Analysis of previous deals:

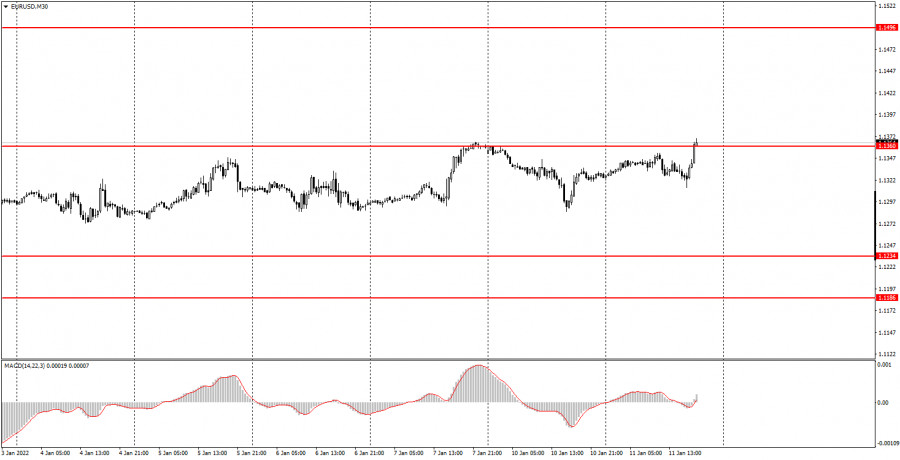

30M chart of the EUR/USD pair

The EUR/USD pair was trading in an upward direction on Wednesday. Finally, after a month and a half of absolute flat, traders managed to get the pair out of the horizontal channel, so now there is every reason to assume the beginning of a new upward trend. We have formed a new ascending channel on the 30-minute TF, which confirms the upward trend at this time. If we talk about fundamental factors, then the euro currency has little reason for growth now. However, the dollar sharply strengthened in the second half of 2021, so for technical reasons, growth is now more preferable. As for today's report on US inflation, it showed that it continues to rise and accelerate. This figure rose to 7.0% at the end of December, which is an anti-record for the last 40 years. Federal Reserve Chairman Jerome Powell announced a day earlier that his department would fight against the rise in consumer prices, but so far we see only inflation growth.

5M chart of the EUR/USD pair

Today's movement was almost perfect on the 5 minute timeframe. Despite the fact that there was a total flat in the first half of the day. Markets have been waiting for the inflation report since the morning and, when it was published, reacted violently to it. The time when the report was published is marked with a tick. Thus, only one trading signal was formed during the day. The pair was near the support area of 1.1360-1.1366 for a long time, after which it nevertheless pushed off from it. Moreover, there were actually two rebounds (the first was in the middle of the European trading session) and novice traders could already open long positions during the first. It was necessary to place a Stop Loss order below the level of 1.1360 when US data were published, but the movement turned out to be in the right direction. The price broke through the levels of 1.1387 and 1.1422 without any problems, and the long position could be manually closed in the late afternoon. The profit on it was about 60 points. If beginners used Take Profit, then the profit ranged from 30 to 40 points.

How to trade on Thursday:

On the 30-minute timeframe, you can clearly see that the price has finally left the horizontal channel, so now preference is given to trades for growth. For example, you can work out signals for a rebound from the lower boundary of a new ascending channel. In general, we believe that the euro will continue to rise in the coming weeks. On the 5-minute timeframe, the levels for January 13 are as follows: 1.1360-1.1366, 1.1387, 1.1422, 1.14696. Recall that for any trade, you should set Take Profit 30-40 points and Stop Loss at breakeven after passing 15 points in the right direction. The deal can also be closed manually near important levels or after the formation of an opposite signal. There will be little macroeconomic statistics on Thursday, and no important statistics at all. Secondary reports will be published in America, which the market is unlikely to pay attention to and work them out. Therefore, tomorrow the volatility of the pair may decrease.

Basic rules of the trading system:

1) The signal strength is calculated by the time it took to form the signal (bounce or overcome the level). The less time it took, the stronger the signal.

2) If two or more deals were opened near a certain level based on false signals (which did not trigger Take Profit or the nearest target level), then all subsequent signals from this level should be ignored.

3) In a flat, any pair can form a lot of false signals or not form them at all. But in any case, at the first signs of a flat, it is better to stop trading.

4) Trade deals are opened in the time period between the beginning of the European session and until the middle of the American one, when all deals must be closed manually.

5) On the 30-minute TF, using signals from the MACD indicator, you can trade only if there is good volatility and a trend, which is confirmed by a trend line or a trend channel.

6) If two levels are located too close to each other (from 5 to 15 points), then they should be considered as an area of support or resistance.

On the chart:

Support and Resistance Levels are the Levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels.

Red lines are the channels or trend lines that display the current trend and show in which direction it is better to trade now.

The MACD indicator (14,22,3) consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend lines (channels and trend lines).

Important speeches and reports (always contained in the news calendar) can greatly influence the movement of a currency pair. Therefore, during their exit, it is recommended to trade as carefully as possible or exit the market in order to avoid a sharp price reversal against the previous movement.

Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time.