The GBP/USD currency pair on Wednesday, before the publication of the results of the Fed meeting, tried to start a correction again. But it could not even gain a foothold above the moving average line, which itself fell to the price, and not vice versa. Thus, there has been no correction for the pound now. We deliberately do not consider all the movements that occurred after the publication of the results of the Fed meeting and the press conference with Jerome Powell. We believe that now, in principle, it makes no sense to consider the technical picture and the results themselves, since the results of the meeting make sense only in the context of the market reaction to them. And the market can react within a day after such an event as a meeting of the central bank. And today the Bank of England will also announce the results of the meeting, so the market may be stormy, and conclusions should be drawn only on Thursday evening or Friday morning.

Once again, it should be noted that the results of the central bank meeting do not make much sense by themselves. What matters is how the market reacts to them. There have repeatedly been situations when the Central Bank made a certain decision, and the market reacted quite logically. Or, on the contrary, it reacted as expected, but then there was a rollback, which returned the pair to its original positions. Therefore, by and large, it does not even make sense whether the Fed has raised the rate or not. The Fed's rate and long-term trend are important. For example, the Bank of England has also taken a course to raise the rate, but at the same time, the British pound has been falling in recent weeks, months, and a year. Yes, it does it much less willingly than the euro currency, for example. Nevertheless, the general trend is downward and it does not matter how many times BA has already raised the rate if the pound is getting cheaper at the same time. Therefore, we believe that the conclusion about the meetings of central banks should be made later.

Reuters: No surprises are expected on Thursday.

As already mentioned, the results of the Bank of England meeting will be summed up today. Almost no one doubts that BA will raise the rate by 0.25%. However, what will be the actions of the regulator in the future? Earlier, Andrew Bailey made it clear that the total rate will be raised to 1%, and no one has made longer-term plans. There is simply no point in building them in the current circumstances. However, nothing prevents experts of various categories and stripes from making their forecasts. To bring these forecasts together, Reuters conducted a poll, the results of which showed that most experts expect a stronger increase in the BA rate than to 1%. In particular, 15 out of 44 experts surveyed believe that at the beginning of next year the rate will be brought to 1.5%. 21 experts believe that the rate will be equal to 1.00% or 1.25%. 8 experts believe that it will be higher than 1.5%. As you can see, the majority does not expect a more serious tightening of monetary policy than two more rate hikes during 2022. From our point of view, this is the most neutral rate increase and the most neutral forecast.

Let's explain why. Currently, inflation in the UK is 5.5% y/y. The same Reuters polls show that inflation could rise to 7.7% y/y in the next quarter. That is, most expect that inflation will continue to rise. And only in the third quarter of 2022 will its slowdown begin. But will 1% of the key rate be enough to bring inflation back to the target level of 2%? From our point of view, no. However, no one knows how long the Ukrainian-Russian conflict will drag on, which has a serious impact on the cost of oil and gas, which spurs up inflation. No one knows what other sanctions will be imposed against the oil and gas industry of the Russian Federation. No one knows what value oil and gas can theoretically decrease. Accordingly, no one can predict what values inflation will slow down without the intervention of the Bank of England. That is, in a word, "uncertainty". And there is such an amount of this uncertainty now that, in principle, any forecasts for more than a couple of months do not make any sense. Consequently, BA takes a neutral position, in which it cannot but raise the rate, but does not promise to raise it until inflation returns to 2%.

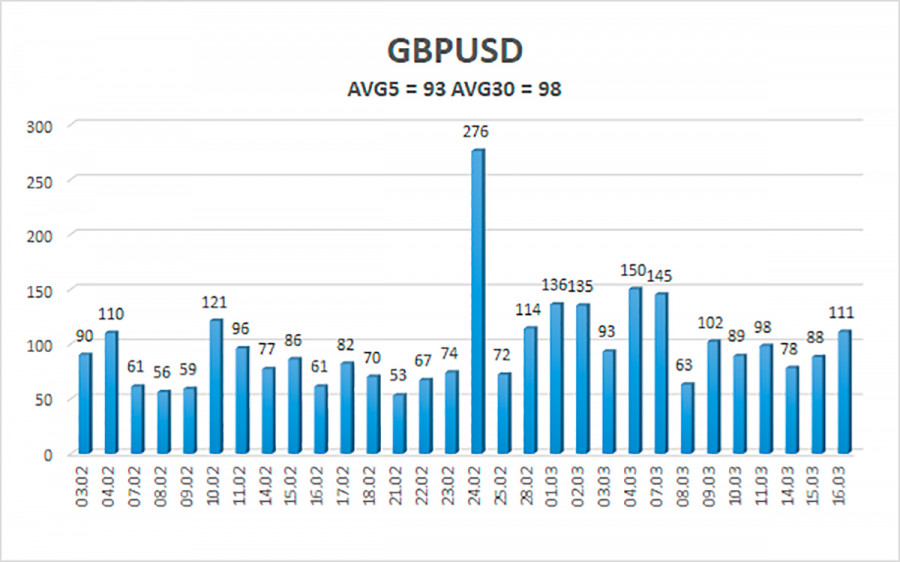

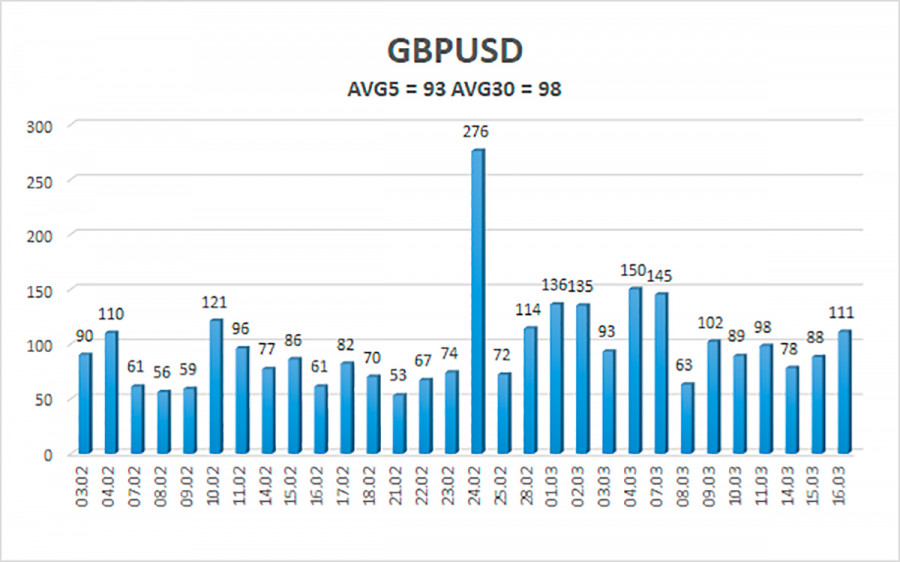

The average volatility of the GBP/USD pair is currently 93 points per day. For the pound/dollar pair, this value is "average". On Thursday, March 17, thus, we expect movement inside the channel, limited by the levels of 1.3050 and 1.3236. The reversal of the Heiken Ashi indicator downwards signals a possible resumption of the downward movement.

Nearest support levels:

S1 – 1.3123

S2 – 1.3062

S3 – 1.3000

Nearest resistance levels:

R1 – 1.3184

R2 – 1.3245

R3 – 1.3306

Trading recommendations:

The GBP/USD pair has started a powerful upward movement in the 4-hour timeframe. Thus, at this time, you should stay in buy orders with targets of 1.3236 and 1.3245 until the Heiken Ashi indicator turns down. It will be possible to consider short positions no earlier than fixing the price below the moving average with the goals of 1.3000 and 1.2939.

Explanations to the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which you should trade now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.