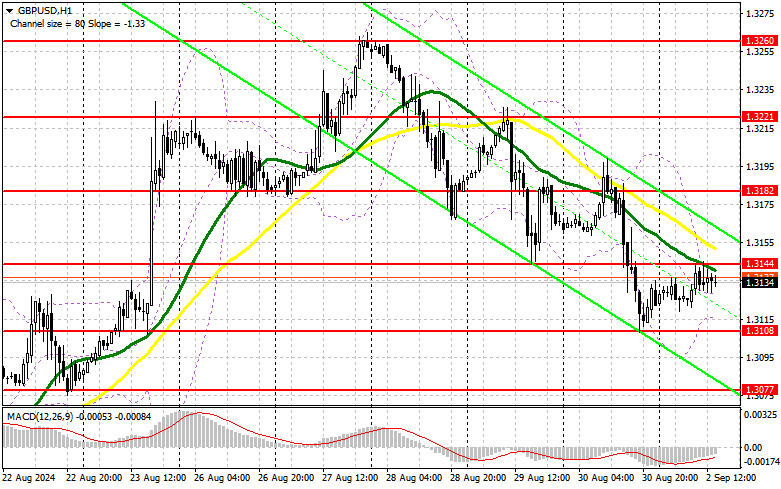

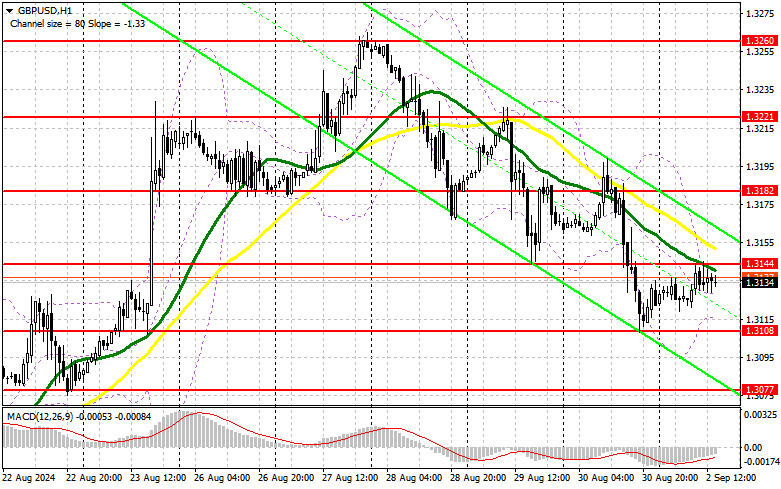

Given that the UK manufacturing data fully matched economists' forecasts, it did not support the British pound, which has recently been struggling with growth. Since there are no statistics in the afternoon, trading will likely remain within the same channel observed during the European session. Fairly, it can be noted that sellers should attempt to break below 1.3108, but this is also unlikely. If the pound declines, only a false breakout around 1.3108 will provide an entry point for long positions, with the expectation of a return to 1.3144, where moving averages are currently positioned on the sellers' side and where breaking through in the first half of the day was not achieved. A breakout and a reverse test from above this range will strengthen the chances of developing an upward trend, leading to the triggering of sellers' stop orders and a suitable entry point for long positions with a potential rise to the 1.3182 level. The furthest target will be the level around 1.3221, where I plan to take profit. In the scenario of a GBP/USD decline and no activity from buyers at 1.3108 in the afternoon, pressure on the pair will increase. This will also lead to a decline and a test of the next support level at 1.3077. Only a false breakout will be a suitable condition for opening long positions. I plan to buy GBP/USD immediately on a rebound from the 1.3037 low, aiming for an intraday correction of 30-35 points.

For Opening Short Positions on GBP/USD:

Sellers remain active but not as aggressively as they were at the end of last week. Nonetheless, strong PMI data for the manufacturing sector reminded us of the current good state of the UK economy, which dampened the desire to sell the pound further. The main task for bears now is to defend the resistance at 1.3144, where a false breakout similar to what I discussed earlier will be an acceptable option for opening new short positions against the trend, targeting a correction and a test of the support at 1.3108. A breakout and a reverse test from below this range will impact buyers' positions, leading to the triggering of stop orders and opening the way to 1.3077, where I expect more active actions from major players. The furthest target will be the level around 1.3005, where I will take profit. Testing this level could lead to the establishment of a new bearish trend for the pair. In the event of a GBP/USD rise and lack of activity at 1.3144 in the afternoon, buyers will regain initiative. Therefore, bears will have no choice but to retreat to the resistance area at 1.3182. I will only sell there on a false breakout. In the absence of downward movement and if that happens, I will look for short positions on a rebound around 1.3221, but only aiming for an intraday correction of 30-35 points.

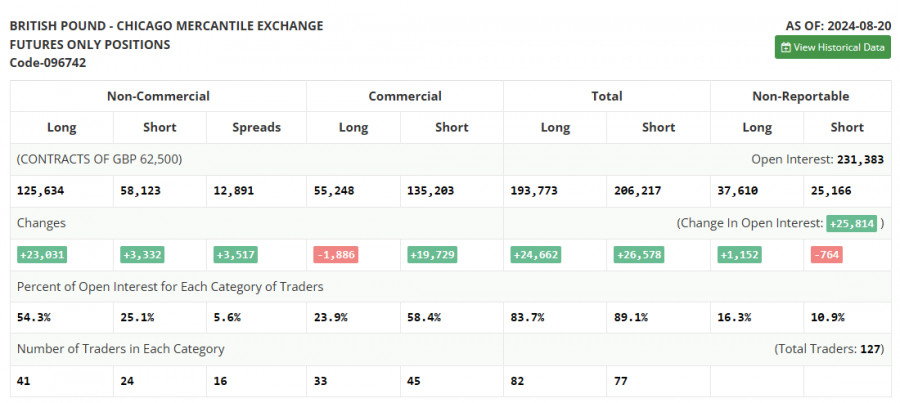

In the COT Report (Commitment of Traders) for August 20, there was a sharp increase in long positions and a slight reduction in short positions. Clearly, more and more people are betting on the pound's rise, which demonstrated one of the strongest rallies in recent times last week. The market is not deterred by the Bank of England's plans to continue lowering interest rates, as everyone is confident in the more aggressive easing policy of the Federal Reserve. So, it's unlikely that the strength of the pound is in question; rather, it's about a weak U.S. dollar, which will face problems in the near term, especially in light of statistics indicating further U.S. inflation declines expected this week. The latest COT report shows that long non-commercial positions jumped by 23,031 to 125,634, while short non-commercial positions increased by 3,332 to 58,123. As a result, the gap between long and short positions grew by 3,517.

Indicator Signals:

Moving Averages:

Trading is occurring around the 30-day and 50-day moving averages, indicating market uncertainty.

Note: The periods and prices of the moving averages are considered on the H1 hourly chart and differ from the general definition of classical daily moving averages on the D1 daily chart.

Bollinger Bands:

In case of a decline, the lower boundary of the indicator around 1.3110 will act as support.

Indicator Descriptions:

- Moving Average (MA): Defines the current trend by smoothing out volatility and noise. Period – 50, marked in yellow on the chart.

- Moving Average (MA): Defines the current trend by smoothing out volatility and noise. Period – 30, marked in green on the chart.

- MACD (Moving Average Convergence/Divergence): Fast EMA – period 12. Slow EMA – period 26. SMA – period 9.

- Bollinger Bands: Period – 20.

- Non-commercial Traders: Speculators such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes and meeting specific requirements.

- Long Non-commercial Positions: Represents the total long open positions held by non-commercial traders.

- Short Non-commercial Positions: Represents the total short open positions held by non-commercial traders.

- Total Non-commercial Net Position: The difference between short and long positions held by non-commercial traders.