In its quarterly regional economic report for April, the Bank of Japan (BoJ) lowered its economic growth forecast for eight of its nine regions on Monday, citing the continued impact of the COVID-19 pandemic on consumption of services and supply concerns, Kyodo news reported.

Just prior to the release of this report, Bank of Japan Governor Haruhiko Kuroda also said that the country's economy showed "some weakness" due to COVID-19. He warned of "extremely high uncertainty" about the impact of the crisis in Ukraine on the Japanese economy, the world's third-largest economy, due in part to soaring commodity prices. Japan is a net importer (one of the largest) of energy and other minerals, and the rise in oil prices provokes an increase in inflation in the country and an increase in foreign exchange purchases by Japanese importers.

Higher energy and raw material prices will accelerate Japan's inflation in the coming months, with the core consumer price index likely to "clearly rise," Kuroda said.

However, Kuroda believes that soaring inflation is unlikely to force the BoJ to change its monetary policy, because inflation, in his opinion, will not last long.

Late last month, the BoJ confirmed unlimited purchases of 10-year government bonds and pledged to continue its loose policy, keeping interest rates at extremely low levels.

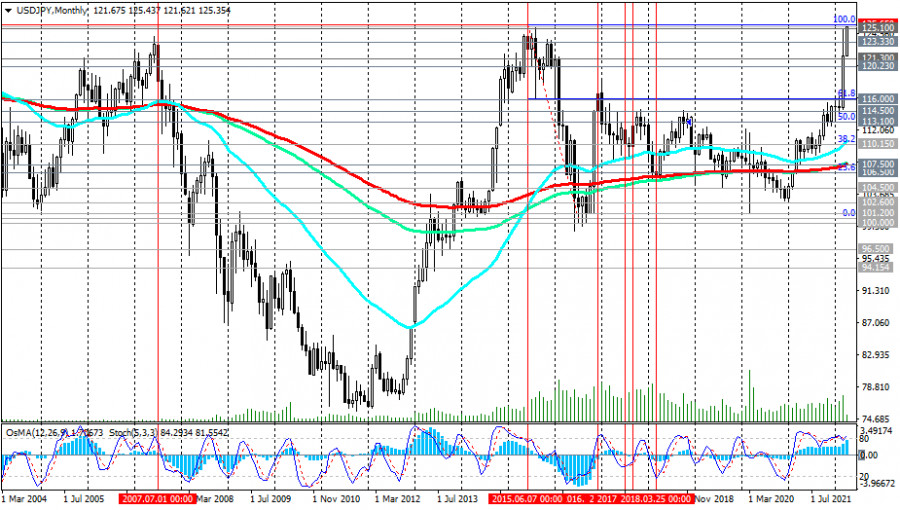

The yen continues to weaken rapidly on the back of rising inflation in Japan and a negative economic outlook, while the Bank of Japan continues to adhere to its extra-loose monetary policy.

At the same time, according to some economists, the yen may begin to strengthen again, and USD/JPY to decline, if the BoJ reconsiders its attitude towards its excessive weakening.

"The stability of foreign exchange rates is important, and rapid moves are not desirable," said Masato Kanda, Japan's vice minister of finance for internal affairs, confirming statements made in March by an official representative of the government and the finance minister.

Kuroda also said today that the yen's fall was "somewhat rapid," which could be seen as a strong warning.

At the same time, many economists warn of growing recession risks in the US due to a string of supply shocks as the Fed raises rates to curb inflation.

The risk of a slowdown in business activity, along with dangerously high inflation, which reached 7.9% in February, poses a difficult task for the Fed. The central bank is trying to cool the economy by slowing down inflation, but not allowing spending cuts and rising unemployment.

In March, the Fed raised its key interest rate by a quarter of a percentage point and signaled six more hikes before the end of the year. This is the most aggressive pace of policy tightening in more than 15 years. Many economists and market participants expect two or more rate hikes of 0.50% at once before the end of 2022, assuming that by the end of 2022 the Fed's key interest rate midrange will be at 2.125%, and by December 2023 it will rise to 2.875 %. But this may no longer be enough to contain the accelerating rise in inflation.

High inflation remains the main risk to the economy, negatively affecting consumer purchasing power and sentiment, prompting the Fed to tighten policy more aggressively.

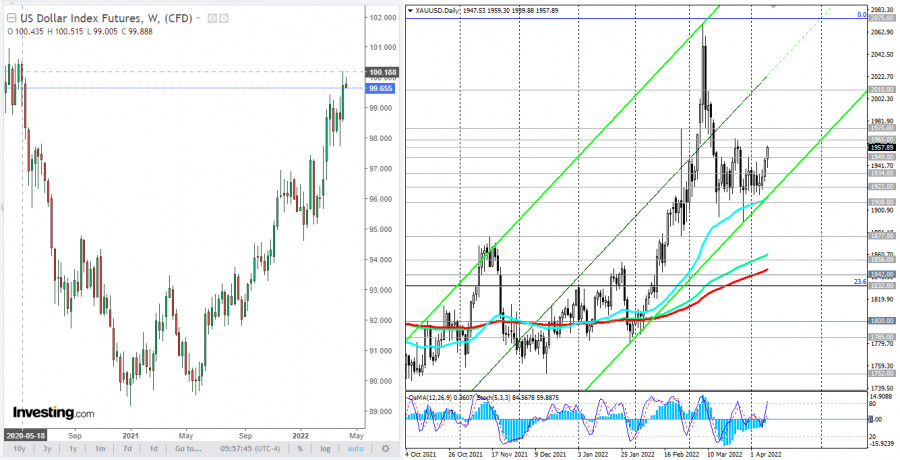

One need only look at the chart of the XAU/USD pair to understand the degree of investor concern regarding the risks from inflation. Despite expectations of a more aggressive policy on the part of the Fed, gold prices are not declining, and today resumed growth. Gold quotes are extremely sensitive to changes in the policies of the world's largest central banks, primarily the Fed. When their interest rates go up, gold quotes tend to go down. But this is not observed. Gold is rising in price, despite the strengthening of the dollar.

Returning to the USD/JPY pair, we can assume its further growth in the short and medium-term. So far, investors still prefer the dollar, while geopolitical tensions persist in the world (outside the US). Thus, last Friday the dollar index (DXY) updated a 2-year high at 100.19, and many economists agree that a breakdown of the psychologically significant level of 100.00 will accelerate the further growth of DXY, and the dollar will continue to strengthen.

Today, USD/JPY is up sharply, posting a 6-week run in a row to break 125.10 (last month and August 2015 high). The discrepancy between the monetary policy rates of the Fed and the Bank of Japan will most likely increase, creating preconditions for further growth of USD/JPY. In this case, the pair will head towards multi-year highs near 135.00, reached in January 2002.