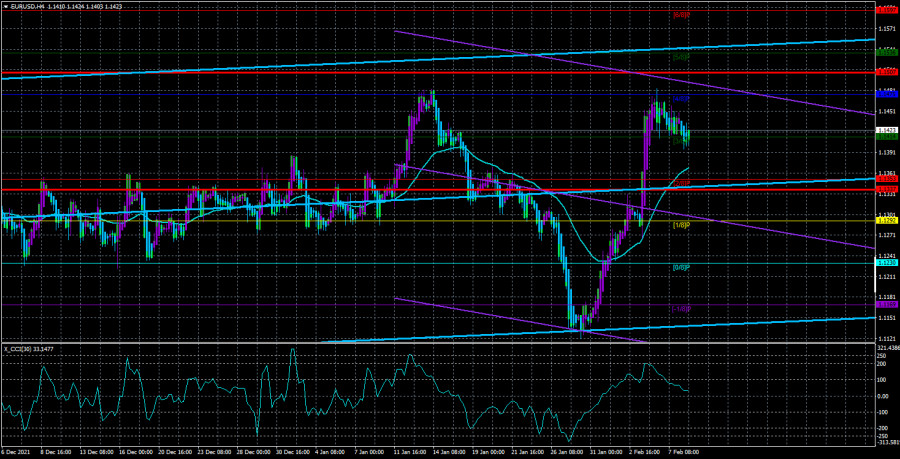

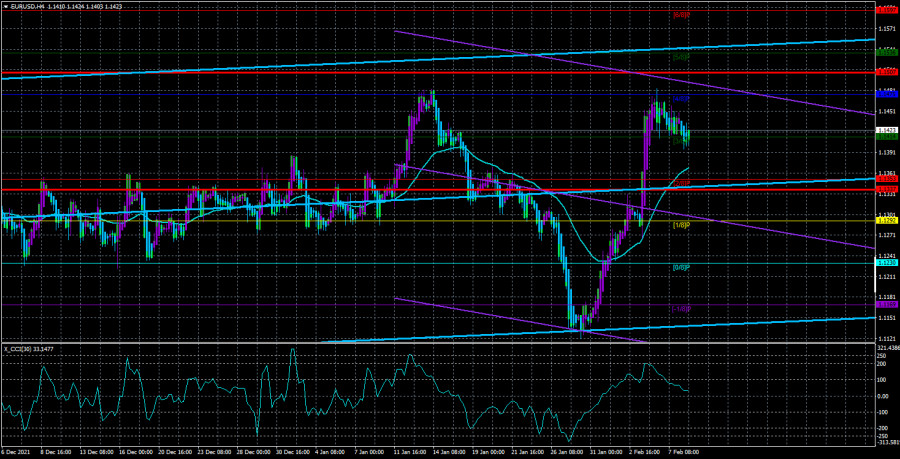

The EUR/USD currency pair traded roughly the same on Tuesday as on Monday. Low volatility, corrective "character", and minimal downward bias. From our point of view, this is not surprising. We warned that with an empty calendar of events, as well as after an over-saturated trading week, the market may need a short pause. In addition, a twofold situation has developed for the euro/dollar pair at this time, in which the price has worked out the Murray level of "4/8" - 1.1475, which is the previous local maximum. Of course, this pattern does not pull at the "double top", since the trend is generally downward, but we can talk about a strong resistance level, which the bulls have not yet managed to overcome. Therefore, in the near future, the pair may continue to adjust to the moving average line. And it may overcome it again. Since the previous local maximum (1.1475) has not been overcome, the prospects for an upward trend are still questionable. Although on a 24-hour timeframe, everything looks as if the downward trend is over. However, after an increase of 300 points last week, the pair needs to adjust, and after the correction is completed, it will be possible to talk about continuing/resuming the hike to the north. We also note that there is an extremely small number of planned important events this week. Therefore, low volatility may persist for most of the week.

The market's attention is shifting to the ECB.

It so happened that in the last few months, all the attention of traders has been focused on the Fed. It was the Fed that was the first to signal its readiness to completely abandon the quantitative stimulus program, as well as its readiness to raise rates. However, the Fed was signaling, and the Bank of England was the first to raise rates. As for the ECB, last year Christine Lagarde repeatedly openly stated that the European economy is too weak and looks like a "patient on two crutches." "Two crutches" are low rates and monetary stimulus. And without these "crutches", according to Lagarde, the economy will not survive. Already this year, she has stated several times that the rates will not be raised. However, the markets have recently begun to lean towards the point of view that Lagarde is a little deceitful. The fact is that inflation in the European Union continues to accelerate and is only slightly behind American inflation. If nothing is done about monetary policy, prices will continue to rise. At the last meeting, Christine Lagarde half-hinted to the market that the decision not to raise the rate in 2022 may be reconsidered. From our point of view, such half-hints could not have caused the euro to rise by 160 points that day. However, the market could interpret her words as it pleased.

In their forecasts, the markets rely on the inflation indicator, so it is the comments of the ECB head on inflation that are of the greatest interest now. And on Monday, Christine Lagarde once again stated that she sees no reason for further acceleration of the consumer price index, and also expects that energy prices will begin to stabilize in the near future, and problems with supply chains will begin to be resolved. It follows from these words that the ECB is still not going to raise rates and wants to go as calmly as possible by tightening monetary policy. Now it assumes the gradual withdrawal of the regulator from the PEPP and APP incentive programs throughout 2022. Thus, we believe that the euro currency still has no grounds for strong growth. From a fundamental point of view. Its chance lies only in the fact that the bears have already had enough of the pair's sales and can now start forming an upward trend for purely technical reasons. However, if the Fed continues to tighten monetary policy at each meeting, and the ECB continues to limit itself to half-hints, then it will be very difficult for the euro currency to continue growing.

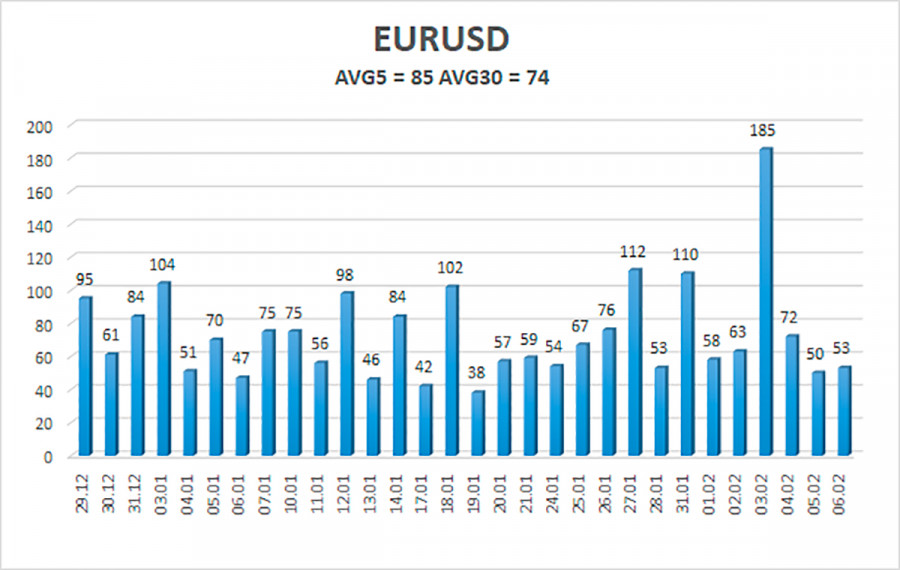

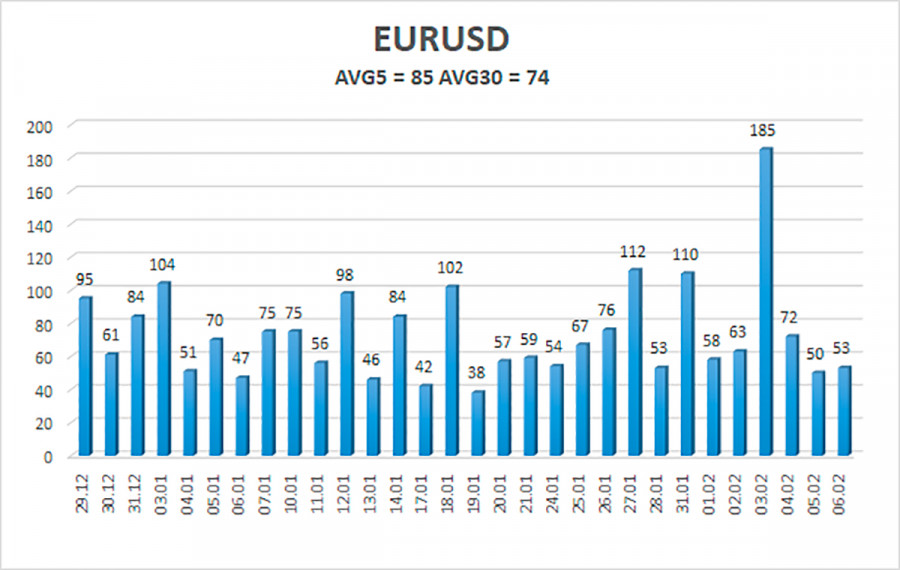

The volatility of the euro/dollar currency pair as of February 9 is 85 points and is characterized as "high". Thus, we expect the pair to move today between the levels of 1.1337 and 1.1507. The upward reversal of the Heiken Ashi indicator will signal the resumption of the upward movement.

Nearest support levels:

S1 – 1.1414

S2 – 1.1353

S3 – 1.1292

Nearest resistance levels:

R1 – 1.1475

R2 – 1.1536

R3 – 1.1597

Trading recommendations:

The EUR/USD pair continues to be located above the moving average line, but it is being corrected. Thus, now we should expect the correction to be completed, after which we should look for an opportunity for new longs with targets of 1.1475 and 1.1507 after the Heiken Ashi indicator turns up. Short positions should be opened no earlier than the price-fixing below the moving average line with targets of 1.1337 and 1.1292.

Explanations to the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.