GBP/USD 5-Minute Analysis

On Wednesday, the GBP/USD currency pair overcame the 1.2691–1.2701 area on its fourth attempt. We have repeatedly noted the pound sterling's impressive resilience against the dollar throughout the year. Even now, while the euro remains stagnant, the pound continues to rise—albeit slowly and modestly. Meanwhile, the euro trades in a "flat within a flat." Yesterday, the price attempted to resume its downward trend but failed for the fourth time to break below the Kijun-sen line. The only event that truly impacted the market was the ISM Services PMI, which, while not disastrous, came in weaker than forecast.

Andrew Bailey's speech, however, offered no significant insights. The Bank of England governor stated that the interest rate could be reduced four times by 0.25% each following year, but this was already known to the market. The fact remains that the BoE is still hesitant to ease monetary policy, fearing a resurgence of inflation. This reluctance remains the only factor genuinely supporting the pound. Later in the evening, Federal Reserve Chair Jerome Powell also delivered a speech, but it is unclear what impact his remarks had. Perhaps he contributed to the dollar's decline.

Yesterday, three trading signals were formed in the 5-minute timeframe. Initially, the price rebounded three times from the 1.2691–1.2701 area, followed by testing the Kijun-sen line. A bounce from the critical line triggered a rise to the 1.2691–1.2701 area, leading to a breakout above it. Consequently, the upward movement may continue today. Yesterday, traders could have opened two trades, which turned out profitable.

COT Report

The COT reports for the British pound show that sentiment among commercial traders has frequently shifted in recent years. The red and blue lines, representing the net positions of commercial and non-commercial traders, often cross and mostly remain close to the zero mark. The recent downward trend occurred when the red line was below zero. The red line is above zero, while the price has breached the key 1.3154 level.

According to the latest report on the British pound, the Non-commercial group closed 18,300 BUY contracts and 2,500 SELL contracts. Thus, the net position of Non-commercial traders decreased by another 15,800 contracts during the week.

The fundamental backdrop still does not justify long-term purchases of the British pound, and the currency has a real chance of resuming a global downtrend. On the weekly timeframe, there is an ascending trendline. Until this line is broken, a long-term decline in the pound is unlikely. While the pound has tested this trendline, it hasn't yet consolidated below it. A rebound and correction could occur in the long term, but we believe the line will eventually be breached, and the downtrend will continue.

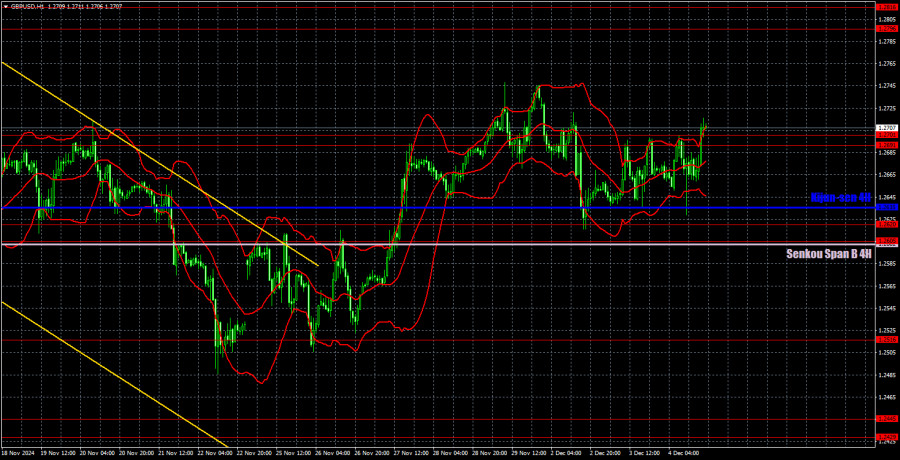

GBP/USD 1-Hour Analysis

On the hourly chart, GBP/USD maintains a general bearish sentiment but continues to correct upward. Aside from the technical necessity of occasional corrections, we still see no fundamental reason for the pound sterling's growth. However, the pound's remarkable resilience continues to work in its favor, allowing it to rise even as the euro remains stagnant.

We highlight the following key levels for December 5: 1.2429–1.2445, 1.2516, 1.2605–1.2620, 1.2796–1.2816, 1.2863, 1.2981–1.2987, 1.3050. The Senkou Span B line (1.2602) and Kijun-sen line (1.2635) can also serve as sources of trading signals. A Stop Loss should be set at breakeven if the price moves 20 pips in the correct direction. Note that the Ichimoku indicator lines may shift during the day, so this should be considered when identifying trading signals.

No significant events or reports are scheduled in the UK or the U.S. on Thursday. Only minor reports, such as unemployment claims, are expected. Nevertheless, we do not rule out the fact that the pound could continue its upward movement today. While there is no logical basis for such behavior, the pound has been charting its course throughout 2024.

Illustration Explanations:

- Support and Resistance Levels (thick red lines): Key areas where price movement might stall. Not sources of trading signals.

- Kijun-sen and Senkou Span B Lines: Ichimoku indicator lines transferred from the H4 timeframe to the hourly chart, serving as strong levels.

- Extreme Levels (thin red lines): Points where the price has previously rebounded. They can serve as trading signal sources.

- Yellow Lines: Trendlines, channels, or other technical patterns.

- Indicator 1 on COT Charts: Reflects the net position size of each trader category.