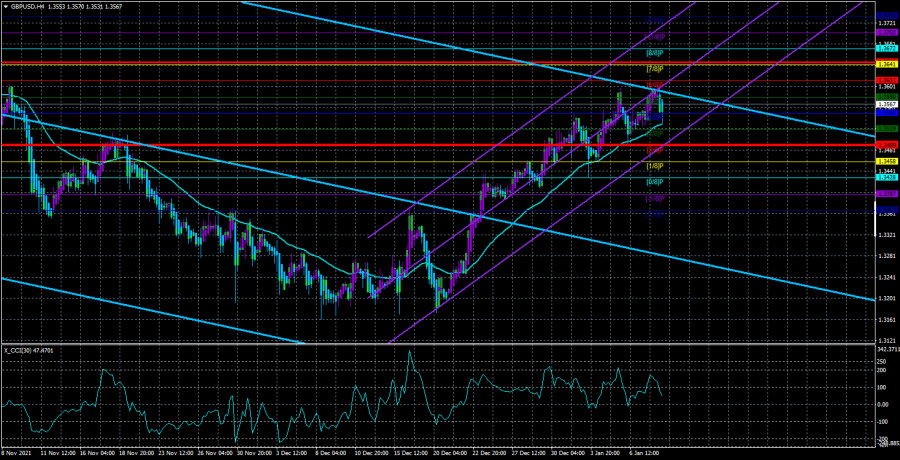

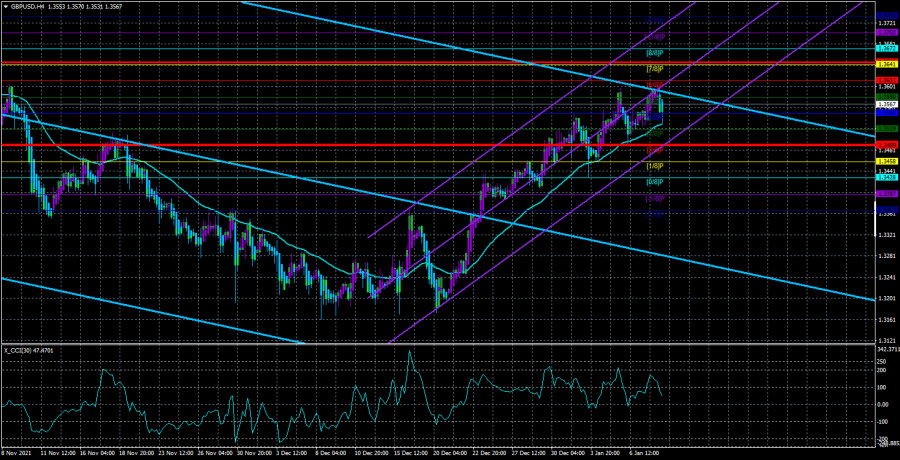

The GBP/USD currency pair on Monday began a new round of correction while continuing to be located above the moving average line. Thus, the upward trend persists. It has been maintained for three weeks, during which the British pound added about 400 points. However, any fairy tale sooner or later comes to an end. The pound played back the decision of the Bank of England to raise the rate by 0.15% in December, but now it is necessary to adjust down at least a little. The signal for correction will be the overcoming of the moving average line. We believe that the current growth of the British currency is the beginning of a new long-term upward trend. At least, it can be. This scenario is opposed only by the factor of tightening monetary policy in the United States. It is not known whether its market participants have fully worked out? As we have already said, two or three increases in the key rate in 2022 may already be embedded in the current dollar exchange rate. However, at the same time, we should not forget that the Fed can also accelerate the pace of monetary policy tightening. This is exactly what has been talked about in the last few weeks. Thus, the growth of the dollar may also resume in 2022. The policy of the Bank of England should be considered separately. If the Fed took a course of tightening, then in the case of BA, it is unclear whether it was a one-time action or whether the British regulator will also gradually wind down QE and raise the rate? In the second case, the British currency will be able to find long-term support. In the first, no. Thus, many questions need to be answered first. And these answers should come from regulators.

The "coronavirus" is not retreating from the UK.

Meanwhile, another series of anti-records on the coronavirus pandemic has been established in the UK. Since the beginning of the pandemic, 150,000 people have already died from the virus in the country, and according to this indicator, the country is in 1st place among European countries. In the whole world, only the USA, Brazil, Russia, Peru, Mexico and India are ahead of it in this sad indicator. In recent weeks, at least 150 thousand diseases have been recorded every day in Britain. This is also an anti-record among European countries, and for the entire period of the pandemic inside Britain. Despite such gigantic figures, they continue to grow. Over the weekend, it became known that Boris Johnson's government had already attracted the military to help medical personnel, as a lot of nurses and doctors had become infected themselves and were forced to go into self-isolation. Thus, the pressure on the healthcare system is increasing due to the shortage of staff in hospitals. However, Boris Johnson's government is not going to introduce a "lockdown" in the near future to somehow stop the spread of a new strain. Let's see how it ends.

In addition to the "coronavirus", negotiations between London and Brussels regarding the "Northern Ireland protocol" should resume in the near future. Recall that last year the parties failed to reach a consensus on this issue. Accordingly, negotiations will continue this year and well, if only this year. So far, it is still difficult to imagine how the parties can come to a common denominator on this issue, since the UK wants to completely revise the protocol, and the European Union is ready only not to change some of its provisions? Negotiations can be long. But first, Britain, of course, needs to deal with the next "wave" of the epidemic. If it is not possible to stop it in the near future, then too many Britons may be isolated at the same time. The work of many enterprises, government agencies, companies, and firms may stop. This is especially true for those whose work does not involve remote mode. For example, a doctor cannot work remotely. The pilot, too. If the fundamental background continues to remain so negative, then BA may refuse to further tighten monetary policy. And in this case, the pound will lose one of its two growth factors in 2022.

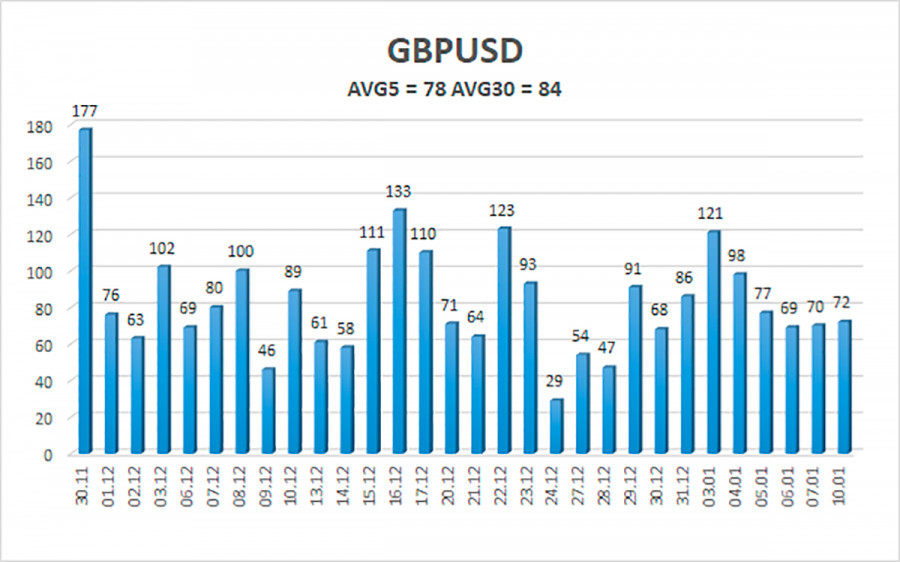

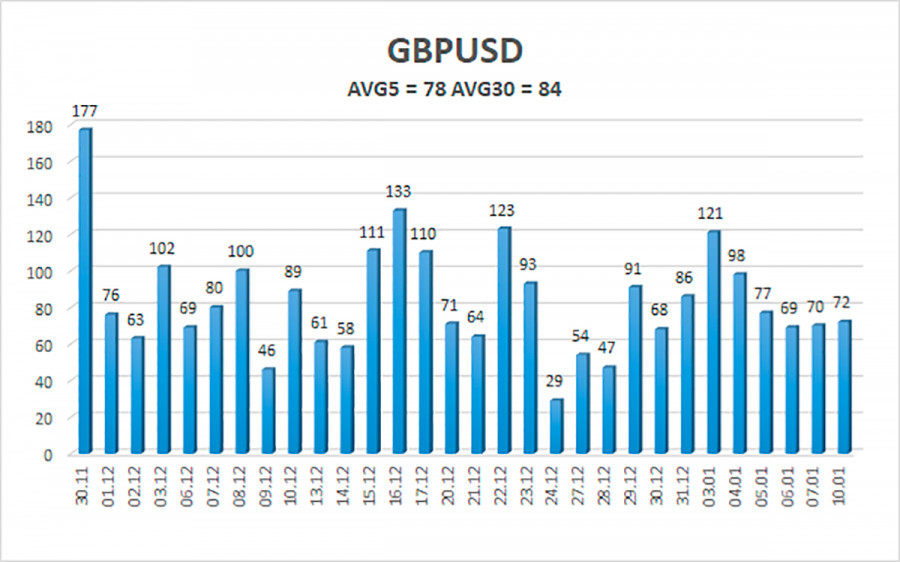

The average volatility of the GBP/USD pair is currently 78 points per day. For the pound/dollar pair, this value is "average". On Tuesday, January 11, thus, we expect movement inside the channel, limited by the levels of 1.3489 and 1.3646. A reversal of the Heiken Ashi indicator upwards will signal a possible new round of upward movement.

Nearest support levels:

S1 – 1.3550

S2 – 1.3519

S3 – 1.3489

Nearest resistance levels:

R1 – 1.3580

R2 – 1.3611

R3 – 1.3641

Trading recommendations:

The GBP/USD pair continues a strong upward movement on the 4-hour timeframe. Thus, at this time it is recommended to open new longs with targets of 1.3641 and 1.3672, as the price has rebounded from the moving average line again. It is recommended to consider short positions if the pair is fixed below the moving average with targets of 1.3489 and 1.3458, and keep them open until the Heiken Ashi indicator turns upwards.

Explanations to the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.