The GBP/USD currency pair fell by 130 points on Friday. That is, it turns out less than the European currency. However, nothing is surprising in this, although the pound/dollar is a more volatile pair than the euro/dollar. However, in recent months and even a year, we have repeatedly said that the pound is getting cheaper much less willingly against the dollar than the euro, and is growing more willingly. This is exactly what we saw on Friday when the fundamental background was the same for both pairs. The same Nonfarm report put the strongest pressure on the pound sterling. More precisely, it provided the strongest support to the US dollar. As a result, the pair is racing at full speed to its local minimum near the 1.3164 level, which is also the 38.2% Fibonacci level. Yes, the pound still cannot overcome this level, although it has been correcting for a year against the upward trend of 2020. It is even difficult to say why the pound is falling less than the euro currency. It is the euro that looks like a more stable currency than the pound. However, we have what we have. So far, 1.3164 remains the key level for the British currency. If it is overcome, then its fall is highly likely to continue.

As for the 4-hour TF, a downward trend is visible here. The pair falls, if not every day, then every other day, and, of course, the key reason for this fall is geopolitics. We have already raised the question of why the Ukrainian-Russian conflict has such a serious impact on world markets. All because now all the countries of the world and their economies are too tied to each other. For example, the same Russian Federation imports almost everything except oil and gas. Now there is a serious threat of the EU countries abandoning Russian oil and gas, or at least reducing the volume of purchases. There are already talks about lifting the oil embargo from Iran and replacing Russian oil with Iranian oil. Is it worth talking about how strong this blow will be for the Russian economy? However, whatever sanctions are imposed against the Russian Federation, this means that those who impose these sanctions will also suffer losses. For example, if Boeing and Airbus refuse to provide their aircraft to the Russian Federation and repair them, then they will not receive a certain income due to the exit from this market. Therefore, the Ukrainian-Russian conflict affects everyone, not just Ukraine and Russia.

Boris Johnson continues to call for more powerful sanctions against Russia.

Boris Johnson has been experiencing a second youth in the last week. He has always been quite a public and open politician, but now, apparently, he is so glad that the media attention is not directed at his "coronavirus parties" that he is ready to do anything, so long as the media attention does not focus on him for as long as possible. In particular, one of the most ardent supporters of maximum sanctions against the Russian Federation is going to hold a meeting with EU leaders in the near future to discuss a new package of sanctions against the Russian Federation. According to Johnson, Russia must fail and it should be visible to everyone that Russia has failed.

Johnson's plan now consists of six points. The British Prime Minister suggests continuing to support Ukraine, increasing economic pressure on the Russian Federation, forming an international coalition to provide humanitarian assistance to Ukraine, using any means to de-escalate the conflict, and strengthening security in the Euro-Atlantic region. In addition, Johnson said that in no case should the "normalization of Russian activities in Ukraine" be allowed. Thus, in the near future, there is no doubt that Moscow will see before itself a new package of sanctions and will impose retaliatory sanctions that will hit business from both sides of the barricades. Accordingly, the economies of all countries that are somehow involved in this sanctions war will suffer. The Russian economy will suffer more, as it largely depends on imported goods. And somewhere at this time, China is rubbing its hands and rejoicing.

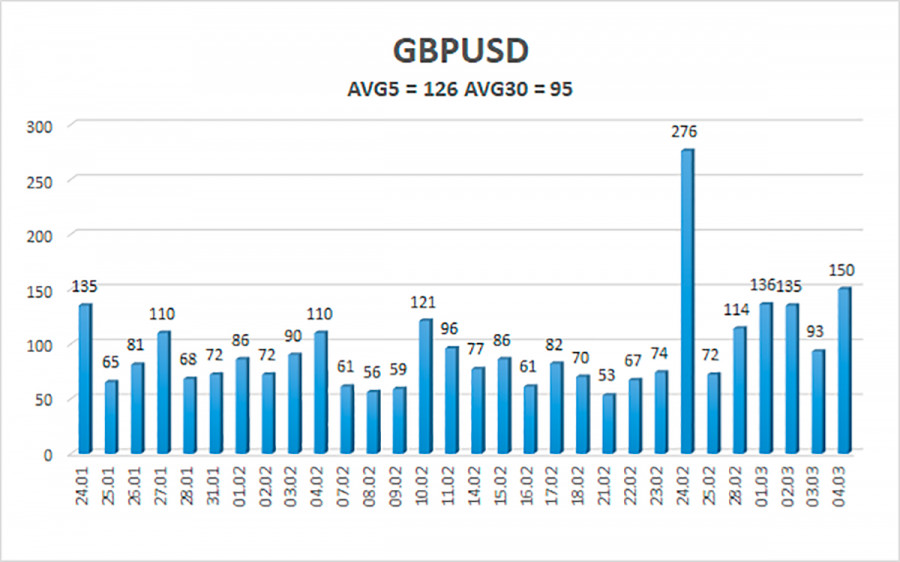

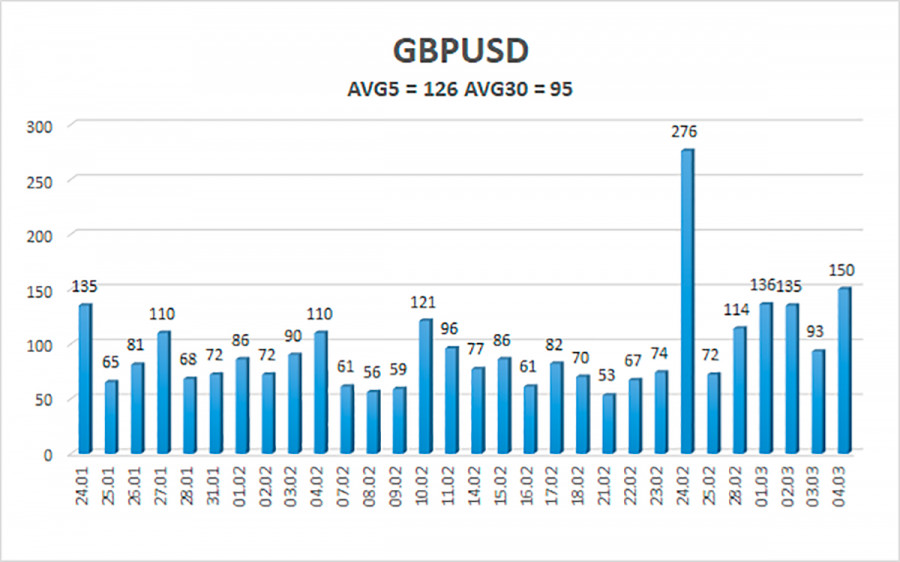

The average volatility of the GBP/USD pair is currently 126 points per day. For the pound/dollar pair, this value is "high". On Monday, March 7, therefore, we expect movement inside the channel, limited by the levels of 1.3103 and 1.3355. A reversal of the Heiken Ashi indicator upwards will signal a round of corrective movement.

Nearest support levels:

S1 – 1.3184

S2 – 1.3123

S3 – 1.3062

Nearest resistance levels:

R1 – 1.3245

R2 – 1.3306

R3 – 1.3367

Trading recommendations:

The GBP/USD pair resumed a strong movement to the south on the 4-hour timeframe. Thus, at this time, you should stay in new sell orders with targets of 1.3184 and 1.3123 until the Heiken Ashi indicator turns up. It will be possible to consider long positions no earlier than fixing the price above the moving average with targets of 1.3428 and 1.3489.

Explanations to the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.