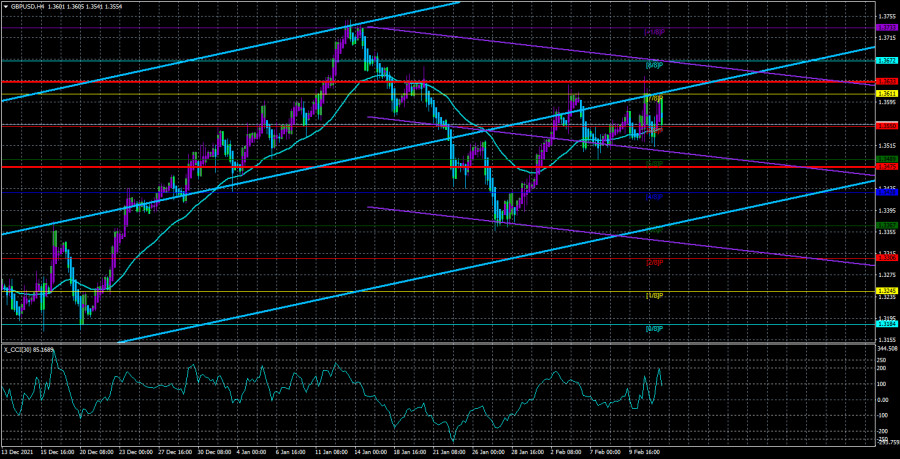

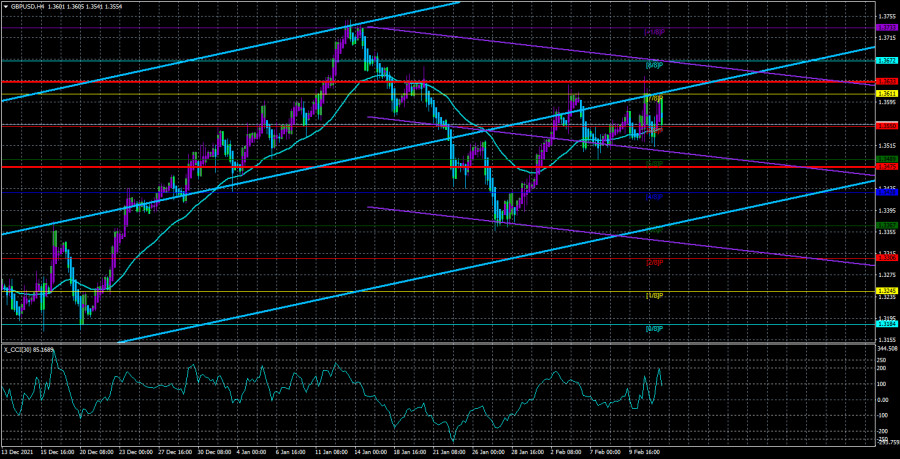

The GBP/USD currency pair continued to trade very erratically on Friday. In principle, the whole last week was spent in very chaotic trading, which is seen in the illustration above. At the end of the week, the pound barely managed to stay above the moving average line, so formally the upward trend persists. As we have repeatedly said, the British currency has much more reason to show growth against the dollar. The Bank of England has already raised the key rate twice and intends to raise it at least twice more this year. Thus, if anyone can grow now against the dollar, it is the pound, because the Fed has never raised the rate, but only promises. But at the same time, do not forget about the intensity of passions around the NATO-Russia conflict. In the event of an escalation of the conflict, the world markets will not be able to react to it. And in this case, the dollar will have new grounds for growth, as the world reserve currency. First, there will be a massive outflow of capital from Ukraine and Russia. And these are dollars. Second, many risky assets will be dumped to avoid risks. Also through dollars. Therefore, we fully assume that the pound may resume its decline in the near future, since simply the dollar will begin to rise in price again. The technical picture of the British currency is very confusing right now. Moreover, the ambiguity is visible on almost all timeframes. There are no clear trends, important lines of the Ichimoku indicator are ignored. The movement itself is as incomprehensible and chaotic as possible. Therefore, the pound, from our point of view, is now the "dark horse" from which it is unclear what to expect.

Boris Johnson will try to avoid punishment for "coronavirus parties".

Let's move a little away from the topic of the conflict in Eastern Europe and return to the figure of Boris Johnson, who has been actively commenting on the actions of the Russian Federation in recent days, which, according to many experts, was done to distract public attention from the figure of Boris Johnson himself. Recall that Scotland Yard took over the investigation of "coronavirus parties". However, the police immediately warned that, most likely, they would not be able to prove Johnson's guilt, especially since it had been a long time ago. Nevertheless, yesterday, it became known that "questionnaires" were sent to everyone who was at those parties, and there are about 50 members of Parliament. These "questionnaires" contain questions about parties during the "lockdown". It is noted that if the answers to the questions do not suit the London police, they will conduct a survey and, if the guilt of Johnson and his colleagues is confirmed, they will have to pay a fine. However, naturally, it is not the fine that scares Boris and his entourage. The fact is that with the official admission of the Prime Minister's guilt, this whole story will receive a new development, and Johnson's career will be under even greater threat than it is now. British experts say that several members of the British Parliament who were previously convicted of quarantine violations were forced to resign. Then, what is better than Boris Johnson and those 50 parliamentarians? It is also reported that the Prime Minister will try to present the situation as if the residence on Downing Street could act as a workplace and, accordingly, "working meetings" with alcoholic beverages could take place in it. In general, this story may develop in the near future. We have already written earlier that even within the Conservative Party, "anti-Johnson" sentiments are maturing with might and main. This means that they are dissatisfied with him and letters are already beginning to be collected by the "committee of 1922". If the number of letters approving Johnson's resignation from his fellow party members reaches 50-60, this could trigger a vote of no confidence and a change in the leader of the Conservative Party. However, from a technical point of view, as long as the pound/dollar pair remains above the moving average, the probability of continuing the upward movement remains.

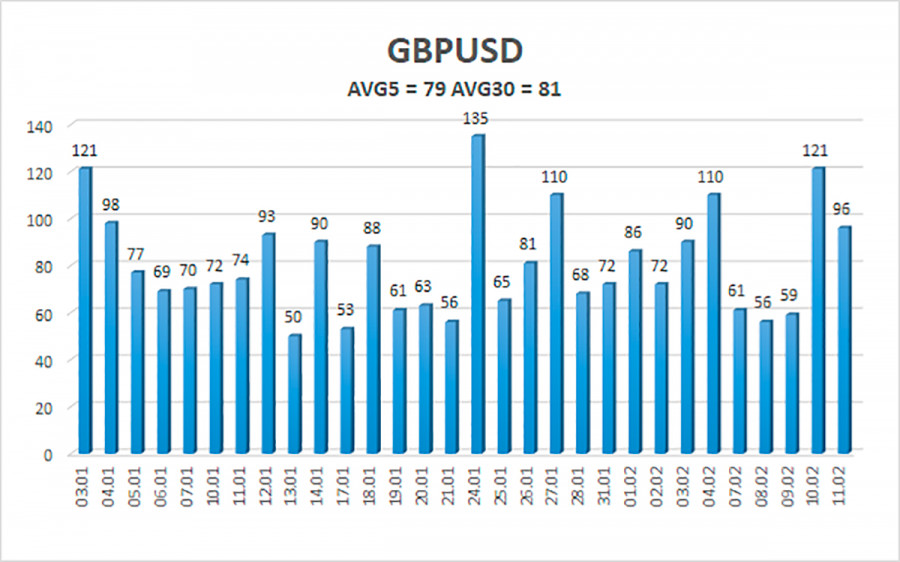

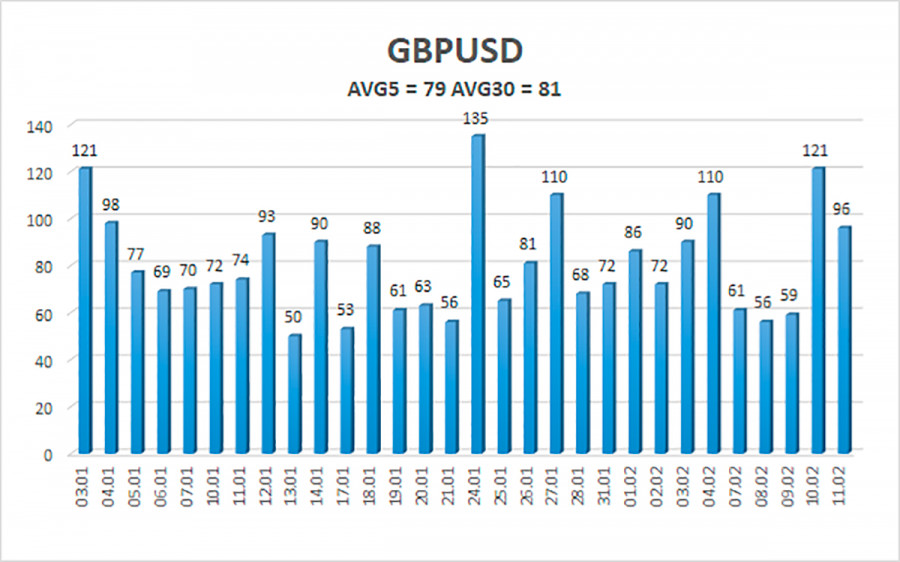

The average volatility of the GBP/USD pair is currently 79 points per day. For the pound/dollar pair, this value is "average". On Monday, February 14, thus, we expect movement inside the channel, limited by the levels of 1.3475 and 1.3633. The reversal of the Heiken Ashi indicator downwards signals a new round of downward correction.

Nearest support levels:

S1 – 1.3550

S2 – 1.3489

S3 – 1.3428

Nearest resistance levels:

R1 – 1.3611

R2 – 1.3672

R3 – 1.3733

Trading recommendations:

The GBP/USD pair on the 4-hour timeframe continues to balance on the verge of not falling below the moving average. Thus, at this time, long positions with targets of 1.3611 and 1.3633 should be considered if there is a new rebound from the moving average line. It is recommended to consider short positions if the pair is fixed below the moving average, with targets of 1.3489 and 1.3475.

Explanations to the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

The moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.