China's reports are beneficial to markets as Asian indices rising

In October, industry as well as retail sales in China grew at a more rapid rate than economists had predicted. New restrictions aimed at reducing COVID-19 outbreaks and supply shortages are likely not to have affected the manufacturing sector too much. However, the slowdown in the real estate sector had a disastrous impact on the economic outlook.

According to official data released today, in October China's manufacturing output rose by 3.5% compared to the same period last year. The increase was 3.1%, contrasting with September. Retail sales also accelerated.

These production results exceeded experts' forecasts by as much as 3.0% year-on-year. However, it is a low indicator, which nearly hit this year's high.

The PRC economy demonstrated an impressive rebound after the COVID-19 pandemic recession last year. However, it has lost momentum since spring. The reason is the slowing manufacturing sector, debt problems in the real estate market and COVID-19 outbreaks.

Louis Kuijs, head of Asia economics at Oxford Economics said that the economic growth rate remained weak in October and the downturn in real estate affected the manufacturing sector.

Moreover, data from the National Bureau of Statistics also showed that retail sales accelerated even after China imposed new restrictions to reduce new COVID-19 cases in the north.

Consequently, retail sales added 4.9% year-over-year in October, surpassing expectations of a 3.5% increase and following a 4.4% rise in September.

People probably stockpile in case of extreme quarantine measures as the Chinese government has previously warned.

Chief economist Zhiwei Zhang noted that growth was likely to slow down in the rest of this year.

Zhang said that the outbreak of the COVID-19 pandemic has forced more cities to tighten travel restrictions. He highlighted that it would likely have a negative impact on the service sector in November. Zhiwei Zhang admitted that the downturn in the real estate sector was worsening. Moreover, he added that it was a key risk to the macroeconomic outlook for several quarters of the following year.

NBS data showed that real estate investment and sales growth continued to slow in October compared with the first nine months, and the number of new constructions, measured by square footage, declined.

Sentiment in China's real estate market was deteriorated by a profound debt crisis as real estate giant China Evergrande and Kaisa Group fighted looming defaults.

New home prices in China fell by 0.2% month-over-month in October, the biggest drop since February 2015. Economists at the CBA said there was a possibility that China's central bank would cut bank reserve requirements (RRR) that week to support activity.

Political background

China's growing manufacturing sector has slowed this year after a rapid recovery from the COVID-19-related slump due to power shortages and production cuts that have created a crisis environment for the industry in recent months.

Louis Kuijs, head of Asia economics at Oxford Economics said that they expected policymakers to take additional easing measures to prevent plunging growth. He added that weaker demand caused a broader industry slowdown.

He believed easing measures to stop a downturn should come into effect early next year.

However, the People's Bank of China is likely to act cautiously to loosen monetary policy to support the economy as slowing economic growth and rising costs of goods fuel fears of stagflation.

On Monday, Fu Linhui, manager at NBS, stated at a briefing in Beijing that signs of stagflation were caused by short-term factors, such as high global commodity prices.

Mostly, investors do not trust the officials' view: fixed-asset investment continued to slow, rising by 6.1% in the first 10 months. It is down 0.1% from the previous crisis year, and down 1.2% compared to January-September.

Zhiwei Zhang said that they believed macroeconomic policy was close to its turning point. He added that they expected the government to increase fiscal spending by the end of the year to stabilize the trend of weakening investment.

Amid all this rhetoric, it is noteworthy that such optimistic release data contrasted sharply with the country's official manufacturing survey for October. For example, China's official purchasing managers' index showed that manufacturing activity declined for the second successive month in October, caused by persistently high commodity prices and lower domestic demand.

Could the reports be adjusted? It is quite possible for administrative methods in China's economy.

Besides, after the data was released, global stock markets climbed again to their recent all-time highs on Monday. The promising economic data from China made investors focus on the numbers. Moreover, interest in regional stocks rose, although falling home prices on the mainland tempered the optimism.

MSCI's broadest index of Asia-Pacific stocks outside Japan rose nearly by 0.4%.

Seema Shah, an economic strategist, said that China's economy slowed more than had been expected, affecting investors' minds that year. He noted that the given data was better than expected and it was encouraging.

Japan's Nikkei added nearly 0.6% after the data showing economic activity declined more than expected in the third quarter raised expectations for aggressive fiscal stimulus.

Chinese are richest in world

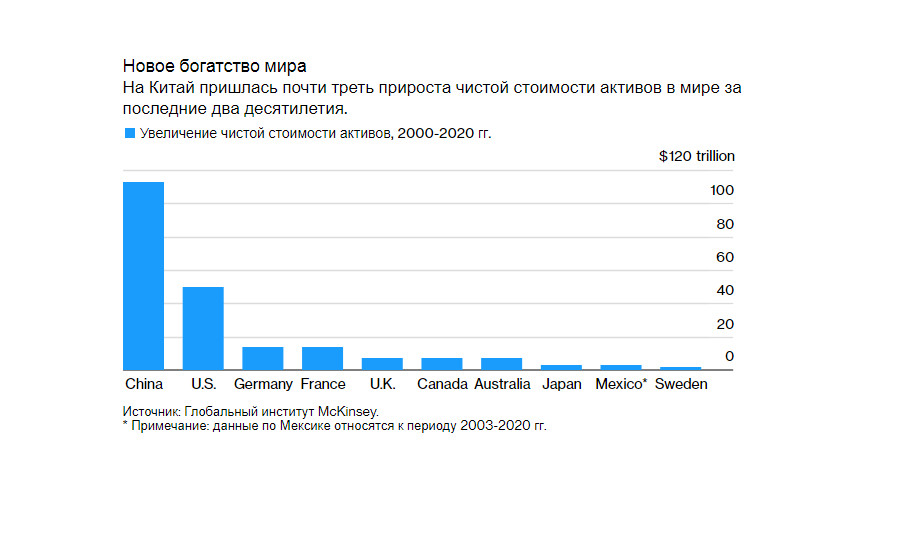

According to the report by the Research Unit of McKinsey & Co, net worth has tripled in the past two decades with China leading the field, surpassing the US and taking the top spot in the world.

It is one of the findings of a new McKinsey & Co. report, which examines the national balance sheets of ten countries that account for more than 60% of global income.

Dr. Jan Mischke, a partner at the McKinsey Global Institute in Zurich, said in an interview that China was then richer than ever.

According to the study, equity capital worldwide rose to $514 trillion in 2020 from $156 trillion in 2000. China accounted for nearly a third of the increase. Its wealth rose sharply to $120 trillion from $7 trillion in 2000, the year before it joined the World Trade Organization, accelerating its economic rise.

10% richest

The United States, held back by a more subdued rise in real estate prices, more than doubled its net worth over that period to $90 trillion.

In both countries, the world's largest economies, the richest 10% of households own more than two-thirds of the wealth. Besides, the report states that their share is growing.

McKinsey estimates that 68% of the world's net worth is held in real estate. The balance is maintained in infrastructure, machinery and equipment. However, it is kept to a much lesser extent in so-called intangible assets such as intellectual property and patents.

Financial assets are not considered in global wealth calculations as they are effectively limited by liabilities: for example, a corporate bond owned by an individual investor is a promissory note of that company. This avoids duplication of capital accounting.

Drawbacks of growth

According to McKinsey, a sharp rise in net worth over the past two decades has outpaced the growth in global gross domestic product and was caused by a sharp rise in real estate prices resulting in falling interest rates. Asset prices were discovered to be nearly 50% higher than their long-term averages relative to income. This raises questions about the sustainability of the wealth boom.

Dr. Jan Mischke said that the net value of assets caused by rising prices in excess of inflation was questionable in many ways. He noted that it was accompanied by all sorts of side effects.

The surge in property values could make homeownership unaffordable for many people and increase the risk of a financial crisis similar to the one that hit the US in 2008 after the housing market bubble burst. China could potentially face similar problems due to the indebtedness of real estate developers such as China Evergrande Group. Declining real estate prices could trigger a global crisis just as it was in 2008.

According to the report, the best solution would be to use global wealth for more productive investments that boost global GDP. A pessimistic scenario will be an asset price crash that could eliminate up to one-third of global wealth, bringing it more in line with global income. Besides, firstly the savings of the middle class would most likely be affected.