Analysis of Thursday's Trades

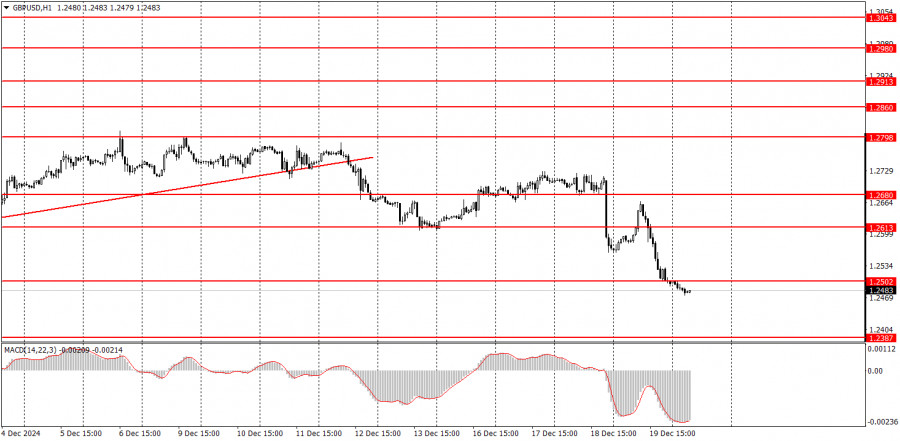

1H Chart of GBP/USD

The GBP/USD pair continued its near-collapse on Friday. Recall that the Federal Reserve meeting results were announced on Wednesday evening, followed by the Bank of England meeting results on Thursday afternoon. In both cases, the outcomes were unequivocally unfavorable for the British currency. It can be said that the pound was rather fortunate, as it managed to show some growth in the first half of the day, which was not based on any apparent justification. However, as we have repeatedly mentioned before, while the pound sterling continues to demonstrate remarkable resilience, it cannot indefinitely withstand an overwhelmingly negative fundamental backdrop. The pound remains overbought and unjustifiably expensive. Over the past two years, the market has focused solely on the factor of the Fed's monetary easing. Although the BoE is in no rush to lower rates, which somewhat supports the British currency, we believe that the decline will continue under virtually any circumstances. It is important not to assume that a downward trend means daily declines in the pound.

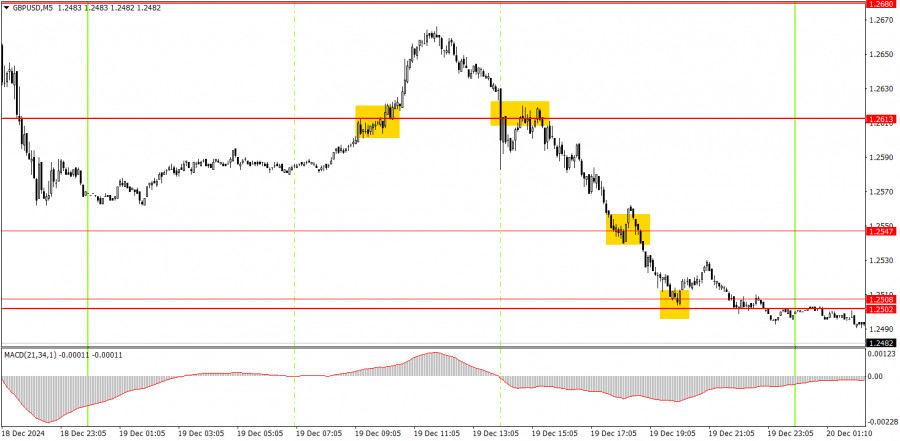

5M Chart of GBP/USD

In the 5-minute timeframe on Thursday, numerous trading signals were generated. The upward movement during the European trading session was particularly confusing and inexplicable. However, the only buy signal near the 1.2613 level could not have resulted in a loss by definition. Afterward, only sell signals were formed, which were also profitable. As a result, the day concluded with a substantial profit.

Trading Strategy for Friday:

The GBP/USD pair has completed its upward correction on the hourly timeframe. We fully support the pound's decline in the medium term, as we believe this is the only logical scenario. However, it should be remembered that the pound sterling demonstrates high resilience against the US dollar. Thus, while further declines are expected, traders should rely on technical signals. The outcomes of the BoE and Fed meetings strongly support continued downward movement.

On Friday, the GBP/USD pair may continue its decline. While a new corrective wave is possible, a drop toward the 1.2387 target appears much more likely.

On the 5-minute timeframe, trading can be based on the following levels: 1.2387, 1.2445, 1.2502-1.2508, 1.2547, 1.2633, 1.2680-1.2685, 1.2723, 1.2791-1.2798, 1.2848-1.2860, 1.2913, 1.2980-1.2993. A retail sales report in the UK will be published on Friday, which is unlikely to cause more than a mild market reaction. In the US, four secondary reports are scheduled, with the PCE Index and Consumer Sentiment Index being the most notable.

Core Trading System Rules:

- Signal Strength: The shorter the time it takes for a signal to form (a rebound or breakout), the stronger the signal.

- False Signals: If two or more trades near a level result in false signals, subsequent signals from that level should be ignored.

- Flat Markets: In flat conditions, pairs may generate many false signals or none at all. It's better to stop trading at the first signs of a flat market.

- Trading Hours: Open trades between the start of the European session and the middle of the US session, then manually close all trades.

- MACD Signals: On the hourly timeframe, trade MACD signals only during periods of good volatility and a clear trend confirmed by trendlines or trend channels.

- Close Levels: If two levels are too close (5–20 pips apart), treat them as a support or resistance zone.

- Stop Loss: Set a Stop Loss to breakeven after the price moves 20 pips in the desired direction.

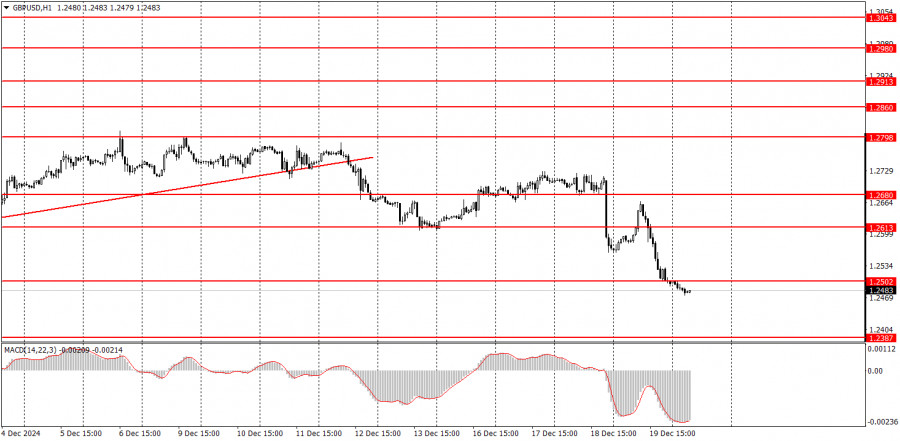

Key Chart Elements:

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.